Telangana SCERT TS 8th Class Telugu Guide Pdf Download 1st Lesson త్యాగనిరతి Textbook Questions and Answers.

త్యాగనిరతి TS 8th Class Telugu 1st Lesson Questions and Answers Telangana

చదువండి – ఆలోచించి చెప్పండి.

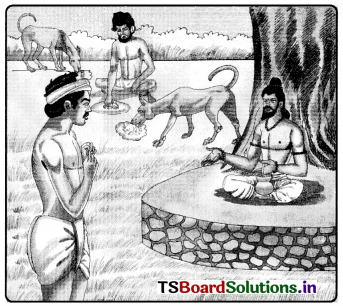

దధీచి మహా తపశ్శాలి. చ్యవన మహర్షి పుత్రుడు. ఒకప్పుడు రాక్షసులు దేవతల అస్త్రాలను గుంజుకొంటుండగా వాటిని దాచిపెట్టుమని దధీచికి దేవతలు ఇచ్చిపోయారు. కానీ ఎంతకాలమైనా వారు రాకపోయేసరికి దధీచి వారి అస్త్రాలను నీరుగా మార్చి తాగాడు. అటు తర్వాత దేవతలు మా అస్త్రాలు మాకిమన్నారు. అప్పుడు ఆ అస్త్రాలు తన ఎముకలను పట్టి ఉన్నందువల్ల యోగాగ్నిలో తన శరీరాన్ని దహించుకొని అస్థికలను తీసుకొమ్మన్నాడు. అట్లా దధీచి ఎముకల నుండి ఇంద్రుని వజ్రాయుధం రూపొందింది.

ప్రశ్న 1.

దధీచి ఎవరు ?

జవాబు.

దధీచి గొప్ప తపస్వి. చ్యవన మహర్షి కుమారుడు.

ప్రశ్న 2.

దధీచి చేసిన త్యాగం ఏమిటి ? ఎందుకు ?

జవాబు.

దధీచి తన శరీరాన్ని యోగాగ్నిలో దహించివేసుకొని తన ఎముకలను దేవతలకు ఆయుధాలుగా ఇచ్చాడు.

ప్రశ్న 3.

త్యాగం అంటే ఏమిటి ?

జవాబు.

తన కష్టనష్టాలను లెక్కచెయ్యకుండా పరహితం కోసం ప్రాణాలను సైతం ఇచ్చేయడమే త్యాగం.

ప్రశ్న 4.

మీకు తెలిసిన త్యాగమూర్తుల పేర్లను తెలుపండి.

జవాబు.

జీమూత వాహనుడు, బలిచక్రవర్తి, ఏకలవ్యుడు, హరిశ్చంద్రుడు మొదలైన వారు గొప్ప త్యాగధనులు.

ఆలోచించండి – చెప్పండి (TextBook Page No. 4)

ప్రశ్న 1.

సత్యధర్మ నిర్మలుడని శిబి చక్రవర్తిని ఎందుకన్నారు ?

జవాబు.

శిబి చక్రవర్తి సత్యం వ్రతంగా కలవాడు. ఆడినమాట తప్పనివాడు. అన్ని ధర్మములు తెలిసినవాడు. ధర్మం తప్పక ఆచరించేవాడు. నిర్మలమైన మనస్సు, ప్రవర్తన కలవాడు. అందుచేత ఆయనను సత్యధర్మ నిర్మలుడన్నారు.

ప్రశ్న 2.

“ధర్మువు సర్వంబునకు హితంబుగ వలయున్” దీనిపై మీ అభిప్రాయాన్ని చెప్పండి.

జవాబు.

‘సత్యం మాట్లాడండి. ధర్మం ఆచరించండి.’ అనే విషయాలను వేద శాస్త్రాలు చెబుతున్నాయి. కాని వాటిని పాటించే సమయంలో వాటివల్ల అందరికీ మేలు జరుగుతుందా, లేదా అని పరిశీలించాలి. ఒకవేళ కీడు కలిగేట్లైతే అప్పుడు వాటిని సరి చూసుకోవాలి. ఏ నియమాలైనా ప్రజలమేలు కోసం ఏర్పాటు చేయబడేవే. అందుకే కవి నన్నయ ధర్మం అందరికీ మేలు కలిగించాలి అని ప్రయోగించాడు.

ప్రశ్న 3.

‘ఆశ్రితులను ఎందుకు విడిచి పెట్టరాదు ?

జవాబు.

బలహీనుడు బలవంతుని వద్దకు రక్షణ కోసం వస్తాడు. అతడు తనను కాపాడగలడు అనే నమ్మకంతో వస్తాడు. కనుక అతనికి ఆశ్రయమిచ్చి కాపాడటం బలవంతుని కర్తవ్యం. ఎన్ని ఆటంకాలు కలిగినా వారి నమ్మకాన్ని వృథా చేయకుండా కాపాడాలి. అందుకే ఆశ్రితులను విడిచిపెట్టరాదు.

ప్రశ్న 4.

ఏ సందర్భంలో ఇతరులు మిమ్మల్ని ఆశ్రయిస్తారు ?

జవాబు.

జంతువుల వలన, ఇతరుల వలన భయం కలిగినప్పుడు, శత్రువులు దండెత్తినప్పుడు, దుష్టుల వలన ప్రాణాలకు ప్రమాదం ఏర్పడినప్పుడు, కష్టాలు కలిగినప్పుడు, తాను తలపెట్టిన మంచి పనులకు ఆటంకాలు కలిగినప్పుడు, తన కష్టాన్ని ఇతరులు దోచుకుంటున్నప్పుడు – ఇలా అనేక సందర్భాల్లో ఇతరులు మనను ఆశ్రయిస్తారు.

ఆలోచించండి – చెప్పండి. (TextBook Page No. 5)

ప్రశ్న 1.

డేగ తన ఆకలిని తీర్చుకోవడానికి శిబి మాంసాన్ని ఎందుకు కోరింది ?

జవాబు.

పావురం డేగకు సహజమైన ఆహారం. శిబి దానికి ఆశ్రయం ఇచ్చాడు. వదిలిపెట్టనంటున్నాడు. ధర్మబద్ధమైన తన ఆహారం తినకపోతే ఆకలితో చనిపోతానని, ఆపై తన భార్య, పిల్లలు కూడా బతకరని డేగ చెప్పింది. నీవు చెప్పింది ధర్మమే ఐనా నేను ఆశ్రయమిచ్చిన పావురాన్ని నీకు ఆహారం కానివ్వను. మరేది కోరినా తెప్పించి యిస్తాను అన్నాడు శిబి. అందుకని డేగ తన ఆకలిని తీర్చుకోడానికి శిబి మాంసాన్ని కోరింది.

ప్రశ్న 2.

‘అనుగ్రహించితి మహా విహగోత్తమ’ అని శిబి చక్రవర్తి అనటాన్ని మీరెట్లా అర్థం చేసుకున్నారు?

జవాబు.

పావురాన్ని తప్ప వేరే ఏ ఆహారాన్నైనా కోరుకో. తెప్పించి ఇచ్చి నీ ఆకలి తీరుస్తాను. పావురాన్ని మాత్రం వదలను అన్నాడు శిబి చక్రవర్తి. అప్పుడు డేగ పావురం బరువుకు సరితూగినంత మాంసాన్ని నీ శరీరం నుంచి కోసి యిస్తే ఒప్పుకుంటాను అన్నది. అందుకే శిబి పరమ సంతోషంతో “ఓ పక్షి రాజా ! నన్ను అనుగ్రహించావు. పావురాన్ని కాపాడతానన్న నా మాట నిలబెట్టావు” అని డేగతో అన్నాడు.

ప్రశ్న 3.

బలి చక్రవర్తి పావురాన్ని రక్షించడానికి ప్రాణత్యాగానికి పూనుకున్నాడు కదా ! త్యాగం ఆవశ్యకత ఏమిటి ? (టెక్స్ట్ బుక్ 5)

జవాబు.

త్యాగం అనేది గొప్ప పుణ్యకార్యం. మనకు అక్కరలేని దాన్ని ఇచ్చేసి త్యాగం చేశాను అనుకోవడం త్యాగం అనిపించుకోదు. తనను ఎవరైనా ఆశ్రయించినప్పుడు వారి కోరిక తీర్చడానికి అవసరమైతే తన ప్రాణాలను కూడా ఇవ్వడానికి సిద్ధపడాలి. అటువంటి వారే చరిత్రలో నిలచిపోతారు. ఆదర్శప్రాయులౌతారు. అందుకే త్యాగం చాలా గొప్ప గుణం.

ఇవి చేయండి

I. విని, అర్థం చేసుకొని, ఆలోచించి మాట్లాడడం

ప్రశ్న1.

త్యాగం అంటే ఏమిటి ? త్యాగంలోని గొప్పతనం ఏమిటి ?

జవాబు.

తనకు ఉన్నదానిలో కొంత ఇతరులకు ఇవ్వడమే త్యాగం. ఎన్ని కష్టాలకైనా ఓర్చుకొని తనను ఆశ్రయించిన వారికి కావలసిన దానిని ఇవ్వడమే త్యాగం. ఇందులో ప్రాణాలను కూడా లెక్కచేయకుండా త్యాగం చేసిన వారు మహనీయులు. మనం త్యాగం చేసినందువలన ఆ ఫలితాన్ని పొందినవారు, వారి ఆత్మీయులు ఎంతో సంతోషపడతారు. ఆ సంతోషం మనకెంతో తృప్తినిస్తుంది. అదీ త్యాగంలోని గొప్పతనం.

ప్రశ్న2.

ఇతరులకోసం, సమాజంకోసం త్యాగం చేసిన వారి గురించి చెప్పండి.

జవాబు.

భారతదేశాన్ని పరాయిపాలన నుంచి విడిపించి ప్రజలు పడుతున్న బానిసత్వపు బాధలను తొలగించడానికి ఎంతోమంది నాయకులు తమ సర్వస్వాన్నీ త్యాగంచేసి ఉద్యమంలో పాల్గొన్నారు. జవహర్లాల్ నెహ్రూ, ప్రకాశం పంతులు మొదలైన ఎందరో నాయకులు ధనాన్ని ఆస్తులను త్యాగం చేశారు. భగత్సింగ్, చంద్రశేఖర్ ఆజాద్, అల్లూరి సీతారామరాజు వంటివారు ప్రాణాలను త్యాగం చేశారు. డా. ద్వారకానాథ్ కొట్నీస్ యుద్ధసైనికుల కోసం అమోఘమైన సేవలందించాడు.

II. ధారాళంగా చదువడం – అర్థం చేసుకొని ప్రతిస్పందించడం

1. కింది వాక్యాల ఆధారంగా పాఠంలోని పద్యపాదాలను గుర్తించి రాయండి.

అ) ధర్మం జగత్తుకంతటికీ మేలు చేయాలి

జవాబు.

ధర్మువు సర్వంబునకు హితంబుగ వలయున్.

ఆ) ఈ పక్షి నాకు ప్రకృతి సహజంగా ఏర్పడిన ఆహారం

జవాబు.

ఇక్కపోతంబు నాకు వేదవిహితంబైన యాహారంబు.

ఇ) ఆశ్రయించిన వారిని విడిచిపెట్టడం ధర్మమవుతుందా చెప్పు

జవాబు.

శరణాగత పరిత్యాగంబు కంటే మిక్కిలి యధర్మం బొండెద్ది ?

2. కింది పద్యాన్ని చదివి ఇచ్చిన ప్రశ్నలకు సరిపోయే జవాబును గుర్తించండి.

‘ఆ॥బ్రతికి నన్నినాళ్ళు ఫలము లిచ్చుటెగాదు.

చచ్చిగూడ చీల్చియిచ్చు తనువు

త్యాగ భావమునకు తరువులే గురువులు

లలిత సుగుణజాల తెలుగు బాల.

అ) ‘చెట్టు’ అను పదానికి సరిపోయే పదం

ఎ) తరువు

బి) గురువు

సి) ఫలం

డి) గుణం

జవాబు.

ఎ) తరువు

ఆ) త్యాగానికి గురువులు ఎవరు ?

ఎ) మానవులు

బి) చెట్లు

సి) పక్షులు

డి) జంతువులు

జవాబు.

బి) చెట్లు

ఇ) తనువును చీల్చి ఇచ్చేవి

ఎ) మేఘాలు

బి) నదులు

సి) చెట్లు

డి) పక్షులు

జవాబు.

సి) చెట్లు

ఈ) చచ్చుట పదానికి వ్యతిరేకార్థం

ఎ) పెరుగుట

బి) తరుగుట

సి) బ్రతుకుట

డి) మేల్కొనుట

జవాబు.

సి) బ్రతుకుట

ఉ) పై పద్యానికి తగిన శీర్షిక

ఎ) భారం

బి) ప్రాణం

సి) యోగం

డి) త్యాగం

జవాబు.

డి) త్యాగం

III. స్వీయరచన

1. కింది ప్రశ్నలకు ఐదేసి వాక్యాల్లో జవాబులు రాయండి.

అ) ఇతరులు ఆహారం తినేటప్పుడు ఎందుకు విఘ్నం కలిగించకూడదో రాయండి.

జవాబు.

ఎవరైనా ఆహారం తినేది ఆకలి తీర్చుకోవడానికే. ఎంతో పనిచేసి, కడుపు ఆకలితో కాలిపోతూంటే, భోజనం చేద్దామని కూర్చొన్న వ్యక్తికి, ఆటంకం కలిగిస్తే ఆ వ్యక్తి చాలా బాధపడతాడు. ఆకలితో నీరసించిపోతాడు. ఇక పని చేయలేడు. పనిచేయలేడు కాబట్టి తిండికి కావలసిన ధనం సంపాదించలేడు. చివరికి ఆరోగ్యమే పాడయ్యే ప్రమాదముంది. అందుకే ఆహారం తినేటప్పుడు విఘ్నం కలిగించకూడదంటారు. సైన్సుపరంగా కూడా కారణముంది. భోజనం చేసే సమయంలో కడుపులోని జీర్ణరసాలు ఉత్తేజంగా ఉంటాయి. భోజనానికి ఆటంకం కలిగిస్తే, ఆ ఊరిన రసాలు పేగుల మీద ప్రభావం చూపి అనారోగ్యం కలిగిస్తాయి.

ఆ) ‘అందరూ ధర్మాన్ని ఆచరించాలి’ అనే విషయాన్ని సమర్థిస్తూ రాయండి.

జవాబు.

‘సత్యం మాట్లాడండి. ధర్మం ఆచరించండి.’ అనే విషయాలను వేద శాస్త్రాలు చెబుతున్నాయి. కాని వాటిని పాటించే సమయంలో వాటివల్ల అందరికీ మేలు జరుగుతుందా, లేదా అని పరిశీలించాలి. ఒకవేళ కీడు కలిగేట్లైతే అప్పుడు వాటిని సరి చూసుకోవాలి. ఏ నియమాలైనా ప్రజలమేలు కోసం ఏర్పాటు చేయబడేవే. అందుకే కవి నన్నయ ధర్మం అందరికీ మేలు కలిగించాలి అని ప్రయోగించాడు.

ఇ) ఇతరుల కొరకు మనం ఎట్లాంటి త్యాగాలను చేయవచ్చో రాయండి.

జవాబు.

ఎవరైనా ప్రమాదంలో ఉన్నప్పుడు ప్రాణాలను కూడా లెక్కచేయకుండా కాపాడాలి. మనం రక్తం దానం చేయవచ్చు. మన పనులను వాయిదా చేసుకొని వారిని హాస్పటల్స్కు తీసుకుని వెళ్ళవచ్చు. మన వాహనంలోనే ప్రమాదానికి గురైన వ్యక్తులను తరలించవచ్చు. నాన్న మనకోసం ఇష్టమైన వస్తువు తెచ్చినప్పుడు చెల్లికి అదే కావాలని అడిగితే తన కోసం మనం దాన్ని తాగ్యం చెయ్యవచ్చు. బస్సులోను, రైలులోను మనకంటే పెద్దవారు నిలబడి మనం కూర్చుని ఉంటే మన సీటు వారికోసం త్యాగం చెయ్యవచ్చు.

ఈ) “త్యాగనిరతి” అనే శీర్షిక పాఠానికి ఏ విధంగా తగినదో రాయండి.

జవాబు.

ఈ పాఠంలో డేగ పావురాన్ని తినడానికి వెంటపడింది. పావురానికి ఆశ్రయమిచ్చి శిబి చక్రవర్తి పావురం కోసం ఏమైనా త్యాగం చెయ్యడానికి సిద్ధపడ్డాడు. రాజు త్యాగ గుణాన్ని ఉపయోగించుకోడానికి డేగ పావురాన్ని త్యాగం చేసింది. డేగ రాజు శరీరంలోని మాంసాన్ని పావురం బరువుకు సరిపడ తూచి యిమ్మన్నది. అలా తూచడంలో చివరికి రాజు తానే త్రాసులో కూర్చుని తన ప్రాణాలనే త్యాగం చేయడానికి సిద్ధపడ్డాడు. తన త్యాగ గుణాన్ని దేవతలు మెచ్చుకున్నారు. అందుచేత ఈ పాఠానికి “త్యాగనిరతి” అనే శీర్షిక తగి ఉన్నది.

2. కింది ప్రశ్నలకు పది వాక్యాల్లో జవాబులు రాయండి.

అ) త్యాగం చేయటంలో ఉన్న గొప్పతనాన్ని, అనుభూతిని వివరించండి. (లేదా) త్యాగనిరతి పాఠ్యభాగ సారాంశాన్ని సొంతమాటల్లో రాయండి. (లేదా) పావురాన్ని రక్షించుటకు శిబి చక్రవర్తి చేసిన త్యాగాన్ని వివరించండి. (లేదా) శిబి చక్రవర్తి తన శరీరాన్ని కోసివ్వటంలో ఆంతర్యం ఏమిటి ? (లేదా) శిబి చక్రవర్తి త్యాగ గుణాన్ని సొంతమాటల్లో వ్రాయండి. (లేదా) త్యాగ గుణం గొప్పతనాన్ని కవి ఎలా వివరించాడు ?

జవాబు.

ఇంద్రుడు, అగ్నిదేవుడు డేగ పావురాల రూపంలో శిబిచక్రవర్తి త్యాగ గుణాన్ని పరీక్షించడానికి వచ్చారు. శరణుకోరి వచ్చిన పావురానికి శిబి అభయమిచ్చాడు. అలా శరణన్న వారిని రక్షించటంలో ఎంతో ఆనందం ఉంటుంది. లోకంలో ఎంతోమంది ఉన్నా పావురం తన దగ్గరికే వచ్చిందంటే తన మీద ఎంతో నమ్మకం ఉండబట్టే గదా అని తలచుకుంటే శిబి గుండె సంతోషంతో ఉప్పొంగిపోయింది. ఆ ఆనందం అనుభవించే వారికే తెలుస్తుంది.

అలాగే ధర్మాధర్మాల గురించి వాదించిన మీదట డేగ పావురానికి సరితూగినంత మాంసం శిబి శరీరం నుంచి తూచి ఇవ్వమన్నప్పుడు “నన్ననుగ్రహించితివి మహావిహగోత్తమ !” అంటూ ఎంతో సంతోషించాడు శిబి, తాను అన్నమాట నిలబెట్టుకోగలుగుతున్నాను గదా అని. అంతేగాక ఒకరిని రక్షించడానికి, మరొకరి ఆకలి తీర్చడానికి తాను ప్రాణత్యాగానికైనా సిద్ధపడ్డాడు. రెండు విధాలుగా ధర్మాన్ని రక్షించగలిగానన్న ఆనందం, అనుభూతి ఎంతో గొప్పవి. ఆ ఆనందం అనుభవించే వారికే బాగా అర్థమౌతుంది.

IV. సృజనాత్మకత/ప్రశంస

అ) అన్ని దానాల్లోకెల్ల అన్నదానం గొప్పది. శరీరంలోని అవయవదానం ఇంకా గొప్పది. అవయవదానంపై ప్రజలకు చైతన్యం కలిగించుమని వార్తాపత్రికలకు లేఖ రాయండి.

వరంగల్,

ది.XX. XX. XXXX

జవాబు.

గౌరవనీయులైన పత్రికా సంపాదకులకు,

నమస్తే తెలంగాణ పత్రిక

పుట్టుకతోనే అవయవలోపాలతో కొందరు పుడుతూ ఉంటే, ప్రమాదాల్లో అవయవాలు పోగొట్టుకునేవారు కొందరు. కన్ను, ముక్కు, చెవి, కాళ్ళు, చేతులు – వీటిలో ఏ అవయవం లేకపోయినా బాధాకరమే. మన చుట్టూ ఉన్న ప్రకృతిలోని అందాలను చూసి ఆనందించాలన్నా, చక్కని సంగీతం వినాలన్నా, సుందరమైన ప్రదేశాలకు వెళ్ళాలన్నా కళ్ళు, ముక్కు, కాళ్ళు, చేతులు తప్పనిసరి. ఇవేకాదు, మూత్రపిండాలు, ఊపిరితిత్తులు వంటి అవయవభాగాలు ముఖ్యమైనవే.

రక్తం అవయవ భాగం కాకపోయినా, అవయవమంత ప్రాముఖ్యమున్నదే. కళ్ళు, మూత్రపిండాలు, ఊపిరితిత్తులు, రక్తంవంటి వాటిని దానమిచ్చి మన చుట్టూ ఆయా అవయవాల లోపంతో బాధపడేవారిని ఆదుకోవడమే మానవజన్మకు సార్థకత.

జీవించి ఉండగానే, కళ్ళు, మూత్రపిండాలు వంటివి దానం చేయవచ్చు. మరణించాక కూడా జీవించి ఉండడానికి మార్గం అవయవదానం. తమ మరణానంతరం, తమ కళ్ళను దానం చేస్తామంటూ, ఎంతోమంది నేటికాలంలో ముందుకొస్తున్నారు.

అలా నేత్రదానంతో ఎంతోమంది అంధులకు వెలుగునిస్తూ, మరణించాక కూడా జీవించడం గొప్ప విషయం. అలాగే ఇటీవల బెంగుళూరుకు చెందిన వ్యక్తి గుండె చెన్నైకి చెందిన మరొక వ్యక్తికి మార్పిడి చేయడం ద్వారా ఆ వ్యక్తికి ప్రాణం పోశారు. అలాగే ఇటీవల విజయవాడకు చెందిన మణికంఠ దానం చేసిన గుండె, నేత్రాలు, మూత్రపిండాలు, ఊపిరితిత్తులు, కాలేయం మరికొందరిని జీవించగలిగేట్లు చేశాయి.

ఇలా అవయవ దానం వల్ల కొంతమంది జీవితాల్లో వెలుగులు నింపవచ్చు. ఇటువంటివారు రాబోయే తరాలకు స్ఫూర్తిదాతలు. చనిపోయాక కూడా జీవించాలంటే అవయవదానమే మార్గం. అవయవ దానానికి అందరూ ముందుకు వచ్చేలా మీ పత్రిక ద్వారా చైతన్యం కలిగించమని విజ్ఞప్తి.

ఇట్లు

బాలభాను,

ఒక పాఠకుడు.

చిరునామా :

నమస్తే తెలంగాణ పత్రికా కార్యాలయం,

రోడ్ నెం. 10, బంజారా హిల్స్

హైదరాబాద్.

V. పదజాల వినియోగం

1. గీత గీసిన పదాలకు అర్థాలను రాయండి.

ఉదా : కపోతములు శాంతికి చిహ్నాలని భావిస్తారు.

కపోతములు = పావురములు

అ) ఆశ్రితులను వదలి వేయుట ధర్మువు కాదు.

జవాబు.

ధర్మువు = ధర్మము

ఆ) ఉత్తముడు పరుల హితమునే కోరతాడు.

జవాబు.

హితమునే = మేలునే

ఇ) ఎందరో మహానుభావుల పరిత్యాగం వల్లనే తెలంగాణ రాష్ట్రం సిద్ధించింది.

జవాబు.

పరిత్యాగం = సమర్పించడం

ఈ) దేశంలో సుఖశాంతులు వర్ధిల్లుగాక !

జవాబు.

వర్ధిల్లు = వృద్ధిపొందు

ఉ) బుభుక్షితుడు రుచిని పట్టించుకోకుండా ఆరగిస్తాడు.

జవాబు.

బుభుక్షితుడు = ఆకలితో బాధపడువాడు’

2. కింది వాక్యాలలోని నానార్థాలను గుర్తించి రాయండి.

ఉదా : ఈ సంవత్సరం వానలు తక్కువగా ఉన్నాయి.

వర్షం = సంవత్సరం, వాన

అ) న్యాయంగా ఆలోచిస్తే పాలల్లో నీళ్ళు కలపడం ధర్మం కాదు.

పాడి : __________, __________

జవాబు.

పాడి : న్యాయం, పాలు

ఆ) అడవిలోని జంతువులకు నీరు కరువవుతున్నది.

వనం : __________, __________

జవాబు.

వనం : అడవి, నీరు

VI. భాషను గురించి తెలుసుకుందాం

1. కింది వాక్యాలను చదువండి. అవి ఎటువంటి వాక్యాలో గుర్తించి జతపరచండి.

ఉదా : లోపలకి రావచ్చు – అనుమత్యర్థక వాక్యం

| అ) దయచేసి వినండి |

1) ఆశ్చర్యార్థక వాక్యం |

| ఆ) రమ చక్కగా రాయగలదు |

2) ప్రశ్నార్థక వాక్యం |

| ఇ) ఆహా ! ఎంత బాగుందో |

3) సామర్థ్యార్థక వాక్యం |

| ఈ) అల్లరి చేయవద్దు |

4) ప్రార్థనార్థక వాక్యం |

| ఉ) గిరి ! ఎక్కడున్నావు ? |

5) నిషేధార్థక వాక్యం |

జవాబు.

అ) 4

ఆ) 3

ఇ) 1

ఈ) 5

ఉ) 2

2. కింది పదాలను విడదీసి సంధి పేరు రాయండి.

అ) ఇంద్రాగ్నులు = _______ + _______ = _______

జవాబు.

ఇంద్ర + అగ్నులు = సవర్ణదీర్ఘ సంధి

సూత్రం : అ, ఇ, ఉ, ఋ లకు సవర్ణాలైన అచ్చులు పరమైనప్పుడు వాని దీర్ఘాలు ఏకాదేశమవుతాయి.

ఆ) త్యాగమిది = _______ + _______ = _______

జవాబు.

త్యాగము + ఇది = ఉత్వ సంధి

సూత్రం : ఉత్తునకు అచ్చుపరమైనపుడు సంధి అవుతుంది.

ఇ) ఆహారార్థం = _______ + _______ = _______

జవాబు.

ఆహార + అర్థం = సవర్ణదీర్ఘ సంధి

సూత్రం : అ, ఇ, ఉ, ఋ లకు సవర్ణాలైన అచ్చులు పరమైనప్పుడు వాని దీర్ఘాలు ఏకాదేశమవుతాయి.

ఈ) నేనెట్లు = _______ + _______ = _______

జవాబు.

నేను + ఎట్లు = ఉత్వసంధి

సూత్రం : ఉత్తునకు అచ్చుపరమైనపుడు సంధి అవుతుంది.

ఉ) శౌర్యాది = _______ + _______ = _______

జవాబు.

శౌర్య + ఆది = సవర్ణదీర్ఘ సంధి

సూత్రం : అ, ఇ, ఉ, ఋ లకు సవర్ణాలైన అచ్చులు పరమైనప్పుడు వాని దీర్ఘాలు ఏకాదేశమవుతాయి.

భాషాకార్యకలాపాలు / ప్రాజెక్టు పని:

ప్రశ్న 1.

త్యాగబుద్ధి కలిగిన ఇద్దరు మహనీయుల వివరాలను లేదా కథలను లేదా సంఘటనలను సేకరించండి. నివేదిక రాసి తరగతిలో ప్రదర్శించండి.

జవాబు.

అ) ప్రాథమిక సమాచారం :

1) ప్రాజెక్టు పని పేరు : త్యాగబుద్ధి కలిగిన ఇద్దరు మహనీయులు.

2) సమాచారాన్ని సేకరించిన విధానం : ఉపాధ్యాయుని ద్వారా / ఇంటిలోని పెద్దల (తాత/నానమ్మ/ అమ్మమ్మ) ద్వారా / గ్రంథాలయ పుస్తకాల ద్వారా

ఆ) నివేదిక :

విషయ వివరణ :

“తనకు ఎంతో అవసరమైనప్పటికిని లెక్కచేయకుండా ఇతరులకు ఇవ్వడాన్నే త్యాగం అంటారు.” దానం, త్యాగం అనే రెండు పదాలు దగ్గర అర్థాన్నిచ్చేవిగా ఉన్నా వీటి మధ్య ఎంతో తేడా ఉంది.

తనకున్నంతలో ఇతరులకు ఇవ్వడం దానం అయితే, తనకున్నా లేకున్నా ఇతరులకు ఇవ్వగలిగే గుణాన్ని త్యాగంగా చెప్పవచ్చు. అలాంటి త్యాగబుద్ధి గలిగిన ఇద్దరు మహాపురుషుల గూర్చి, నేను నివేదికలో పొందు పరుస్తున్నాను.

1. రంతిదేవుడు

“అతిథి దేవో భవ” అనేది మన సాంప్రదాయం. దాన్ని అక్షరాల ఆచరించి శాశ్వత కీర్తి పొందిన రంతిదేవుని కథ నాకెంతోగానో నచ్చింది. రంతిదేవుడు ఒక మహారాజు. అమిత దానశీలి. తన రాజ్యాన్ని, సంపదలను దానం చేసి భార్యా బిడ్డలతో అడవికి వెళ్ళాడు.

అడవిలో కాయ, కసరులు తింటూ కడుపు నింపుకొనేవాడు, దైవికంగా లభించినది తిని తృప్తిపడేవాడు తప్ప దేన్నీ కోరేవాడు కాదు. భవిష్యత్ అవసరాలకు కూడా దేన్నీ దాచుకొనేవాడు కాదు. ఒకసారి 48 రోజులు పాటు అతనికి, అతని కుటుంబానికి ఏమీ లభించలేదు. 49వ రోజున కొంత ఆహారం లభించింది. కుటుంబమంతా కూర్చుండి తినడానికి ఉపక్రమించ బోతుండగా ఒక బ్రాహ్మణ అతిథి వచ్చాడు. అతనికి ఆహారం పెట్టాడు. తర్వాత ఒక బీదవాడు వచ్చాడు. రంతిదేవుడు అతని ఆకలి కూడా తీర్చి పంపాడు. తర్వాత ఒకడు, తన కుక్కల క్షుద్బాధ తీర్చమని వేడుకోగా వాటికి ఆహారం పెట్టాడు. చివరికి కొద్ది పాయసం మాత్రమే మిగిలింది. దాన్నే తలా కాస్తా తాగుదామనుకోగా, ఒక ఛండాలుడు వచ్చాడు. ఉన్న పాయసం అతనికి ఇచ్చి, ఆకలి బాధ తట్టుకోలేక రంతి దేవుడు స్పృహ తప్పి పోయాడు. మరుక్షణమే దేవుడు ప్రత్యక్షమై అతనికి మోక్షాన్ని ప్రసాదించాడు.

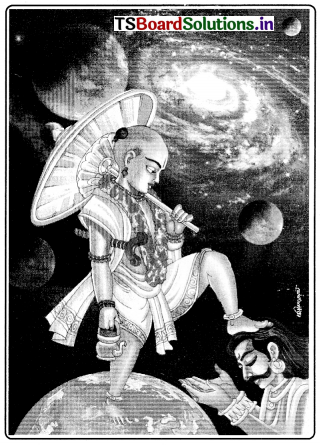

2. బలిచక్రవర్తి

రాక్షస రాజైన బలి చక్రవర్తి మహా బలవంతుడు. అతనికి ఎదురొడ్డి పోరాడలేక దేవతలు మహావిష్ణువును శరణు కోరతారు. ఎలాగైనా బలి చక్రవర్తిని చంపనైనా చంపు లేదా మాపై ఆధిపత్యం చలాయించకుండానైనా చూడ మంటారు. అప్పుడు విష్ణువు వారికి అభయమిచ్చి, తాను వామనరూప ధారియై బలి వద్దకు వెళ్తాడు. గొడుగు ధరించి వచ్చిన ఆ వామనమూర్తిని చూడగానే రాక్షస గురువైన శుక్రాచార్యుల వారి మనస్సెందుకో కీడు శంకించింది.

దివ్యదృష్టితో అతడు శ్రీ మహావిష్ణువని గ్రహించి బలిని, అతనికి దానమివ్వవద్దని ఎంత చెప్పినా బలి చక్రవర్తి ససేమిరా వినడు. తన కులం, వంశం, దేశం నాశనమైనా, చివరికి తాను చనిపోయినా ఆడిన మాట తప్పను అని వామనునికి 3 అడుగుల నేల దానం చేస్తాడు. 2 అడుగులకే భూమ్యాకాశాలను ఆక్రమించిన వామనుడు, తన 3వ అడుగు ఎక్కడ పెట్టాలో చెప్పమంటాడు. అప్పుడు బలి, తన శిరస్సు పైన ఉంచమంటాడు. వామనుడు, బలి శిరస్సుపై తన పాదాన్ని ఉంచి పాతాళానికి తొక్కి వేస్తాడు. దాంతో దేవతలకు బలి చక్రవర్తి పీడ విరగడైంది.

ఇ) ముగింపు :

ఈ విధంగా తమ సచ్చీలత, త్యాగనిరతి అనే గుణాలతో చరిత్రలో నిలిచిపోయిన ఇరువురు మహాపురుషుల కథలు చదువుతుంటే నాలో ఎంతో ఉత్తేజం, ఉద్వేగం కలిగాయి. ఇలాంటి మహాపురుషులను కన్న భరతభూమికి వందనాలు అర్పించాలనిపించింది.

TS 8th Class Telugu 1st Lesson Important Questions త్యాగనిరతి

ప్రశ్న 1.

“శరణాగత పరిత్యాగంబు కంటె మిక్కిలి యధర్మం బొండెద్ది” అని శిబి అన్నాడు కదా! శరణాగతులను ఎందుకు విడువకూడదు ?

(లేదా)

శరణుకోరిన వారిని వదలకూడదు. ఎందుకు ?

(లేదా)

శరణాగత పరిత్యాగం అధర్మం అంటే నీకేమి అర్థమైంది ?

జవాబు.

తనను ఆశ్రయించినవారు శరణాగతులు. తనను కాపాడ గల్గినవారి వద్దకే, గొప్పనమ్మకంతో వస్తారు. ఆశ్రయమిచ్చిన వారిని కాపాడటం ధర్మం, కర్తవ్యం. ఎన్ని ఆటంకాలు ఎదురైనా, వారి నమ్మకాన్ని వమ్ము చేయకుండా ఆశ్రితులను కాపాడాలి శరణాగతులను వదలకూడదు. వారిని కాపాడకుండా వదిలిపెడితే అది అధర్మం అవుతుంది.

ప్రశ్న 2.

త్యాగం అంటే ఏమిటి ? త్యాగం ఎందుకు చేయాలి? దేనిని గొప్పత్యాగం అంటారు ? త్యాగగుణం ఎందుకు కలిగి

ఉండాలి ?

జవాబు.

తనకి ఉన్నంతలో కొంత ఇతరులకి ఇవ్వడమే త్యాగం. ఎన్ని కష్టాలకైనా ఓర్చుకొని తనను ఆశ్రయించిన వారికి కావలసిన దానిని ఇవ్వడమే త్యాగం. ఆశ్రయించినవారి కోసం తన ప్రాణాలనైనా సంతోషంగా ఇవ్వడానికి సిద్ధపడడాన్ని గొప్పత్యాగం అంటారు.

త్యాగ ఫలితాన్ని పొందినవారు, వారి ఆత్మీయులు ఎంతో సంతోషపడతారు కనుక ఆ సంతోషం మనకెంతో తృప్తినిస్తుంది. అదీ త్యాగంలోని గొప్పతనం. అనిర్వచనీయమైన ఆనందం, సంతృప్తి పొందటం కోసం త్యాగ గుణం కలిగి ఉండాలి.

ప్రశ్న 3.

శిబిచక్రవర్తి వంటి వాళ్ళ కీర్తి శాశ్వతమని వివరించండి.

జవాబు.

ప్రాణభయంతో ఆశ్రయించిన వారు నీచులే అయినా వారిని విడిచి పెట్టడం ధర్మం కాదు. ఆహారమే కావలసివస్తే అడవిలో ఎన్నో జంతువులు ఉంటాయి. వాటిని తిని ప్రాణాలు నిలుపుకోవచ్చు అని డేగతో అన్నాడు. ఆ డేగ శిబితో పావురం తనకు సహజసిద్ధంగా కల్పించబడిన ఆహారం. దీన్ని కాపాడాలనుకుంటే దాని బరువుకు తూగినంత మాంసం నీ శరీరం నుండి నాకు పెట్టమని అన్నది. తన ప్రాణాలను సైతం లక్ష్యపెట్టక ఆశ్రయించిన పావురాన్ని కాపాడటానికి సిద్ధపడ్డ శిబి చక్రవర్తిలాంటి వాళ్ళ కీర్తి శాశ్వతంగా నిలిచి ఉంటుంది.

ప్రశ్న 4.

త్యాగనిరతి పాఠం ద్వారా డేగ దృష్టిలో ధర్మం అంటే ఏది ?

జవాబు.

అన్ని ప్రాణులు ఆహారం తీసుకొనే బ్రతుకుతాయి. ఆహారం లేకపోతే ప్రాణులు ఉండవు. డేగకు పావురం వేదంచే నిర్దేశింపబడిన ఆహారం. డేగలు పావురాలను తింటాయి. కాబట్టి పావురాన్ని చంపి తినుట తప్పుకాదని, అది ధర్మబద్ధమే అని డేగ ఉద్దేశం.

ప్రశ్న 5.

త్యాగనిరతి పాఠం ఆధారంగా శిబి చక్రవర్తికి, డేగకు మధ్య జరిగిన సంభాషణ రాయండి.

జవాబు.

సంభాషణ

డేగ : ఓ శిబి చక్రవర్తీ ! నువ్వు గొప్ప సత్యధర్మ పరుడవని విన్నాను. మరి ఆకలిగొన్నవాడినైన నా ఆహారాన్ని తిననీకుండ చేస్తున్నావెందుకు ? నేను ఆకలితో చనిపోతే నా పిల్లలు, భార్య బతకరు. ఇన్ని ప్రాణాలు పోవడానికి నీవు కారణమౌతావు. ఇది నీకు ధర్మమా ?

శిబి చక్రవర్తి : నేను నీ ఆహారమైన పావురాన్ని రక్షిస్తానని మాట ఇచ్చాను. నీ ఆకలి తీర్చడానికి నీకేం కావాలో కోరుకో ఇస్తాను.

డేగ : పావురాలు మా జాతికి ఆహారమని వేదాల్లో కూడా చెప్పబడింది. కనుక నాకీ పావురాన్నిచ్చే సెయ్.

శిబి చక్రవర్తి : అడవిలోని ఏ జంతువుల మాంసం కావాలన్నా తెప్పించి ఇస్తాను. ఈ పావురాన్ని విడిచిపెట్టను. నేను ఆడిన మాట తప్పను.

డేగ : అయితే దీని బరువుకు సమానమైన మాంసము నీ శరీరం నుండి కోసి యివ్వు.

శిబి చక్రవర్తి : చాలా సంతోషం. తప్పక ఇస్తాను. (భటులతో-) భటులారా ! త్రాసు తీసుకురండి.

భటులు : చిత్తం మహాప్రభూ ! (త్రాసు తెచ్చారు. శిబి మాంసం కోసి త్రాసులో పెట్టాడు. రెండవ వైపు పావురాన్ని ఉంచారు.)

శిబి చక్రవర్తి : ఏమి ఆశ్చర్యం ! ఎంత మాంసం ఉంచినా తూగడం లేదు ! నేను స్వయంగా త్రాసులో కూర్చుంటాను. (కూర్చున్నాడు.)

డేగ : భళా ! శిబి చక్రవర్తీ ! నీ త్యాగనిరతి అపూర్వం. మెచ్చాను నీ త్యాగానికి.

శిబి చక్రవర్తి : మహానుభావా ! ఎవరు మీరు ?

డేగ : నేను ఇంద్రుడను. ఈ పావురం అగ్నిదేవుడు. నీ త్యాగాన్ని పరీక్షించడానికి ఈ రూపాలలో వచ్చాము. నీ ధైర్య శౌర్యాదిగుణాలు చాలా గొప్పవి. నీ కీర్తి ఆచంద్రతారార్కంగా వర్ధిల్లుతుంది.

పర్యాయపదాలు:

- విఘ్నము : ఆటంకము, అడ్డంకి

- భూతములు : ప్రాణులు, జీవులు

- ఆహారము : అన్నము, భోజనము

- పుత్త్రులు : కుమారులు, కొడుకులు

- భార్య : సతి, ఇల్లాలు, పెండ్లము

- కపోతము : పావురము, పారావతము

- పక్షి : ఖగము, పులుగు

- వనము : అడవి, అరణ్యం

- మిక్కిలి : ఎక్కువ, అధికము, కడిది

- అవని : భూమి, పుడమి, ధాత్రి

- వాసవుడు : ఇంద్రుడు, పాకారి

- తనువు : శరీరము, దేహము

- దహనుడు : అనలుడు, అగ్ని, పావకుడు

నానార్థాలు:

- ఆగ్రహము = పట్టుదల, కోపము

- పాడి = న్యాయము, ధర్మము, తీర్పుస్వభావం, ఆచారం

- తుల = త్రాసు, సమానము

- భూతము = ప్రాణి, గతము

ప్రకృతి – వికృతులు:

- ప్రకృతి -వికృతి

- సత్యము – సత్తెము

- ధర్మము – దమ్మము

- ఆహారము – ఓగిరము

- మతి – మది

- హితము – ఇత

- పక్షి – పక్కి

- యత్నము – జనము

- మృగము – మెకము

- గుణము – గొనము

- శబ్దము – సద్దు

- బ్రహ్మ – బమ్మ, బొమ్మ

- ఆశ్చర్యము – అచ్చెరువు

- కీర్తి – కీరితి

- అగ్ని – అగ్గి

వ్యుత్పత్త్యర్థాలు:

- పక్షి : పక్షములు కలది (పక్షి)

- ఖగము : ఆకాశమున తిరుగునది. (పక్షి)

- దహనుడు : దహించు స్వభావము (అగ్ని)

- బుభుక్ష : కలవాడు. తినవలెనను కోరిక (ఆకలి)

- పుత్రుడు : పున్నామ నరకము నుండి రక్షించువాడు. (కొడుకు)

సంధులు

- విఘ్నమిట్టులు : విఘ్నము + ఇట్టుల = ఉత్వసంధి

- వియోగంబగు : వియోగంబు + అగు = ఉత్వసంధి

- ఇమ్మని : ఇమ్ము + అనిన = ఉత్వసంధి

- అధముడయిన : అధముడు + అయిన = ఉత్వసంధి

- మాంసమెల్ల : మాంసము + ఎల్ల = ఉత్వసంధి

- సూత్రం : ఉత్తునకు అచ్చుపరమైనపుడు సంధి అవుతుంది.

- ఇంద్రాగ్నులు : ఇంద్ర + అగ్నుల = సవర్ణదీర్ఘ సంధి

- శరణాగత : శరణ + ఆగత = సవర్ణదీర్ఘ సంధి

- ఆహారార్ధం : ఆహార + అర్థం = సవర్ణదీర్ఘ సంధి

- సూత్రం : అ, ఇ, ఉ, ఋ లకు సవర్ణాలైన అచ్చులు పరమైనప్పుడు వాని దీర్ఘాలు ఏకాదేశమవుతాయి.

- గుణోన్నతి : గుణ + ఉన్నతి = గుణసంధి

- విహాగోతామ : విహగ + ఉత్తమ = గుణసంధి

- సూత్రం : అకారానికి ఇ, ఉ, ఋ లు పరమైనపుడు క్రమంగా ఏ, ఓ, అర్లు ఏకాదేశమవుతాయి.

- ఎట్టియధముడు : ఎట్టి + అధముడు = యడాగమసంధి

- మిక్కిలి యధర్మము : మిక్కిలి + అధర్మము = యడాగమసంధి

- తులయెక్కె : తుల + ఎక్కె = యడాగమసంధి = యడాగమసంధి

- సూత్రం : సంధిలేని చోట స్వరం కంటే పరంగా ఉన్న స్వరానికి యడాగమం అవుతుంది.

సమాసములు

- ఇంద్రాగ్నులు – ఇంద్రుడును, అగ్నియును – ద్వంద్వ సమాసము

- వాసవదహనులు -వాసవుడును, దహనుడును – ద్వంద్వ సమాసము

- తనయంగము – తనదైన అంగము – విశేషణ పూర్వపద కర్మధారయ సమాసము

- సర్వభూతములు – సర్వములైన భూతములు – విశేషణ పూర్వపద కర్మధారయ సమాసము

- పెక్కుజీవములు – అనేకములైన జీవములు – విశేషణ పూర్వపద కర్మధారయ సమాసము

- వేదవిహితము – వేదముచేత విహితము – తృతీయా తత్పురుష సమాసము

- విహగోత్తముడు – విహగములలో ఉత్తముడు – షష్ఠీ తత్పురుష సమాసము

- అవనినాథుడు – అవనికి నాథుడు – షష్ఠీ తత్పురుష సమాసము

- గుణోన్నతి – గుణములందు ఉన్నతి – సప్తమీ తత్పురుష సమాసము

- ఒక్క కపోతము – ఒక్కటైన కపోతము – ద్విగు సమాసము

- శబ్ద బ్రహ్మము – శబ్దమనెడి బ్రహ్మము – రూపక సమాసము

పద్యాలు – ప్రతిపదార్థాలు – తాత్పర్యాలు

1. ఆ॥ నిన్ను సత్య ధర్మ నిర్మలుఁగా విందు

నట్టి నీకు బాడియయ్య ? యిప్పు

డతి బుభుక్షితుండనై యున్న నాకు నా

హార విఘ్న మిట్టులాచరింప ?

ప్రతిపదార్థం :

అయ్య = ఓ రాజా ! శిబి చక్రవర్తీ!

నిన్ను = నిన్ను గురించి

సత్య ధర్మనిర్మలున్ + కాన్ = సత్యము, ధర్మము పాటించే పవిత్రునిగా

విందున్ = విని ఉన్నాను

అట్టి నీకు = అంత గొప్పవాడివైన నీకు

ఇప్పుడు = ఈ సమయంలో

అతి = మిక్కిలి

బుభుక్షితుండను + ఐ =ఆకలి గొన్నవాడనై

ఉన్న నాకున్ = ఉన్నటువంటి నాకు

ఇట్టులు = ఈ విధంగా

ఆహార విఘ్నము = భోజనానికి ఆటంకము

ఆచరింప = కలిగించుట

పాడి + అ = న్యాయమేనా ?

తాత్పర్యం:

ఓ శిబి చక్రవర్తీ ! నీవు సత్య ధర్మాలను ఆచరించటం చేత కళంకం లేనివాడివని విన్నాను. అటువంటి నీవు ఈ సమయంలో మిక్కిలి ఆకలితో ఉన్న నాకు ఆహారం దొరకకుండా చేయటం న్యాయమేనా ?

2. వ॥ సర్వ భూతంబులు నాహారంబున జీవించి వర్ధిల్లు, నిదినాకు, భక్ష్యంబు గానినాఁడు

బుభుక్షావేదనం జేసి ప్రాణ వియోగంబగు, నట్లయిన నా పుత్రులు భార్యయు జీవింపనేర,

రొక్క కపోతంబు రక్షించి పెక్కు జీవులకు హింససేయుట ధర్మవిరోధంబు

ప్రతిపదార్థం :

సర్వభూతంబులు ఆహారంబున = ప్రాణులన్నియు

జీవించి = బతికి

వర్ధిల్లు = వృద్ధిపొందును.

ఇది = ఈ పావురము

నాకు = డేగనైన నాకు

భక్ష్యంబు + కానినాడు = ఆహారం కాకపోతే

బుభుక్షావేదనన్ + చేసి = = ఆకలిబాధ వలన

ప్రాణ వియోగంబు + అగున్ = ప్రాణములు పోవును

అట్లు + అయిన = అలా జరిగితే

నా పుత్రులు = నా బిడ్డలు

భార్యయు = భార్యయును

జీవింప నేరరు = బ్రతకలేరు

ఒక్క కపోతంబు = ఒక్క పావురాన్ని

రక్షించి = కాపాడి

పెక్కు జీవులకు = అనేక ప్రాణులకు

హింస + చేయుట = బాధ కలిగించుట

ధర్మ విరోధంబు = ధర్మానికి విరుద్ధము

తాత్పర్యం:

అన్ని ప్రాణులు కూడా ఆహారం మూలంగానే బ్రతుకుతూ వృద్ధి పొందుతాయి. ఈ పావురం నాకు ఆహారం కాకపోతే ఆకలి బాధతో నా ప్రాణాలు పోతాయి. అట్లైతే పిల్లలు, భార్య కూడా బతుకజాలరు. ఒక్క పావురాన్ని కాపాడి ఇన్ని ప్రాణులను హింసించటం ధర్మానికి వ్యతిరేకమే కదా!

3. క॥ ధర్మజ్ఞులైన పురుషులు

ధర్మువునకు బాధసేయు ధర్మువునైనన్ ధర్మముగా మదిఁ దలఁపరు

ధర్మువు సర్వంబునకు హితంబుగ వలయున్

ప్రతిపదార్థం:

ధర్మజ్ఞులు + ఐన = ధర్మమును తెలిసిన

పురుషులు = మనుషులు

ధర్మువునకు = ధర్మానికి

బాధ + చేయు = హాని కలిగించే

ధర్మువున్ + ఐనన్ = ధర్మాన్నైనా సరే

మదిన్ = మనసులో

ధర్మముగా = ధర్మము అని

తలపరు = ఆలోచించరు

ధర్మువు = ధర్మమెప్పుడూ

సర్వంబునకు = ఎల్లరకు

హితంబుగ = మేలు కలిగించేదిగ

వలయున్ = ఉండవలెను.

తాత్పర్యం:

ధర్మం తెలిసినవారు ధర్మానికి కీడుచేసే ఎటువంటి ధర్మాన్నైనా ధర్మమని మనస్సులో తలచుకోరు. ధర్మం అనేది అన్నింటికీ మేలును కలిగించేదిగానే ఉండాలి.

4. వ॥ ఇక్కపోతంబు నాకు వేదవిహితంబైన యాహారంబు.

‘శ్యేనాః కపోతాన్ ఖాదయన్తి’ యను వేదవచనంబు

గలదు గావున దీని నాకు నాహారంబుగా నిమ్మనిన

దానికి శిబి యిట్లనియె

ప్రతిపదార్థం:

ఈ + కపోతంబు = ఈ పావురము

నాకు = డేగనైన నాకు

వేదవిహితంబు + ఐన = వేదములు నిర్దేశించిన

ఆహారంబు = ఆహారము

శ్యేనాః = డేగలు

కపోతాన్ = పావురాలను

ఖాదయంతి = తింటాయి

అను = అనునది

వేదవచనంబు+కలదు = వేదములు చెప్పిన మాట ఉన్నది.

కావున = అందుచేత

నాకున్ = నాకు

దీనిన్ = ఈ పావురాన్ని

ఆహారంబుగాన్ = భోజనంగా

ఇమ్ము = ఇవ్వవలసినది

అనిన = అనగా

దానికి = ఆ డేగకు

శిబి = శిబి చక్రవర్తి

ఇట్లు + అనియె = ఇలా అన్నాడు.

తాత్పర్యం:

ఈ పావురం నాకు వేదంచే నిర్దేశింపబడిన ఆహారం. “డేగలు పావులను తింటాయి” అనే వేద వాక్యం ఉన్నది. కాబట్టి దీనిని నాకు ఆహారంగా ఇవ్వుమని అడిగిన డేగతో శిబి ఈ విధంగా బదులు పలికాడు.

5. తే॥ ప్రాణభయమున వచ్చి యిప్పక్షి నన్ను

నాశ్రయించె నాశ్రితునెట్టి యధముఁడయిన విడువఁడనినను నేనెట్లు విడుతు దీని ?

నాశ్రిత త్యాగమిది ధర్మువగునె ? చెపుమ

ఈ + పక్షి = ఈ పక్షియైన పావురము

ప్రాణభయమున = ప్రాణం పోతుందనే భయంతో

వచ్చి = నా దగ్గరకు వచ్చి

నన్నున్+ఆశ్రయించెన్ = నా శరణు కోరింది.

ఎట్టి = ఎటువంటి

అధముడు+అయిన = నీచుడైనా కూడా

విడువడు = వదిలిపెట్టడు

అనినను = అంటారు గదా !

నేను = రాజునైన నేను

దీనిన్ = ఈ పక్షిని

ఎట్లు విడుతును = ఎలా వదిలిపెట్టగలను ?

ఇది = ఇలా

ఆశ్రిత త్యాగము = శరణు అన్నవారిని విడిచిపెట్టటం

ధర్మువు+అగును+ఎ = ధర్మము అనిపించుకుంటుందా ?

చెపుము + అ = నీవే చెప్పుము

తాత్పర్యం:

ప్రాణభయంతో వచ్చి ఈ పావురం నన్ను ఆశ్రయించింది. ఎంతటి నీచుడయినా రక్షించుమని వచ్చిన ఆశ్రితుడిని విడిచిపెట్టడు. నేనెట్లా విడిచిపెడతాను? ఆశ్రితులను విడిచిపెట్టడం ధర్మం ఎట్లా అవుతుందో నీవే చెప్పు.

6. వ॥ నీవు పక్షివయ్యును ధర్మమెఱింగినట్లు పలికితి, శరణాగత పరిత్యాగంబు కంటె మిక్కిలి యధర్మం బొండెద్ది?

నీ యాఁకలి దీననకాని యొంట నుపశమింపదే ? నీ యత్నం బాహారార్థం బేని యిప్పు డివ్వనంబున మృగ

మహిష వరాహ ఖగ మాంసంబులు దీనికంటె మిక్కిలిగాఁ బెట్టెద, నిక్కపోతంబు వలని యాగ్రహం బుడుగుము,

దీని నేనెట్లును విడువ’ననిన శ్యేనం బిట్లనియె ..

ప్రతిపదార్థం:

నీవు = నీవు

పక్షివి + అయ్యును = పక్షివై యుండి కూడా

ధర్మము+ఎఱింగిన + అట్లు = ధర్మాలు తెలిసిన వానివలె

పలికితి = మాట్లాడావు

శరణ + ఆగత = శరణు అంటూ వచ్చినవారిని

పరిత్యాగంబు కంటె = విడిచిపెట్టుట కంటె

అధర్మంబు = అధర్మం

ఒండు + ఎద్ది = వేరొకటి ఏమున్నది?

నీ + ఆకలి = నీ ఆకలి

దీనన కాని = దీనితోనే తప్ప

ఒంటన్ = వేరొకదానితో

ఉపశమింపదు + ఏ = = శాంతించదా ?

నీ యత్నంబు = నీ ప్రయత్నము

ఆహార + అర్థంబు +ఏని = ఆహారం కోసమే ఐతే

ఇప్పుడు = ఈ సమయంలో

ఈ + వనంబున = ఈ అడవిలోని

మృగ = జింకల

మహిష = దున్నల

వరాహ = పందులు

ఖగ = పక్షుల

మాంసంబులు = మాంసములను

దీనికంటె = ఈ పావురం కంటె

మిక్కిలి = ఎక్కువగా

పెట్టెదన్ = తినడానికి పెడతాను

ఈ + కపోతంబువలని = ఈ పావురం విషయంలో

ఆగ్రహంబు = పట్టుదల

ఉడుగుము = విడిచిపెట్టు

దీనిని = ఈ పావురాన్ని

నేను = నేను

ఎట్లును = ఏ పరిస్థితిలోనూ

విడువను = వదిలిపెట్టను

అనిన = అని రాజు పలుకగా

శ్యేనం = డేగ

ఇట్లు + అనియె = ఇలా అన్నది.

తాత్పర్యం:

నీవు పక్షివి ఐనప్పటికీ ధర్మం తెలిసిన దానివలె మాట్లాడావు. రక్షించుమని కోరి వచ్చిన వారిని విడిచిపెట్టటం కన్న అధర్మం మరొకటుంటుందా ? నీ ఆకలి ఈ పావురాన్ని తింటే కానీ తీరదా ? నీ ప్రయత్నం ఆహారం కోసమే అయితే ఇప్పుడు అడవిలో ఎన్ని జంతువులు లేవు ? లేళ్ళు, దున్నలు, పందులు, పక్షులు మొదలైన వాటి మాంసాలు దీని కన్నా ఎక్కువగా పెడతాను. ఈ పావురం మీద కోపాన్ని విడిచిపెట్టు. దీన్ని మాత్రం నేను విడువను. అని శిబి చెప్పగా డేగ ఇట్లా బదులు పలికింది.

7. ఆ॥ నాకు విహిత భక్షణంబిది; యిప్పక్షి బూని కావ నీకు బుద్ధియేని

యవని నాథ ! దీని యంత నీ మాంసంబు

దూచి నాకుఁ బెట్టు తొలగ కిపుడ

ప్రతిపదార్థం:

అవని నాథ = ఓ రాజా!

ఇది = ఈ పావురము

నాకు = డేగనైన నాకు

విహిత భక్షణంబు = విధించబడిన ఆహారము

పూని = పట్టుదలతో

ఈ + పక్షిన్ = ఈ పావురాన్ని

కావన్ = రక్షించడానికి

నీకు = నీకు

బుద్ధి + ఏని = ఇష్టమైనట్లైతే

దీని + అంత = దీనితో సమానమైన

నీ మాంసంబు = నీ శరీర మాంసాన్ని

తూచి = తూకంవేసి

తొలగక = తప్పించుకోకుండా

ఇపుడు + అ = ఇప్పుడే

నాకున్ + పెట్టు = నాకు ఆహారంగా పెట్టు

తాత్పర్యం :

ఓ రాజా ! ఈ పావురం నాకు సహజసిద్ధంగా కల్పించబడిన ఆహారం. ఒకవేళ దీన్ని నీవు కాపాడాలని అనుకుంటే, దాని బరువుకు తూగినంత మాంసాన్ని నీ శరరీం నుంచి నాకు పెట్టుమని అడిగింది.

8. చ॥ అనిన ‘ననుగ్రహించితి మహా విహగోత్తమ’ యంచు సంతసం

బున శిబి తత్క్షణంబ యసి పుత్రిక నాత్మశరీర కర్తనం ‘

బనఘుఁడు సేసి చేసి తన యంగమునం గల మాంసమెల్లఁ బె

ట్టినను గపోతభాగమ కడిందిగ డిందుచు నుండె నత్తులన్

ప్రతిపదార్థం:

అనినన్ = ఆ డేగ ఇలా పలుకగా

శిబి = శిబి చక్రవర్తి

మహావిహగ+ఉత్తమ = ఓ శ్రేష్ఠుడైన పక్షిరాజా !

ననున్ = నన్ను

అనుగ్రహించితి = కరుణించావు

అంచు = అని పలుకుతూ

సంతసంబున = సంతోషముతో

అనఘుడు = పుణ్యాత్ముడైన ఆ శిబి

తత్ + క్షణంబు + అ = వెంటనే

అసి పుత్రికన్ = చిన్న కత్తితో

ఆత్మ = తన యొక్క

శరర = దేహమును

కర్తనంబు

చేసి చేసి = కత్తిరించుట = ఎన్నోసార్లు చేసి

తన = తన యొక్క

అంగంబునన్ + కల = శరీరము నందున్న

మాంసము + ఎల్లన్ = మాంసమంతయు

ఆ + తులన్ = ఆ త్రాసులో

పెట్టినను = పెట్టినా

కపోత భాగము = పావురము ఉన్నవైపు

కడిందిగ = మిక్కిలిగా

డిందుచున్ + ఉండెన్ = దిగిపోతూ ఉన్నది.

తాత్పర్యం:

అనగా సంతోషించిన శిబి పక్షులన్నింటిలో గొప్ప.. దానివైన నీవు నాపై దయ చూపావు అని చెప్పి వెంటనే చిన్న కత్తితో తన శరీరంలోని మాంసాన్ని కోసి తక్కెడలో వేస్తూ పావురం బరువుతో తూకం వేశాడు. తన దేహంలోని మొత్తం మాంసం వేసినప్పటికీ పావురం ఉన్నవైపే తక్కెడ మొగ్గుతున్నది.

9. క॥ దానికి నచ్చెరువడి ధర

ణీ నాథుఁడు తనువు నందు నెత్తురు దొరుఁగం దాన తుల యెక్కె నంతన్

వాని గుణోన్నతికి మెచ్చి వాసవ దహనుల్

ప్రతిపదార్థం :

ధరణీ నాథుడు = శిబి మహారాజు

దానికిన్ = ఆ విచిత్రానికి

అచ్చెరు + పడి = ఆశ్చర్యపడి

తనువునందు = తన శరీరమందు

నెత్తురు = రక్తము

తొరుగన్ = కారుచుండగా

తాను + అ = తానే

తుల + ఎక్కెన్ = త్రాసులో కూర్చున్నాడు.

అంతన్ = వెంటనే

వాసవ దహనుల్ = ఇంద్రుడు, అగ్నిదేవుడు

వాని = ఆ రాజు యొక్క

గుణ + ఉన్నతికిన్ = గుణముల ఔన్నత్యానికి

మెచ్చి = మెచ్చుకొని

తాత్పర్యం :

తన శరీరం నుండి ఎంత మాంసం ఇచ్చినా పావురంతో సరితూగక పోవటంతో ఆశ్చర్యపడ్డ శిబి చక్రవర్తి తానే తక్కెడలో కూర్చున్నాడు. ఇటువంటి ఆత్మార్పణతో కూడిన అతని త్యాగ గుణాన్ని చూసి ఇంద్రుడు, అగ్నిదేవుడు మెచ్చుకొని

10. వ॥ శ్యేనకపోత రూపంబులు విడిచి నిజరూపంబులఁ జూపి ‘నీ ధైర్య శౌర్యాది గుణంబు లనన్యసాధారణంబులు

గావున నీ కీర్తి నిత్యంబై శబ్ద బ్రహ్మంబు గలయంత కాలంబు వర్తిల్లుచుండు’మని శిబికి వరంబిచ్చి ఇంద్రాగ్నులు

చనిరి.

ప్రతిపదార్థం :

శ్యేన కపోత రూపంబులు = డేగ పావురం రూపాలను

విడిచి = వదిలిపెట్టి

నిజరూపంబులన్ చూపి =తమ స్వీయరూపాలను చూపించి

నీ ధైర్యశౌర్య + ఆది = నీ ధైర్యము, శౌర్యము మొదలైన

గుణంబులు = లక్షణాలు

అనన్య సాధారణంబులు = ఇతరులెవ్వరికీ లేనివి

కావున = అందువలన

నీ కీర్తి = నీ యశస్సు

నిత్యంబు + ఐ = శాశ్వతమై

శబ్ద బ్రహ్మంబు + కల + అంతకాలంబు = శబ్దము ఉన్నంతకాలము

వర్తిల్లుచున్ = స్థిరముగా

ఉండుము + అని = ఉండిపోతావు అని

శిబికి = శిబి చక్రవర్తికి

వరంబు + ఇచ్చి = వరమిచ్చి

ఇంద్ర + అగ్నులు = ఇంద్రుడును, అగ్నియును

చనిరి = వెళ్ళారు.

తాత్పర్యం :

డేగ, పావురం రూపాల్లో ఉన్న ఇంద్రుడు, అగ్ని వారి నిజరూపాలతో సాక్షాత్కరించి “నీ ధైర్య, శౌర్య గుణాలు చాలా గొప్పవి. ఇవి ఇతరులకు సాధ్యంకావు. కావున నీ కీర్తి శాశ్వతంగా ఉంటుంది” అని వెళ్ళిపోయారు.

పాఠం ఉద్దేశం:

ప్రశ్న.

త్యాగనిరతి పాఠం నేపథ్యం వివరించండి.

జవాబు.

పూర్వకాలంలో శిబి భృగుతుంగ పర్వతంపై యజ్ఞం చేశాడు. అప్పుడు ఇంద్రుడు, అగ్నిదేవుడు శిబిచక్రవర్తి గుణగణాలను పరీక్షించాలనుకున్నారు. అగ్ని పావురంగా మారాడు. ఇంద్రుడు డేగ రూపం ధరించాడు. డేగంటే భయంతో పావురం శిబి చక్రవర్తి వద్దకు వచ్చి శరణు కోరింది.

పాఠ్యభాగ వివరాలు:

ప్రశ్న, త్యాగనిరతి పాఠ్యభాగ వివరాలు తెల్పండి.

జవాబు.

త్యాగనిరతి పాఠం ఇతిహాస ప్రక్రియకు చెందినది. ఇతిహాసం అంటే ‘ఇది ఇట్లా జరిగింది’ అని అర్థం. ఇతిహాసంలో కథకు ఎక్కువ ప్రాధాన్యం ఉంటుంది. ఈ కథలు గ్రంథస్థం కాక ముందు వాగ్రూపంలో ఉండేవి. భారత రామాయణాలను ఇతిహాసాలు అంటారు. ఈ పాఠాన్ని శ్రీమదాంధ్ర మహాభారతంలోని అరణ్యపర్వంలోని తృతీయ ఆశ్వాసం నుండి గ్రహించారు.

కవి పరిచయం:

ప్రశ్న.

త్యాగనిరతి పాఠం రచించిన కవిని పరిచయం చేయండి.

జవాబు.

రాజమహేంద్రవరాన్ని రాజధానిగా పరిపాలించిన రాజరాజ నరేంద్రుని ఆస్థానకవి నన్నయ. ఇతనికి వాగనుశాసనుడనే బిరుదు ఉన్నది. 11వ శతాబ్దం వాడు.

వ్యాసుడు మహాభారతాన్ని సంస్కృతంలో రాశాడు. నన్నయ మహాభారతంలోని పద్దెనిమిది పర్వాలలో ఆది, సభా పర్వాలు, అరణ్యపర్వంలో 4వ ఆశ్వాసంలో “శారదరాత్రులు” అనే పద్యం (11వ శతాబ్దం) వరకు తెలుగులోకి అనువదించాడు. “ఆంధ్రశబ్ద చింతామణి” అనే తెలుగు వ్యాకరణ గ్రంథాన్ని సంస్కృతంలో రాశాడు. తన కవిత్వంలో ‘అక్షరరమ్యత, ప్రసన్నకథా కలితార్థయుక్తి, నానారుచిరార్థసూక్తి నిధిత్వం’ అనే లక్షణాలున్నాయని చెప్పుకున్నాడు.

(గమనిక : జవాబు రాసేటప్పుడు గీతగీసిన వాక్యాలు రాస్తే చాలు.)

ప్రవేశిక:

మన ప్రాచీన సాహిత్యంలో నైతిక విలువలకు ఎంతో ప్రాధాన్యం ఉన్నది. భారత, రామాయణాలు ఉత్తములైన రాజుల కథలను వివరిస్తాయి. వారిలో శిబి చక్రవర్తి త్యాగగుణానికి తార్కాణంగా నిలుస్తాడు. తనను ఆశ్రయించిన ఒక పావురాన్ని డేగ నుండి రక్షించడానికి తన ప్రాణాలను సైతం లెక్కచేయడు. అది ఎట్లానో తెలియజేయడం ఈ పాఠం నేపథ్యం.

కఠిన పదాలకు అర్ధాలు

భూతము = ప్రాణి

బుభుక్షావేదన = ఆకలిబాధ

పాడి = న్యాయము, ధర్మము

కపోతం = పావురం

ఖాదయంతి = తింటాయి

శ్యేనం = డేగ

అధముడు = నీచుడు

ఆశ్రితులు = ఆశ్రయించినవారు

పరిత్యాగం = విడిచిపెట్టుట

ఒండు = మరొకటి

మహిషం = దున్న

ఖగం = పక్షి, విహగము

వరాహం = పంది

ఉపశమించు = శాంతించు

విహితము = విధించబడిన, చెప్పబడిన

అసి = కత్తి

అపుత్రిక = చిన్నకత్తి

కర్తనము = కత్తిరించుట

అంగము = శరీరభాగము

కడు = మిక్కిలి

ధరణి= భూమి

నాథుడు = భర్త

ధరణీనాథుడు = = భూ భర్త = రాజు

తొరుగు = కారుచుండగా

వాసవ దహనులు = ఇంద్రుడు, అగ్నిదేవుడు

ఉన్నతి = ఔనత్యం

చనుట = వెళ్ళుట

నేనివి చేయగలనా?