Telangana TSBIE TS Inter 1st Year Accountancy Study Material 6th Lesson Bank Reconciliation Statement Textbook Questions and Answers.

TS Inter 1st Year Accountancy Study Material 6th Lesson Bank Reconciliation Statement

Short Answer Questions:

Question 1.

What do you mean by Bank Reconciliation Statement ?

Answer:

- The statement prepared for reconciling the balance of cash book and pass book is known as Bank Reconciliation Statement.

- Bank Reconciliation Statement may be defined as, “a statement prepared with uncom¬mon adjustments of cash book and pass book to find out the reasons of difference in the balance as shown by traders cash book and bankers pass book”.

Question 2.

What is a Bank Pass Book ?

Answer:

- The Pass book is prepared by the banker on the name of the customer who is having an account with the bank. Pass book is merely a copy of the customer’s account in the books of a bank.

- In this book, all the deposits and withdrawals made by the customer during the particular period is recorded.

![]()

Question 3.

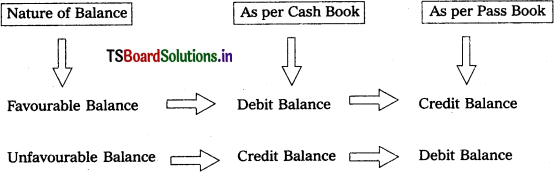

What do you mean by Favorable Balance ?

Answer:

- When the cash book shows the debit balance and the pass book shows credit balance, it is called favourable balance.

- Favourable indicate that the businessman has got money in his account with the bank.

Question 4.

What do you mean by Unfavorable Balance ?

Answer:

- Overdraft is a credit facility to draw amounts repeatedly and repay by depositing cash and cheques and as well as draw amount if the need arises. This overdraft can be called as unfavourable balance.

- In unfavourable balance, cash book shows the credit balance and pass book shows the debit balance.

Question 5.

What do you understand by Overdraft ?

Answer:

- Overdraft is a credit facility given by a bank to draw excess amounts upto a certain ‘ limit sanctioned as and when the need arises.

- This can be repaid by depositing cash and cheques and bank charges interest on the overdraft facility availed by the firm. The overdraft can be called as ‘unfavourable balance’.

![]()

Essay Questions:

Question 1.

Explain the nature and importance of the Bank Reconciliation Statement.

Answer:

Every businessman who opens a current account with the bank is given a book called pass book. It is a record of traders or customers account in the bank. The businessman also record these transactions in the bank column of the Cash Book.

The balance shown by cash book and pass book should be equal if all entries are correctly and fully recorded in the two books. But in actual practice, these two balances may not be the same as on a particular date. A statement, is prepared to reconcile the balances of cash book and pass book, is called ‘Bank Reconciliation Statement’.

In other words, it can be said that Bank Reconciliation Statement is a statement prepared to reconcile. The difference between the balances as per the bank column of the cash book and pass book on any given date.

A bank reconciliation statement is prepared in order to obtain the following advantages :

- Locating the mistakes on either side.

- Preventing any fraud and misappropriations.

- Enabling the business concern to get upto date record of transactions from the bank.

- Ensuring a proper evidence of payment.

- Enabling a business concern to take up the matter with the bank in respect of cheques.

![]()

Question 2.

Describe the causes of disagreement between the balance shown in the Cash Book and Pass Book.

Answer:

There may be number of reasons due to which the balances shown in the bank column of the cash book and bank pass book do not agree with each others. The following are reasons for their difference :

1. The following items are entered in the bank column of the cash book, but not in the bank pass book :

- Cheques received by the firm but not yet deposited in the bank. This will appear only on the debit side of the cash book.

- Cheques drawn by the firm but not yet presented to the bank for payment. This item is credited in the cash book.

2. The following items are entered in bank pass book, but not in the cash book :

- Payments made by the business customers directly to the bank. This appears only on the credit side of the bank statement.

- Bank charges paid by the firm for using some of the bank services. This is debited in

the pass book. - As per standing orders of the customer, the bank make regular payments like rent and insurance premium etc. This appears on the debit side of the bank statement.

- When the business gives permission to a creditor to obtain money directly from the bank. This appears only on the debit side of the pass book.

- The interest paid on the loans and overdrafts appear on the debit side of the bank statement.

- The interest on money deposited in the bank appear on the credit side of the bank statement.

- Sometimes, cheques or bills are returned to business due to lack of cash in their accounts and the same is debited to firm’s account by the bank. There is no corresponding entry in the cash book.

3. Difference caused by errors :

- There may be some errors from firms side.

Ex : Omission, wrong recording or wrong balance etc. - Sometimes a bank may also commit errors.

![]()

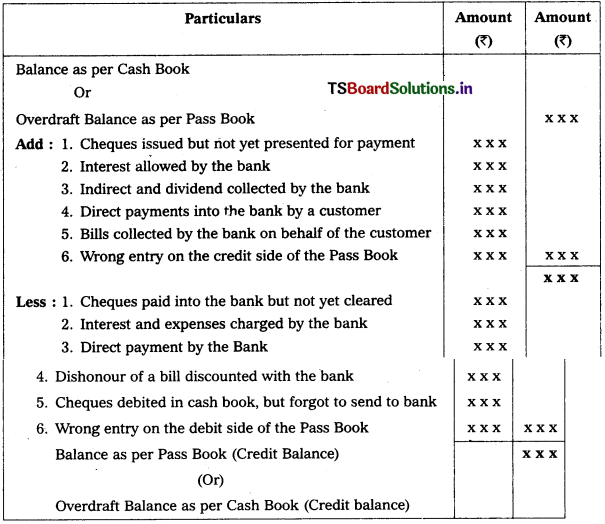

Question 3.

Explain the procedure of preparing the Bank Reconciliation Statement by taking imaginary items and figures.

Answer:

Bank reconciliation statement is prepared to reconcile the two balances of Cash Book and Pass Book. The preparation of bank reconciliation statement starts with making adjustments to one balance to reach the other balance, which ensures agreement between both the balances.

The balances of Cash book and Pass Book are two types which are shown below.

The Bank reconciliation statement is prepared usually at the end of period, i.e., a month, a quarter, half year or a year, whichever is convenient to the firm. When both the books, i.e., cash book and pass book are given in problem, then see whether the two books related to the same period or for different periods.

If the books are for different periods, then the common items should be considered and if it is for same period, then items not appearing in both the books should be taken into consideration.

Preparation of BRS

![]()

Question 4.

List out any five items having the effect of higher balance ¡n the Cash Book.

Answer:

The following items having the effect of higher balance in the Cash Book.

1. Cheques not Credited by the Bank:

Cheques received by the firm debited in the cash book, but not sent to bank. This will appear only on the debit side of the cash book. Thus cash book shows higher balance than pass book.

2. Bank Charges:

Bank charge some charges for their services. This appears on the debit side of the bank statement. This transaction having effect of higher balance in cash book.

3. Standing Order:

This arises when a business instructs the bank to make regular payments of fixed amount, such as rent, insurance policies etc. They appear on the debit side of the bank statement. That means cash book shown higher balance.

4. interest on Overdraft or Loans :

These interests are paid on loans and overdrafts and appear on the debit side of bank statement. But it is not entered in cash Book. This cash book shown higher balance.

5. Cheques / Bills sent to Bank but Dishonoured :

When we send bill or cheque to bank for collection, sometimes the cheques / bills are returned to business due to lack of cash balance in their accounts, the same are debited to firm’s account by the bank. But the firm records the same when it receives the information from the bank. As a result, the balance of cash book is higher than the Pass Book balance.

![]()

Problems:

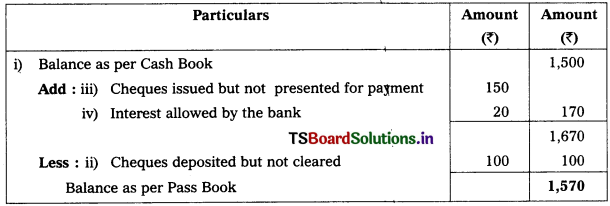

Question 1.

Prepare a bank reconciliation statement of Mr. Vasudev from the following particulars.

j) Balance as per Cash Book ₹ 1,500.

ii) Cheques deposited but not cleared ₹ 100.

iii) Cheques Issued but not presented for payment ₹ 150

iv) Interest allowed by bank ₹ 20.

Solution:

Bank Reconciliation Statement of Mr. Vasudev.

Question 2.

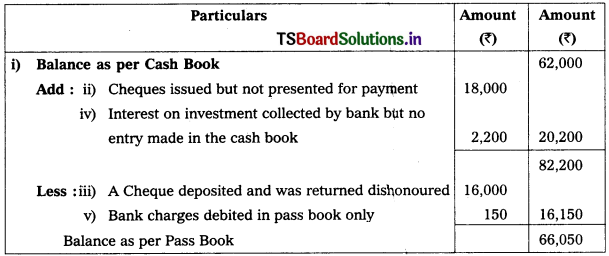

Prepare a bank reconciliation statement of S.V Traders and find the balance as per Pass book as on 31-12-2018.

i) Cash book balance as on 31.12-2018 is ₹ 62,000.

ii) Cheques amounting to ₹ 18,000 Issued but not presented for payment.

iii) A cheque for ₹ 16,000 deposited and was returned dishonoured.

iv) Interest on investment ₹ 2,200 was collected by bank but no entry is made in the cash book.

v) Bank charges debited in the pass book only ₹ 150.

Solution:

Bank Reconciliation Statement of S.V. Traders as on 31.12-2018.

![]()

Question 3.

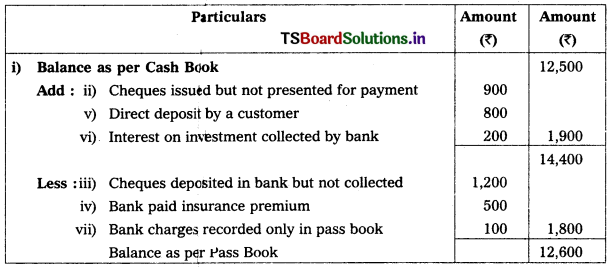

Prepare a bank reconciliation statement of Mr. Saketh from the following data as on 31.12.2018.

i) Balance as per Cash Book ₹ 12,500.

ii) Cheques issued but not presented for payment ₹ 900

iii) Cheques deposited in bank but not collected ₹ 1,200

iv) Bank paid insurance premium ₹ 500

v) Direct deposit by a customer ₹ 800

vi) Interest on investment collected by bank ₹ 200

vii) Bank charges recorded only in Pass Book ₹ 100

Solution:

Bank Reconciliation. Statement of Mr. Saketh as on 31-12-2018.

Question 4.

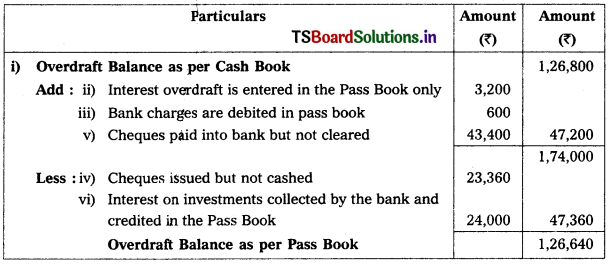

From the following particulars, ascertain the balance that would appear in the Bank Pass Book of Premier Polymers Ltd., at 31st December, 2017.

i) The bank overdraft as per Cash Book on 31st December, ₹ 1,26,800.

ii) Interest on overdraft for 6 months ending 31st December, ₹ 3,200 is entered in the Pass Book only.

iii) Bank charges of ₹ 600 ifor the above period are debited in the Pass Book.

iv) Cheques issued but not cashed prior to 31st December, amounted to ₹ 23,360.

v) Cheques paid into bank but not cleared before 31st December, were for ₹ 43,400.

vi) Interest on investments collected by the bank and credited in the Pass Book ₹ 24,000.

Sol.

Bank Reconciliation Statement of Premier Polymers Ltd., as on 31-12-2017.

![]()

Question 5.

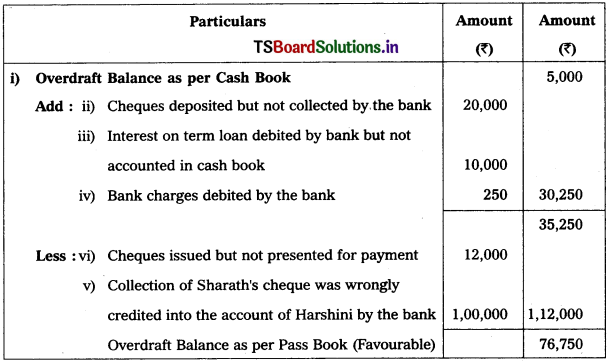

As per cash book the bank account of Harshini is showing an overdraft balance of ₹ 5,000. Prepare a Bank reconciliation statement taking into the following items.

i) Cheques issued but not presented for payment till 31-03-2016 ₹ 12,000.

ii) Cheques deposited but not collected by the bank till 31-03-2016 ₹ 20,000.

iii) Interest on term loan ₹ 10,000 debited by the bank on 31-3-2016 but not accounted in her books.

iv) Bank charges ₹ 250 was debited by the bank during March, 2016 but accounted in her books on 4 – 4 – 2016.

v) An amount of ₹ 10,000 representing collection of Sharath’s cheque was wrongly credited into the account of Harshini by the bank.

Solution:

Bank Reconciliation Statement of Harshini.

Question 6.

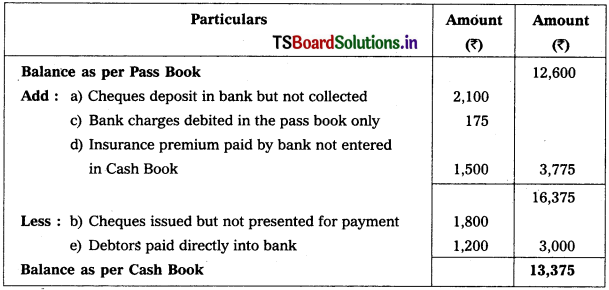

Pass Book of a trader shows a balance of ₹ 12,600. On comparing the Pass Book with the Cash Book the following discrepancies were noted.

a) Cheques deposited in bank but not collected ₹ 2,100.

b) Cheques issued but not presented for payment ₹ 1,800.

c) Bank Charges ₹ 175.

d) Bank paid insurance premium ₹ 1,500.

e) Debtors paid directly into bank account ₹ 1,200.

Solution:

Bank Reconciliation Statement

![]()

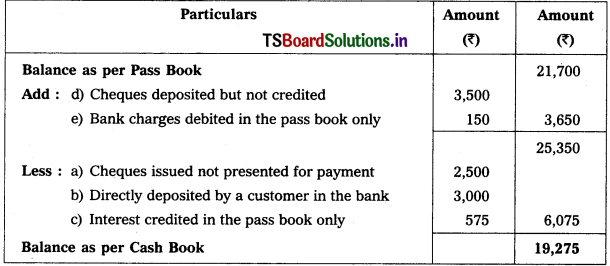

Question 7.

Murthy and Son’s Pass Book showed a balance of ₹ 21,700 as on 30th September, 2018. On comparing the Cash Book the following discrepancies were noted.

a) Cheques issued but not yet presented for payment ₹ 2,500

b) Directly deposited by a customer ₹ 3,000

c) Interest credited by bank is found in Pass Book only ₹ 575

d) Cheques deposited in bank but not credited ₹ 3,500

e) Bank charges ₹ 150

Prepare a Bank Reconciliation Statement showing balance as per Cash Book.

Solution:

Bank Reconciliation Statement of Murthy and Son’s as on 30th September 2018.

Question 8.

Giri Ind Ltds bank balance as per Pass Book is ₹ 8,900. There ¡s disagreement between Cash Book and Pass Book balances as on 31-3-2018. Prepare Bank Reconciliation Statement by considering following transactions.

a) Cheque issued but not presented for payment ₹ 2,100

b) Cheque deposited for collection, but not yet realized ₹ 900

c) A wrong debit given by bank in Pass Book ₹ 500

d) Bank charges debited only in Pass Book ₹ 210

e) Direct payment of insurance premium as per standing instructions ₹ 600

Solution:

Bank Reconciliation Statement of Giri Ind Ltd as on 31-3-2018.

![]()

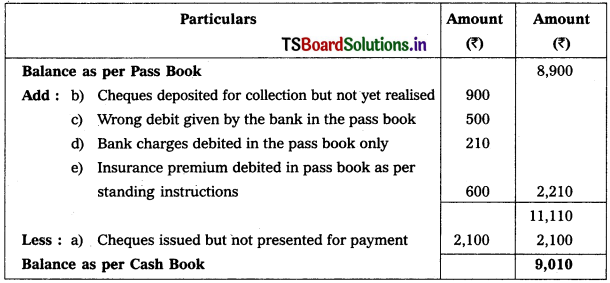

Question 9.

On comparing the bank Pass Book of BBR Ltd. With its Cash Book (bank column), the following differences were noticed. Prepare BRS with the help of Cash Book Balance ₹ 15,000.

a) Cheque sent for collection, not yet realized ₹ 5,600

b) Cheques issued but not yet present for payment ₹ 4,200

c) The receipts side of Cash Book has been overcast by ₹ 300

d) A cheque drawn on firm’s current a/c wrongly debited in its savings a/c ₹ 2,100

e) A cheque of ₹ 900 deposited into bank, but forgot to enter in Cash Book.

Solution:

Bank Reconciliation Statement of BBR Ltd.

Question 10.

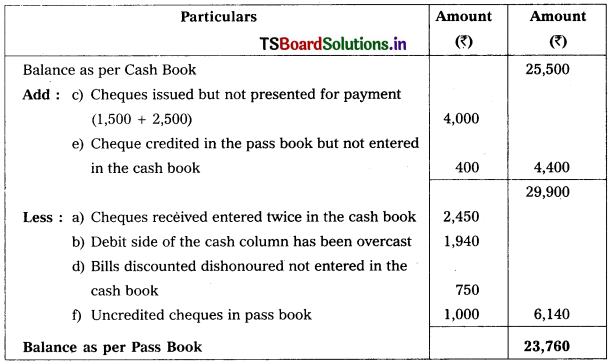

Reddy’s Cash Book shows a favorable balance of ₹ 25,500 as on 31st Decemeber, 2018. On comparing the same with his Pass Book following differences were noticed. Calculate bank balance as per Pass Book.

a) A cheque for ₹ 2,450 received from Saritha & Co was entered twice in the Cash Book.

b) The receipts column of the Cash Book has been over added by ₹ 1,940

c) Several cheques, totaling ₹ 6,000 were issued to different suppliers. Of these, cheques worth ₹ 1,500 were debited in Pass Book on 2nd January, 2019 and ₹ 2,500 on 4th January. The balance being debited before 31st December, 2018.

d) Bills dicounted, got dishonored ₹ 750

e) A cheque of ₹ 400 was credited in Pass Book, but was not recorded in Cash Book.

f) Uncredited cheque ₹ 1,000.

Solution:

Bank Reconciliation Statement of Reddy as on 31st December, 2018.

![]()

Question 11.

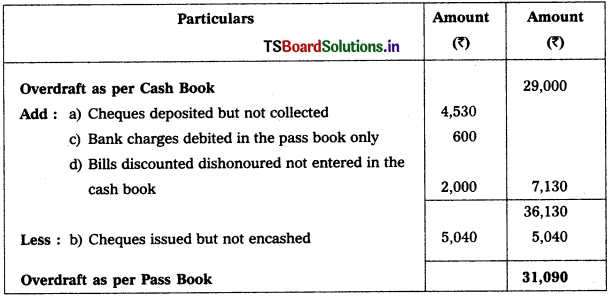

On 31st December, 2018 the Cash Book showed an unfavourable balance ₹ 29,000. Prepare a Reconciliation Statement with the following information.

a) Cheques had been deposited into the bank but were not collected ₹ 4,530.

b) A cheque issued to Karthik Reddy, the supplier, has not been encashed ₹ 5,040.

c) There was a debit entry in the Pass Book of ₹ 600 for bank charges.

d) Bills worth ₹ 2,000 wer dicounted but dishonored.

Solution:

Bank Reconciliation Statement as on 31-12-2018.

Question 12.

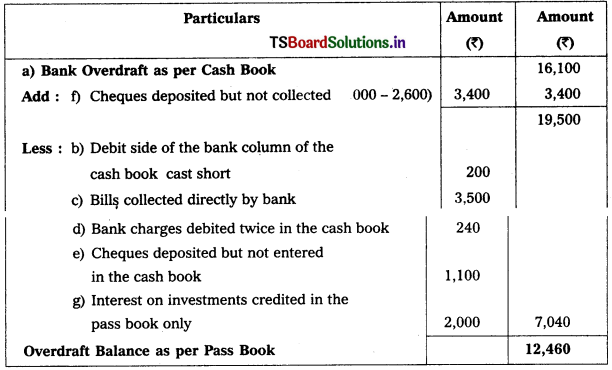

From the following particulars prepare a Bank Reconciliation Statement.

a) Bank Overdraft as per Cash Book ₹ 16,100

b) Debit side of the bank column of Cash Book cast short ₹ 200

c) Bills collected directly by bank Rs. 3,500

d) Bank charges recorded twice in the Cash Book ₹ 240

e) A cheque deposited as per bank statement but not recorded in the Cash Book ₹ 1,100.

f) The cheques of 6,000 deposited but collections as per statement ₹ 2,600

g) Interest on investment collected by the banker, same was shown only in Pass Book ₹ 2,000.

Solution:

Bank Reconciliation Statement as on ………….

![]()

Question 13.

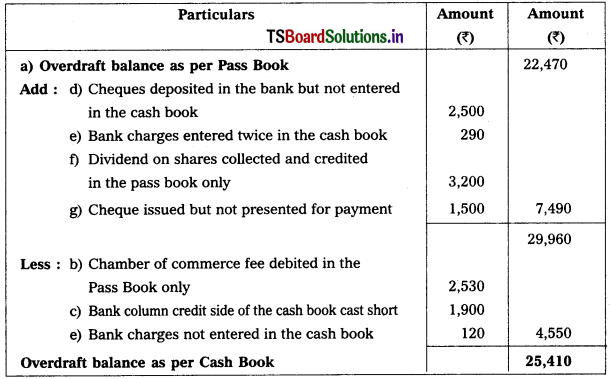

From the following particulars prepare Bank Reconciliation Statement as on 31st March, 2016.

a) Overdraft balance as on 31-3-2016 as per Bank statement ₹ 22,470.

b) As per standing instructions given to bank, chamber of Commerce fee ₹ 2,530 was paid by the bank but was not recorded in the Cash Book.

c) On 23-3-2016, the credit side of the bank column of the Cash Book was cast ₹ 1,900 short.

d) Cheque deposited into the bank but not recorded in Cash Book ₹ 2,500

e) In the Cash Book, a Bank charge of ₹ 290 was recorded twice while another bank charge of ₹ 120 was not recorded at all.

f) Dividend on shares ₹ 3,200 was collected by bank directly the trader has no information.

g) Two cheques of ₹ 1,850 and ₹ 1,500 were issued but out of them only one cheque of ₹ 1,850 was presented for payment up to reconcile day.

Solution:

Bank Reconciliation Statement as on 31.3.2016.

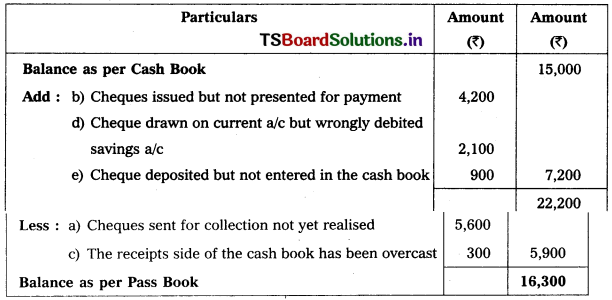

Question 14.

Prepare Bank Reconciliation Statement of Karthik as on 31-03-2017.

a) Bank overdraft as per Pass Book ₹ 6,500

b) Cheques deposited into bank ₹ 5,000, but only ₹ 2,000 was collected.

c) Cheques issued but not presented for payment ₹ 1,500

d) A customer directly deposited in our bank ₹ 1,200

e) Bank charges ₹ 200; Insurance premium ₹ 300 has debited in the Pass Book only.

f) Dividend ₹ 300 collected by the bank has credited in the Pass Book only.

Solution:

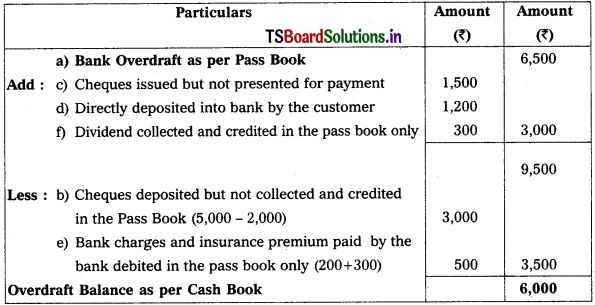

Bank Reconciliation Statement of Karthik as on 31.3.2017.

![]()

Question 15.

Prepare Bank Reconciliation Statement of P.R.G Rao & Sons as on 31-03-2018.

a) Bank overdraft as per Cash Book ₹ 14,500

b) Cheques issued but not yet presented for payment ₹ 4,500

c) Directly deposited by a Customer in our bank account ₹ 3,500

d) Cheques deposited in bank but not credited ₹ 7,500

e) Bank charges debited in pass book only ₹ 200

f) Interest debited in the pass book only ₹ 500

Solution:

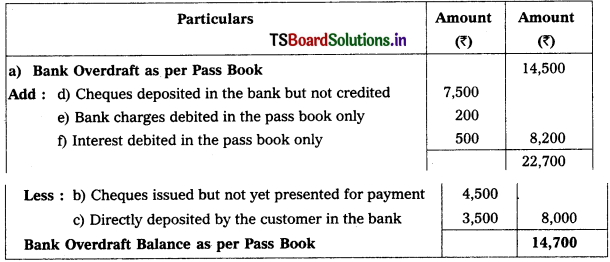

Bank Reconciliation Statement of P.R.G Rao and Sons as on 31.3.2018.

![]()

Textual Examples:

Question 1.

From the following details, prepare a Bank Reconciliation statement for M/s. Kakatiya Fertilizers as on December 31, 2018.

i) Balance as per cash book ? 200.

ii) Cheques deposited but not yet collected by the bank ? 1,500.

iii) Cheque issued to Mr. Aijun has not yet been presented for payment ? 2,500.

iv) Bank charges debited in the pass book f 200.

v) Interest allowed by the bank ^ 100.

vi) Insurance premium directly paid by the bank as per standing instructions ? 500.

Solution:

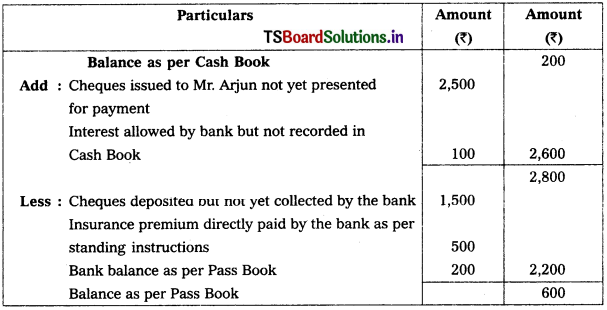

Bank Reconciliation Statement as on December 31, 2018.

Question 2.

Prepare a Bank Reconciliation Statement of M/s.Madhavi Traders and find out the balance as per Pass Book as on 31-12-2018.

a) Cash book balance as on 31-12-18 is ₹ 58,000/-

b) Cheques amounting to ₹ 25,000 issued on 25-12-18 were presented for payment on 5-1-19.

C) A cheque for ₹ 20,000 deposited on 21-12-18 was returned dishonoured on 8-1-19.

d) interest on Investments ₹ 1,500 was collected and credited by bank but no entry is in the cash book.

e) Bank charges debited in Pass book only ₹ 120.

Solution:

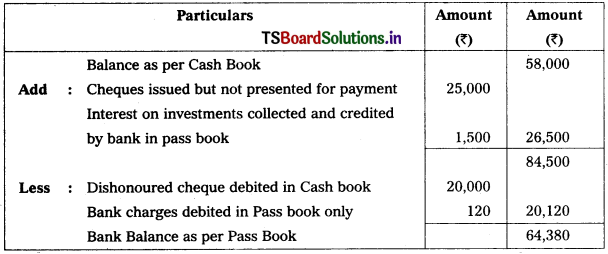

Bank Reconciliation Statement of M/s.Madhavi Traders as on December 31, 2018.

![]()

Question 3.

Prepare a Bank Reconciliation Statement of New Indian Stores as on 30th June, 2017 from the following particulars.

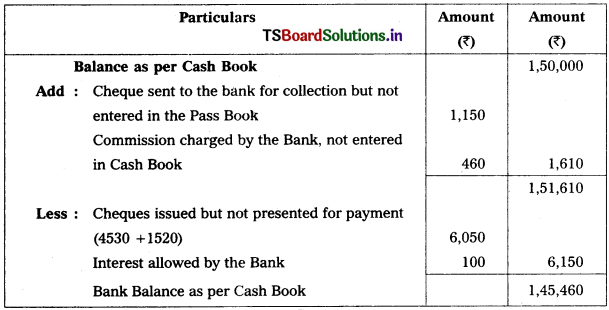

a) Balance as per Pass Book ₹ 1,50,000.

b) Two cheques for ₹ 4,530 and ₹ 1,520 issued on 25th June were presented for payment at the Bank in July.

c) A cheque for ₹ 1,150 sent to the bank for collection, was not entered in the pass book till 30th June.

d) The Bank allowed ₹ 100 as interest and charged ₹ 460 as bank commission but both of them were not entered in the cash book.

Solution:

Bank Reconciliation Statement of New Indian Stores As on June 30th, 2017.

Question 4.

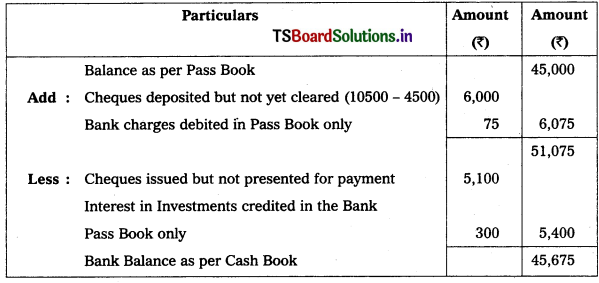

On 30th April, 2018, the Pass Book of M/s. Paramesh Brothers showed a credit balance of ₹ 45,000.

a) Cheques amounting to ₹ 10500 were deposited in the Bank but only cheques of ₹ 4500 were cleard upto 30th April.

b) Cheques amounting to ₹ 15000 were issued but cheques worth ₹ 5100 not been presented for payment in the Bank upto 30th April.

c) In the Pass Book there was a credit of Rs. 300 for interest on investments and debit of ₹ 75 for bank charges.

Prepare a Bank Reconciliation Statement showing the balance as per Cash Book.

Solution:

Bank Reconciliation Statement of M/s. Paramesh Brothers as on 30-04-2018.

![]()

Question 5.

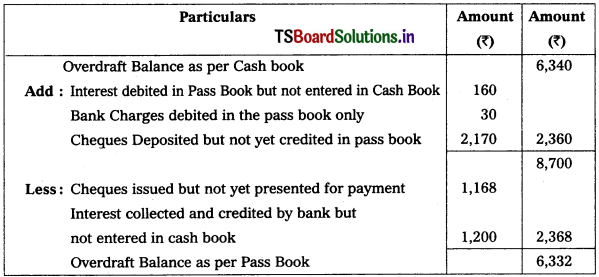

From the following particulars ascertain the balance that would appear in the pass book of Mr. Pavan on 31st December, 2018.

i) The bank overdraft as per cash book on 31st December, 2018 ₹ 6,340

ii) Interest on overdraft for 6 month endir 31st December, 2018 ₹ 160 is entered in pass book.

iii) Bank charges of Rs. 30 are debited in the pass book only.

iv) Cheques issued but not cashed prior to 31st December, 2018 amounted to ₹ 1,168.

v) Cheques paid into bank but not cleared before 31st December, 2018 were for ₹ 2,170.

vi) Interest on investments collected by the bank and credited in the pass book ₹ 1,200.

Solution:

Bank Reconciliation Statement as on 31st, December, 2018.

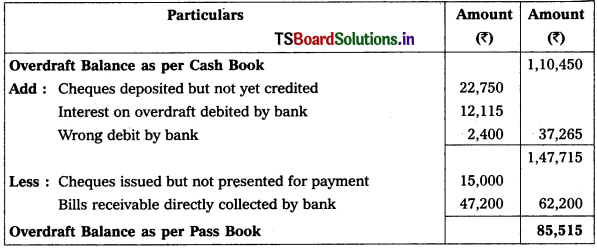

Question 6.

Prepare a Bank Reconciliation Statement as at June, 30, 2018 for M/s.XYZ Private Limited from the information given below.

i) Bank overdraft as per cash book ₹ 1,10,450

ii) Cheques issued on June 20, 2018 but not yet presented for payment ₹ 15,000

iii) Cheques deposited but not yet credited by bank ₹ 22,750

iv) Bills receivable directly collected by bank ₹ 47,200

v) Interest on overdraft debited by bank ₹ 12,115

vi) Amount wrongly debited by bank ₹ 2,400

Solution:

Bank Reconciliation Statement as on June 30, 2018

![]()

Question 7.

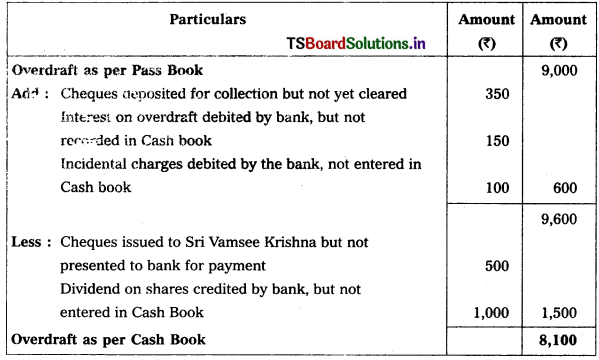

The Cash Book of M/s. Srinivasa Enterprises showed a Credit Balance (Overdraft) of ₹ 9,000 as on 30th June, 2018 but the Bank Pass Book showed a different amount as on that date. You are required to prepare a Bank Reconciliation Statement from the following particulars :

a) A cheque of ₹ 500 was issued to Sri Vamsee Krishna, was not presented to the bank for payment.

b) The bank collected ₹ 1,000 on account of dividend on shares and credited the same to the bank account but it was not recorded in cash book.

c) A cheque for ₹ 350 was deposited in the bank but the proceeds were not credited by bank till 30th June.

d) An interest on overdraft amounting to ₹ 150 was charged by bank but the same was not entered in cash book.

e) The Bank debited ₹ 100 being incidental charges as on 30th June but there was no record of this amount in the cash book.

Solution:

Bank Reconciliation Statement of M/s. Srinivasa Enterprises As on 30th June, 2018

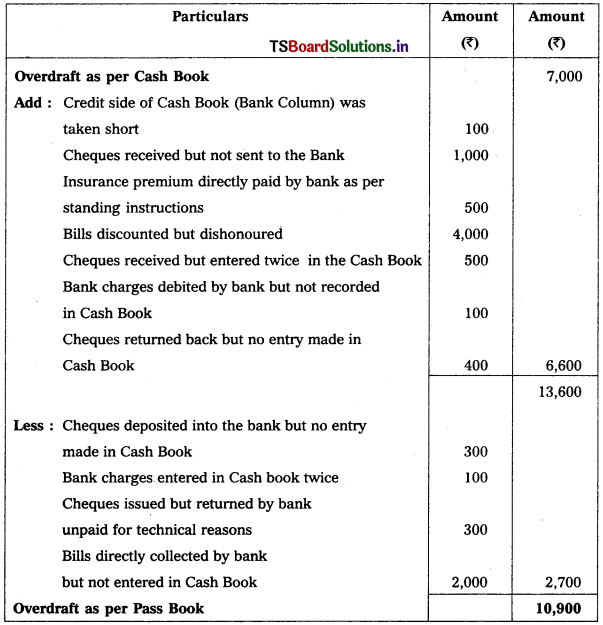

Question 8.

Prepare a Bank Reconciliation Statement of M/s. Swaminathan & Sons as on 31st December, 2017 from the following particulars.

a) Bank overdraft as per Cash Book ₹ 7,000.

b) Credit side of bank column of cash book was taken short by ₹ 100.

c) Cheques received but not sent to the bank worth ₹ 1,000.

d) Cheques amounting ₹ 300 deposited into the bank but no entry was made in the Cash Book.

e) Insurance premium ₹ 500 paid directly by the bank as per the standing instruction by the M/s. Swaminathan & Sons.

f) Bank charges entered in the cash book twice ₹ 100.

g) A cheque worth ₹ 400 returned back, but no entry was passed. Out of the cheques issued, two cheques amounting ₹ 300 were returned unpaid on account of techni¬cal reasons.

h) Bills for ₹ 2,000 were directly collected by the bank but not entered in Cash Book.

i) Bills worth of ₹ 4,000 were discounted but dishonoured.

j) Cheques ₹ 500 received and entered twice.

k) Bank charges ₹ 100 debited by the bank but not recorded in Cash Book.

Solution:

Bank Reconciliation Statement of M/s. Swaminathan & Sons As on 31st December, 2017

![]()

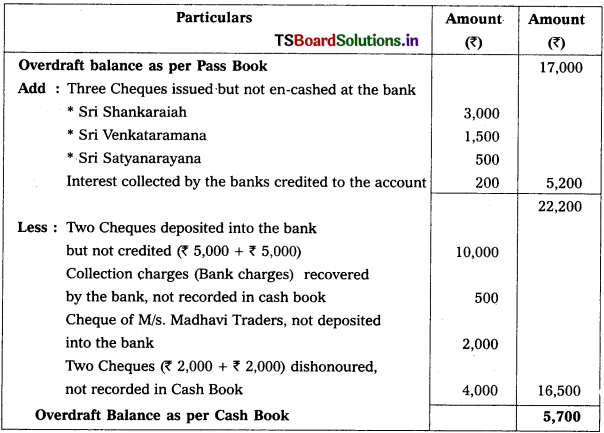

Question 9.

The Bank Pass Book of M/s Murali Super Market showed an overdraft of ₹ 17,000 on 30th November, 2016 and on the same date the Cash Book of the firm showed a different balance. You are required to prepare a Bank Reconciliation Statement from

the following particulars :

a) Two cheques worth of ₹ 5,000 each were deposited into the bank but the proceeds were credited only on 2nd December.

b) Three cheques for ₹ 3,000, ₹ 1,500 and ₹ 500 were issued to Sri Shankaraiah, Sri Venkataramana and Sri Satyanarayana but the same were not en-cashed at the bank upto 30th November.

c) Bank charged ₹ 500 being collection charges on some cheques but the said amount was not entered in Cash Book as yet.

d) A cheque for ₹ 2,000 was received from M/s. Madhavi Traders and the same was recorded in cash book but it was forgotten to be sent to the bank.

e) The bank credited ₹ 200 on account of interest received on a bill sent for collection but no intimation was sent.

f) The two cheques for ₹ 2,000 each were earlier deposited in the bank and the same were dishonoured for which the bank debited the amount in the Pass Book but not entered in Cash Book.

Solution:

Bank Reconciliation Statement of M/s. Murali Super Market As on 30th November, 2016

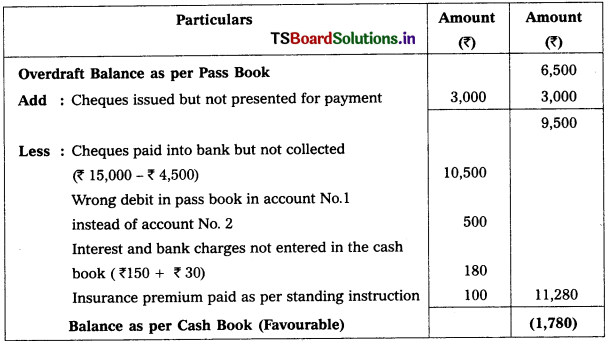

Question 10.

Mr. Vasta gives you the following information regarding his bank account. It shows an overdraft balance of ₹ 6,500 on March 31, 2018. This does not agree with the cash book balance.

i) Cheques amounting to ₹ 15,000 were paid into bank, out of which, only cheques amounting to ₹ 4,500 were credited by the bank.

ii) Cheques issued during March amounted in all to ₹ 11,000, out of these, cheques amounting to ₹ 3,000 were unpaid till March 31, 2018.

iii) The bank has wrongly debited acount No. 1 with ₹ 500 in respect of a cheque drawn on account No. 2.

iv) The account stands debited with ₹ 150 for interest and ₹ 30 for bank charges.

v) The bank has paid the annual insurance premium of ₹ 100 in according to instruc¬tions.

You are required to ascertain balance as per cash book.

Solution:

Bank Reconciliation Statement as on March 31, 2018

![]()

Question 11.

From the following information, prepare a Bank Reconciliation Statement as at 31st December, 2017 for Telangana Steels Ltd.

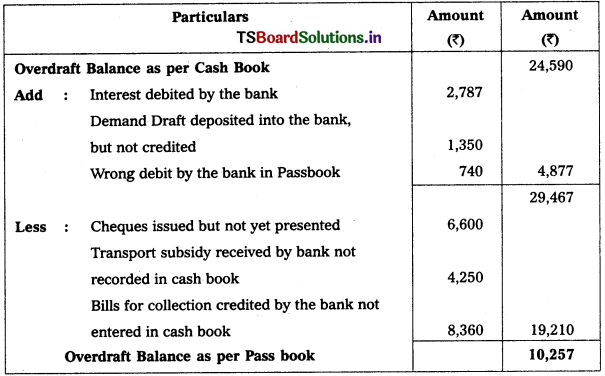

i) Bank Overdraft Balance as per Cash Book on 31st December, 2017 24,590

ii) Interest debited by bank on 26th December, 2017 but no advice received 2,787

iii) Cheques issued before 31st December, but not yet presented for payment 6,600

iv) Transport subsidy received from the state government directly by Bank 4,250

v) Demand Draft deposited into the bank, but not credited till 31st December 1,350

vi) Bills for collection credited by the bank till 31st December, 2017 But no

information received by the company in this regard 8,360

vii) Amount wrongly debited to company account by the bank 740

Solution:

Bank Reconciliation Statement of M/s. Telangana Steels Ltd. as on 31st December, 2017