Telangana TSBIE TS Inter 1st Year Accountancy Study Material 4th Lesson Preparation of Subsidiary Books Textbook Questions and Answers.

TS Inter 1st Year Accountancy Study Materia 4th Lesson Preparation of Subsidiary Books

Short Answer Questions:

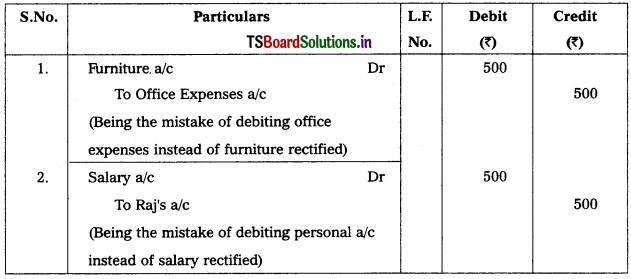

Question 1.

Record the following transactions in the purchases book.

2019 March

March 1st Purchased goods from Anil – ₹ 2,000

March 3rd Bought goods from Raju – ₹ 4,000

March 7th Purchased goods from Srikanth – ₹ 5,000 (Trade discount 10%)

March 13th Goods purchased from Venkat – ₹ 1,600

March 18th Purchased goods from Mahesh – ₹ 1,400

March 24th Purchases – ₹ 3,000

March 26th Purchased goods from Ashok – ₹ 2,500

Solution:

Purchases Book

Working Notes :

1. On March 7th Trade discount = Amount × \(\frac{\text { Rate }}{100}\)

= 5,000 × \(\frac{10}{100}\) = 500

2. On 24th March it is cash transaction so, it should not be recorded in purchases book.

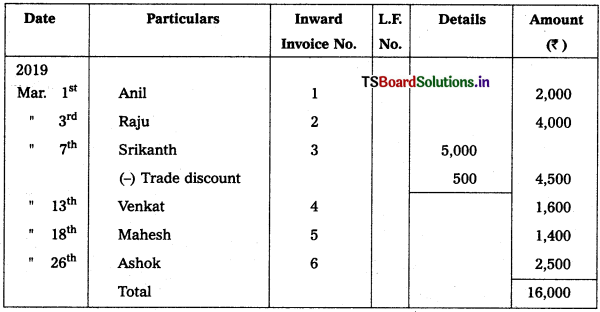

Question 2.

Prepare purchases book from the following :

2018 April

1st Purchased goods from Shekar – ₹ 4,000

4th Cash purchases – ₹ 2,000

8th Bought goods from Shyam – ₹ 8,000 (Trade discount 5%)

12th Goods purchased from Karthik – ₹ 2,400

18th Purchased goods from Naresh – ₹ 3,000

25th Purchased furniture from Aakash – ₹ 6,000

Solution:

Purchases Book

Working Notes :

1. On 4th April it is cash purchases so, it should not be recorded in purchases book.

2. On 8th April Trade discount = 8,000 × \(\frac{5}{100}\) = 400.

3. On 25th April Asset purchased so, it is not to be recorded.

![]()

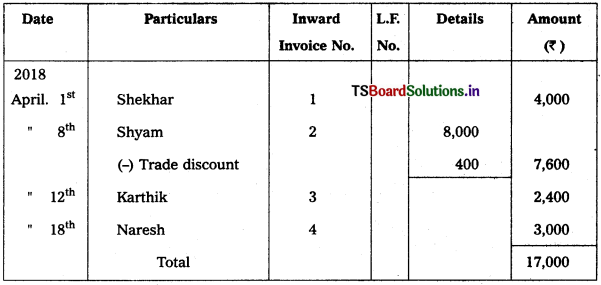

Question 3.

Prepare purchases Book.

2018 December

December 1st Purchased goods from Pallavi – ₹ 4,200

December 5th Goods purchased from Teja – ₹ 8,000

December 10th Bought goods from Vedhagni – ₹ 3,800

December 14th Purchased goods from Sudha – ₹ 6,000 (Trade discount ₹ 600)

December 18th Purchased goods from Ramya – ₹ 2,000

Solution:

Purchases Book

Question 4.

Enter the following transactions in the purchases book.

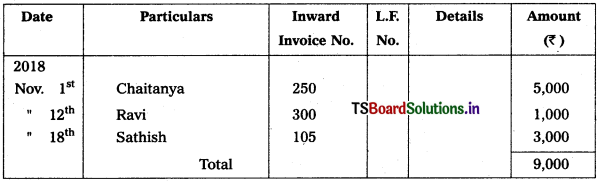

2018 November

November 1st Goods purchased from Chaitanya ₹ 5,000 as per Invoice No. 250.

November 12th Goods purchased from Ravi ₹ 1,000 on Credit Invoice No. 300.

November 18th Purchased goods from Sathish for ₹ 3,000 as per Invoice No. 105.

November 23rd Purchased goods from Pavan for cash ₹ 2,500 as per Invoice No. 410,

Solution:

Purchases Book

Working Notes :

On 23rd November it is cash transactions so, it should not be recorded in purchases book.

![]()

Question 5.

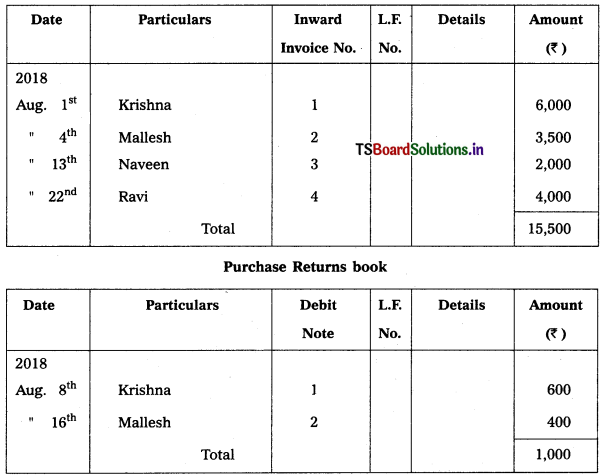

Enter the following transactions in purchases book and purchase returns book.

2018 Aug.

Aug. 1st Purchased goods from Krishna – ₹ 6,000

Aug. 4th Goods purchased from Mallesh – ₹ 3,500

Aug. 8th Returned goods to Krishna – ₹ 600

Aug. 13th Bought goods from Naveen – ₹ 2,000

Aug. 16th Goods returned to Mallesh – ₹ 400

Aug. 22nd Purchased goods from Ravi – ₹ 4,400

Solution:

Purchases Book

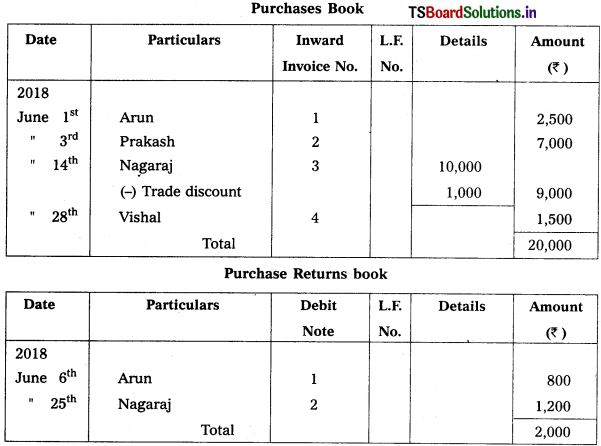

Question 6.

Enter the following transactions in the proper subsidiary books.

2018 June

June 1st Purchased goods from Arun – ₹ 2,500

June 3rd Purchased goods from Prakash – ₹ 7,000

June 6th Return outwards to Arun – ₹ 800

June 14th Purchased goods from Nagaraj – ₹ 10,000 (Trade discount 10%)

June 19th Goods purchased from Nikhil for Cash – ₹ 4,000

June 25th Goods returned to Nagaraj – ₹ 1,200

June 28th Bought goods from Vishal – ₹ 1,500

Solution:

Working Notes :

1. On 14th June Trade discount = Amount × \(\frac{\text { Rate }}{100}\)

= 10,000 × \(\frac{10}{100}\) = 1,000

2. On 19th June it is cash purchases so, it should not ne recorded in purchases book.

![]()

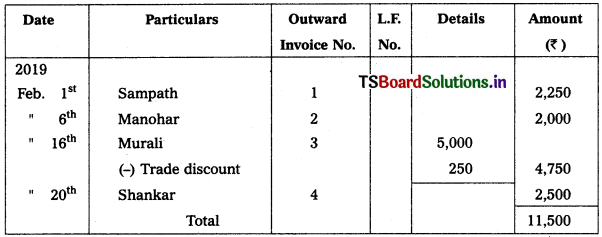

Question 7.

Enter the following transactions in the Sales book.

2019 Feb

Feb 1st Sales goods to Sampath – ₹ 2,250

Feb 6th Sold goods to Manohar – ₹ 2,000

Feb 10th Cash sales – ₹ 1,800

Feb 16th Sold goods to Murali – ₹ 5,000 (Trade discount 5%)

Feb 20th Goods sold to Shankar on Credit – ₹ 2,500

Solution:

Purchases Book

Working Notes :

1. On 10th February cash sales so, it should not to be taken

2. On 16th Feb : Trade discount = 5,000 × \(\frac{5}{100}\) = 250.

Question 8.

Prepare Sales book from the following particulars.

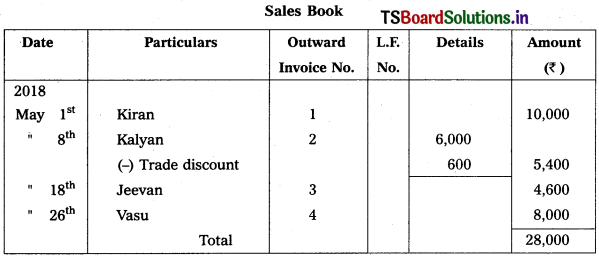

2018 May

May 1st Sold goods to Kiran – ₹ 10,000

May 8th Sold goods to Kalyan – ₹ 6,000 (Trade discount 10%)

May 12th Goods sold to Sanjeev for Cash – ₹ 3,000

May 18 Sold goods to Jeevan – ₹ 4,600

May 24th Sold old Machinery to Sandeep – ₹ 2,500

May 26th Goods sold to Vasu – ₹ 8,000

Solution:

Working Notes :

1. On 12th May it’s cash sales so, it not to recorded.

2. On 8th May : Trade discount = 6,000 × \(\frac{10}{100}\) = 600

3. On 24th May: Machinery sold to Sandeep. We are not record the sale of Assets in Sales book.

![]()

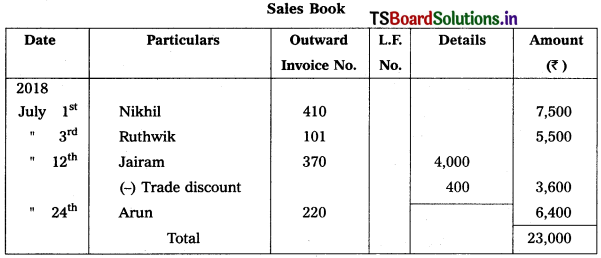

Question 9.

Prepare the sales book.

2018 July

July 1st Sold goods to Nikhil ₹ 7,500 as per Invoce No. 410

July 3rd Sold goods to Ruthwik on credit ₹ 5,500 as per Invoice No. 101

July 12th Goods sold to Jairam ₹ 4,000 as per Invoice No. 370 (Trade discount 10%)

July 18th Sold goods to Sharma for Cash ₹ 8,000

July 24th Goods sold to Arun ₹ 6,400, Invoice No. 220

Solution:

Working Notes :

1. On 12 July : Trade discount = Amount × \(\frac{\text { Rate }}{100}\)

= 4,000 × \(\frac{10}{100}\) = 400

2. On 18th July : Cash items should not be taken.

Question 10.

Record the following transactions in Sales Book and Sales Returns Book.

2018 Sept.

Sept. 1st Sold goods to Satyam – ₹ 2,500

Sept. 5th Sold goods to Ajay – ₹ 7,200

Sept. 7th Goods sold to Varun – ₹ 2,800

Sept. 10th Satya returned goods – ₹ 300

Sept. 14th Sold goods to Akhila – ₹ 4,000

Sept. 16th Returns inwards from Varun – ₹ 200

Sept. 25th Goods sold to Karthik for Cash – ₹ 3,000

Solution:

Working Note :

On 25th September it is cash sales so, it should not be taken in sales book.

![]()

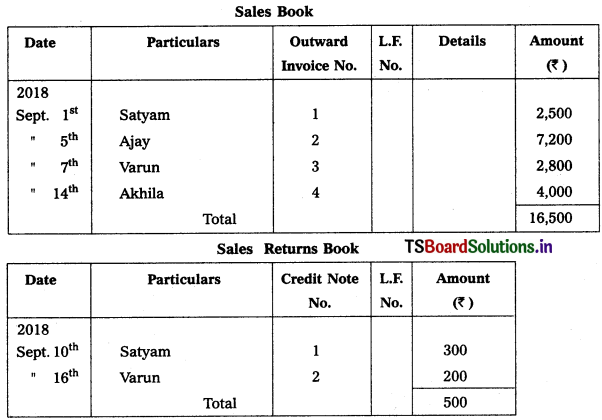

Question 11.

Prepare Sales Book and Sales Returns Book from the following Information. [Mar. 2018]

2017 May

May 1st Sold goods to Rahul – ₹ 6,500

May 3rd Sold goods to Manish – ₹ 6,000

May 8th Returned goods by Rahul – ₹ 700

May 11th Sold goods to Raj Kumar – ₹ 12,000

May 14th Sold goods to Bharath – ₹ 11,000

May 17th Returned goods from Raj Kumar – ₹ 2,000

May 21st Sold goods to Anand – ₹ 9,000

Solution:

Question 12.

Record the following transactions in proper subsidiary books.

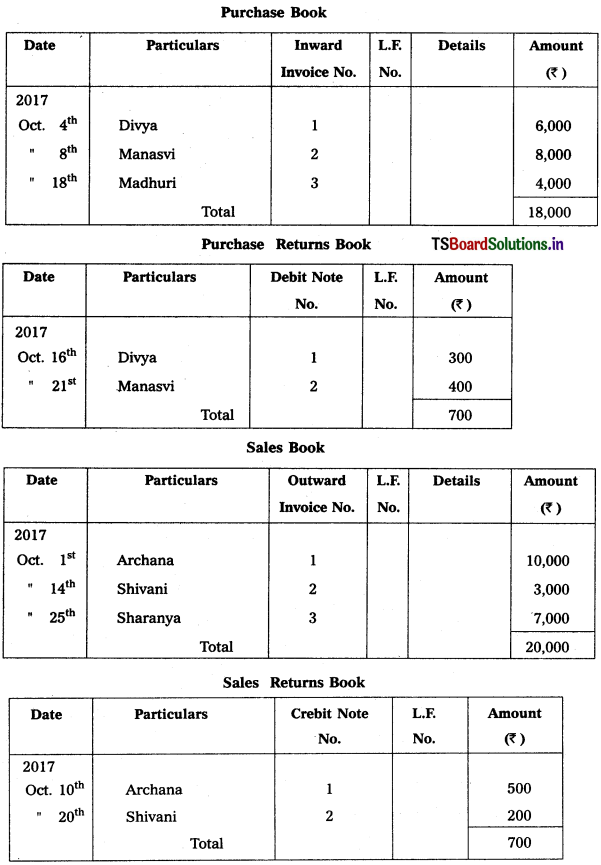

2017 Oct.

Oct. 1st Sold goods to Archana – ₹ 10,000

Oct. 4th Goods purchased from Divya – ₹ 6,000

Oct. 8th Purchased goods from Manasvi – ₹ 8,000

Oct. 10th Goods returned by Archana – ₹ 500

Oct. 14th Goods sold to Shivani – ₹ 3,000

Oct. 16th Returned goods to Divya – ₹ 300

Oct. 18th Purchased goods from Madhuri – ₹ 4,000

Oct. 20th Shivani returned goods – ₹ 200

Oct. 21st Return outwards to Manasvi – ₹ 400

Oct. 25th Goods sold to Sharanya on Credit – ₹ 7,000

Solution:

![]()

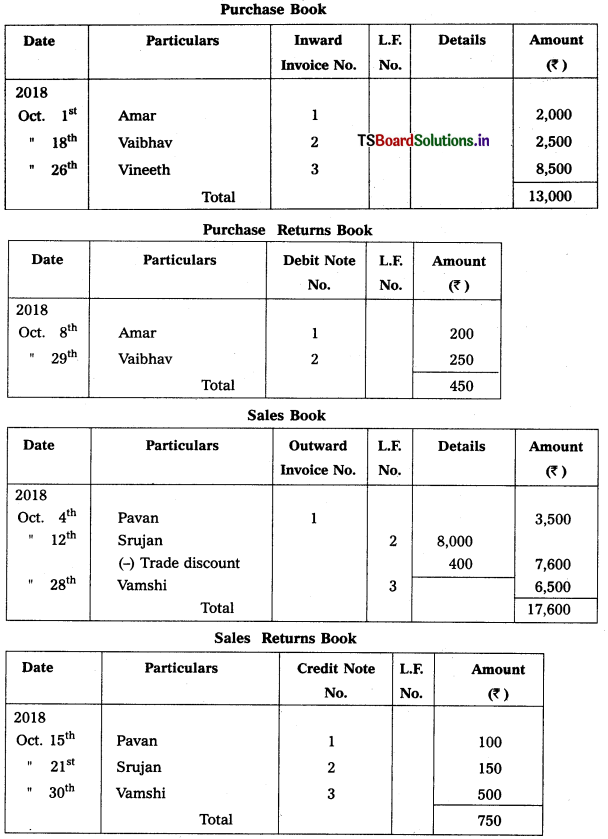

Question 13.

Prepare proper subsidiary books from the following particulars.

2018 Oct.

Oct. 1st Purchased goods from Amar – ₹ 2,000

Oct. 4th Goods sold to Payan – ₹ 3,500

Oct. 8th Goods returned to Amar – ₹ 200

Oct. 12th Sold goods to Srujan – ₹ 8,000 (Trade discount 5%)

Oct. 15th Goods returned from Payan – ₹ 100

Oct. 17th Purchased Machinery from Raju – ₹ 5,000

Oct. 19th Goods purchased from Vaibhav – ₹ 2,500

Oct. 21st Returned goods from Srujan – ₹ 150

Oct. 24th Sold goods to Ramesh for cash – ₹ 4,000

Oct. 26th Purchased goods from Vmeeth – ₹ 8,500

Oct. 28th Sold goods to Vamshi on credit – ₹ 6,500

Oct. 29th Goods returned to Vaibhav – ₹ 250

Oct. 30th Vanishi returned goods – ₹ 500

Solution:

Working Notes :

1. On 17th Oct Assets purchases are not taken in purchases book.

2. On 24th Oct Cash sales should not be taken in sales book.

![]()

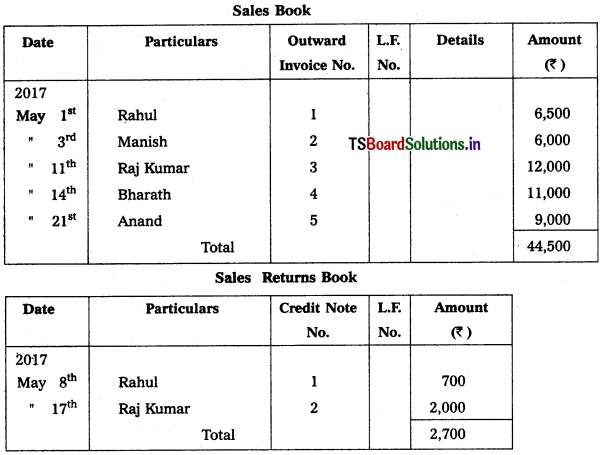

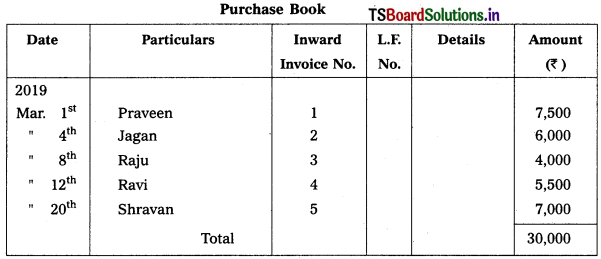

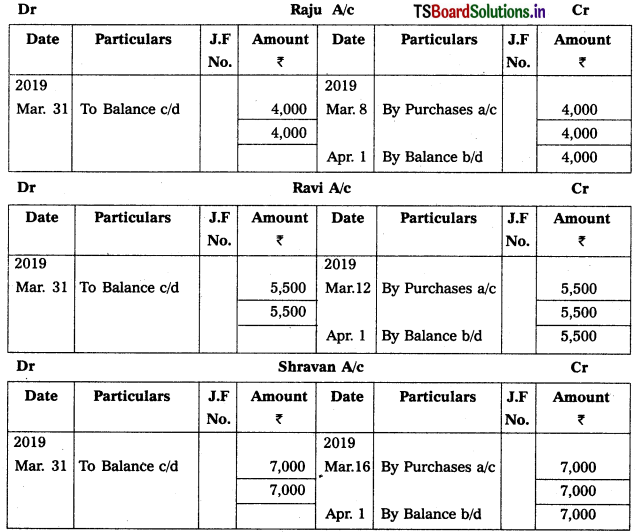

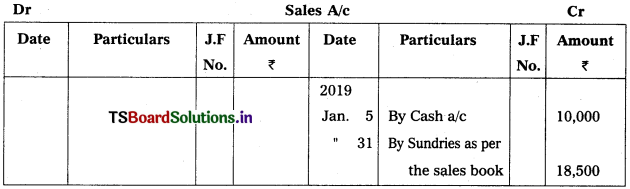

Question 14.

Prepare purchase book and post them in Ledger.

2019 Mar.

Mar. 1st Goods purchased from Praveen – ₹ 7,500

Mar. 4th Purchased goods from Jagan – ₹ 6,000

Mar. 8th Purchased goods from Raju – ₹ 4,000

Mar. 12th Goods purchased from Ravi – ₹ 5,500

Mar. 16th Purchased furniture from Aslsh – ₹ 2,000

Mar. 20th Goods purchased from Shravan – ₹ 7,000

Solution:

Working Notes :

On 16th March Assets purchases are not taken in Purchases book.

Ledger Posting:

![]()

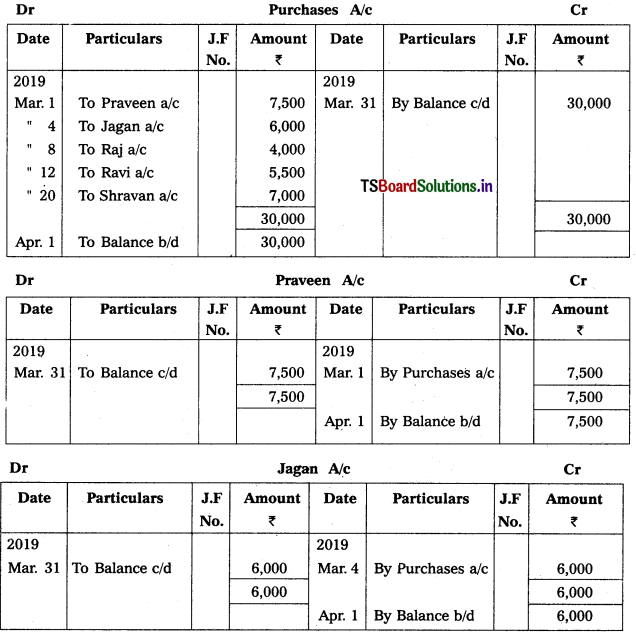

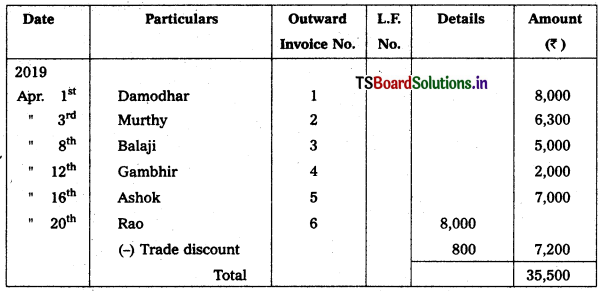

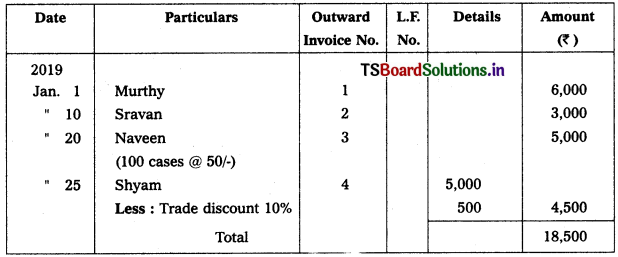

Question 15.

Prepare Sales Book from the following transactions and prepare Ledger.

2019 April

April 1st Goods sold to Damodhar – ₹ 8,000

April 3rd Sold goods to Murthy – ₹ 6,300

April 8th Sold goods to Balaji – ₹ 5,000

April 12th Goods sold to Gambhir – ₹ 2,000

April 16th Sold goods to Ashok – ₹ 7,000

April 18th Sold old furniture to Kishore – ₹ 5,000

April 20th Goods sold to Rao – ₹ 8,000 (Trade discount 10%)

Solution:

Sales Book

Working Notes :

1. On 18th April sale of Assets are not taken in Sales Book.

2. On 20th April: Trade discount = Amount × \(\frac{\text { Rate }}{100}\)

= 8,000 × \(\frac{10}{100}\) = 800

Ledger Posting:

![]()

Very Short Answer Questions:

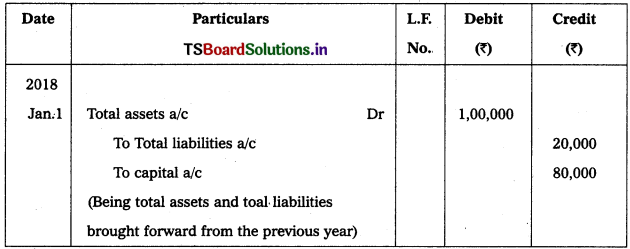

Question 1.

Write the opening entry as on 1st Jan. 2018 from the following. Total Assets of the firm is ₹ 1,00,000 and total of Liabilities of the firm is ₹ 20,000.

Solution:

Opening Entry as on 1 Jan. 2018

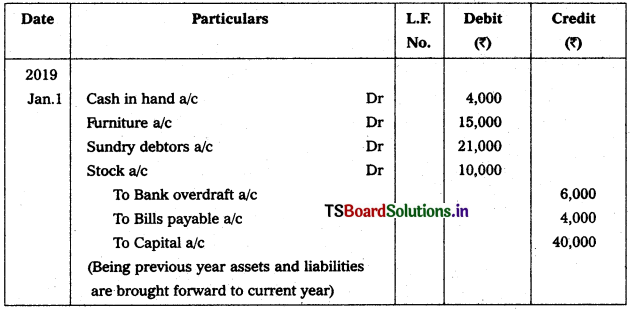

Question 2.

Write the opening entry as on 1st Jan. 2019 in the books of Karthik from the following.

Cash in hand – ₹ 4,000

Furniture – ₹ 15,000

Bank overdraft – ₹ 6,000

Sundry Debtors – ₹ 21,000

Stock – ₹ 10,000

Bills payable – ₹ 4,000

Solution:

In the books of Karthik Opening Entry as on 1 Jan. 2019

![]()

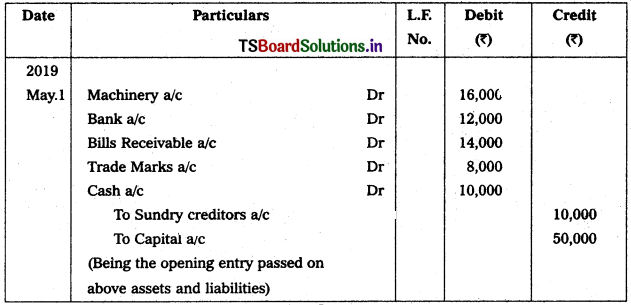

Question 3.

Record the opening entry from the following Assets and Liabilities on 1st May 2019.

Machinery – ₹ 16,000

Bank – ₹ 12,000

Bills receivable – ₹ 14,000

Sundry Creditors – ₹ 10,000

Trade Marks – ₹ 8,000

Cash – ₹ 10,000

Solution:

Opening Entity as on 1 May 2019

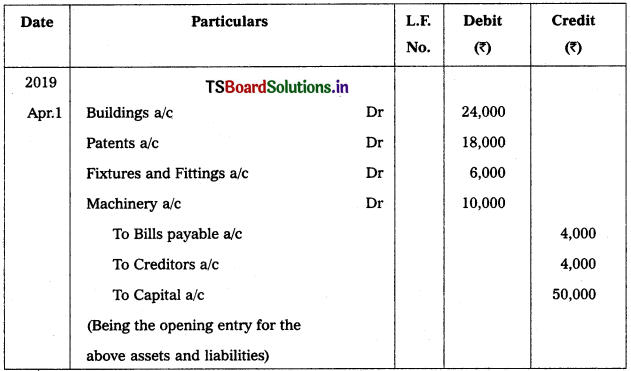

Question 4.

Record the opening entry as on 1st April 2019 from the following particulars.

Buildings – ₹ 24,000

Patents – ₹ 18,000

Fixtures & Fittings – ₹ 6,000

Bills payable – ₹ 4,000

Machinery – ₹ 10,000

Creditors – ₹ 4,000

Solution:

Opening Entry as on 1 April 2019

![]()

Question 5.

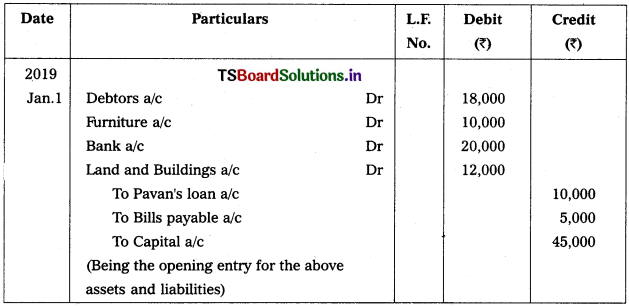

Write opening Journal entry as on 1st Jan. 2019 from the following.

Debtors – ₹ 18,000

Furniture – ₹ 10,000

Bank balance – ₹ 20,000

Loan from Pavan – ₹ 10,000

Bills payable – ₹ 5,000

Land and Buildings – ₹ 12,000

Solution:

Opening Entry as on 1st Jan. 2019

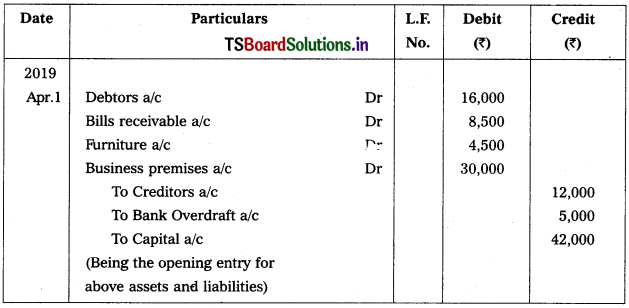

Question 6.

Write the opening Journal entry as on 1st April 2019 from the following.

Debtors – ₹ 16,000

Creditors – ₹ 12,000

Bills receivable – ₹ 8,500

Furniture – ₹ 4,500

Bank overdraft – ₹ 5,000

Business premises – ₹ 30,000

Solution:

Opening Entry as on 1st April 2019

![]()

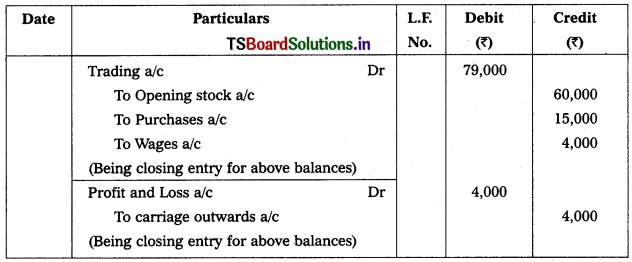

Question 7.

Write closing entries from the following Ledger balances of Balaji.

Opening stock – ₹ 60,000

Purchases – ₹ 15,000

Carriage outwards – ₹ 1,000

Wages – ₹ 4,000

Solution:

Closing Entries in the books of Balaji

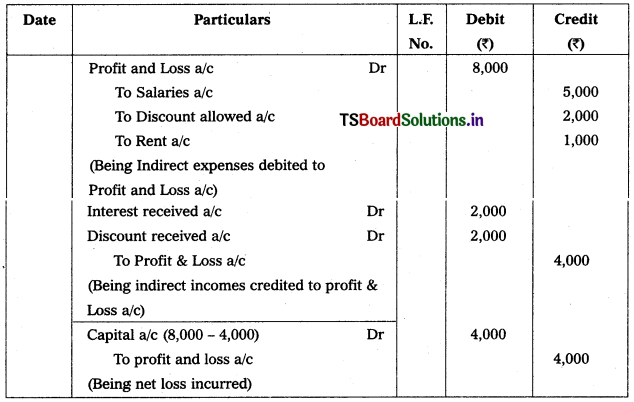

Question 8.

Record the closing entries from the Ledger balances of “Suhas” books.

Salaries – ₹ 5,000

Discount allowed – ₹ 2,000

Rent – ₹ 1,000

Discount received – ₹ 2,000

Interest received – ₹ 2,000

Solution:

Closing Entries in the books of Suhas

![]()

Question 9.

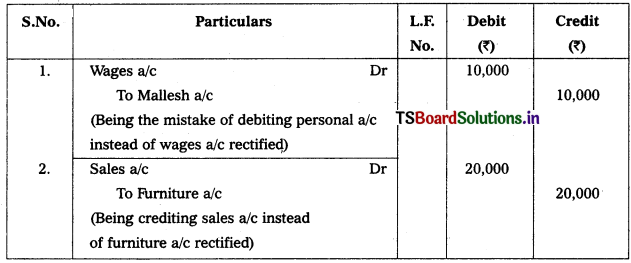

Rectify the following entries dated on 31st Mar. 2019.

1. Wages paid to accountant Mallesh ₹ 10,000, debited to his personal a/c.

2. Furniture sold ₹ 20,000, wrongly credited to Sales a/c.

Solution:

Rectification Entries

Question 10.

Rectify the following entries dated on 31st Mar. 2019.

1. Commission paid ₹ 4,000 wrongly debited to Interest paid a/c.

2. Rent paid to Reddy ₹ 5,000, wrongly debited to wages a/c.

Solution:

Rectification Entries

![]()

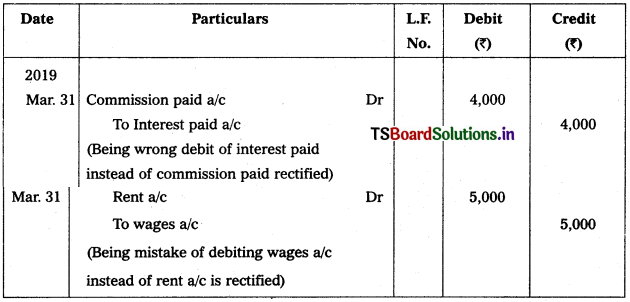

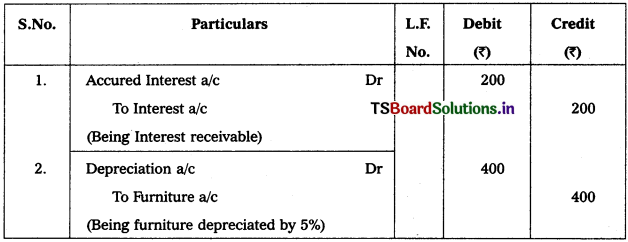

Question 11.

Pass adjustment Journal entries for the following.

1. Accrued Interest ₹ 200.

2. Provide depreciation @ 5% on Furniture, value of Furniture is ₹ 8,000.

Solution:

Adjustment Journal Entries

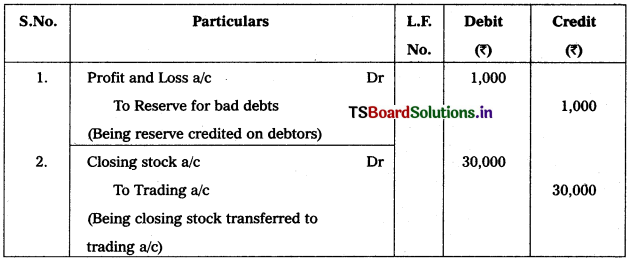

Question 12.

Pass adjustment Journal entries for the following.

1. Provide reserve for bad debts @ 10% on Debtors. Debtors value is ₹ 10,000.

2. Closing stock ₹ 30,000.

Solution:

Adjustment Journal Entries

![]()

Textual Examples:

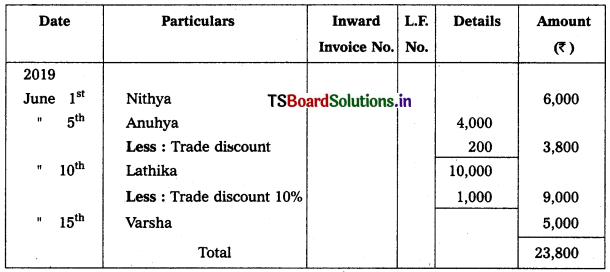

Question 1.

Prepare purchases book from the following transactions.

2019 Jan.

Jan. 1 Purchased goods from Nithya ₹ 6,000

Jan. 5 Purchased goods from Anuhya ₹ 4,000 (Trading discount ₹ 200)

Jan. 10 Goods purchased from Lathika ₹ 10,000 (Trading discount 10%)

Jan. 15 Varsha sold goods to us ₹ 5,000

Jan. 20 Purchased goods from Srinidhi for cash ₹ 5,000

Solution:

Purchases Book

Note :

The transaction dated on January 20, 2019 is not recorded in Purchases Journal because, it is cash transaction of purchases.

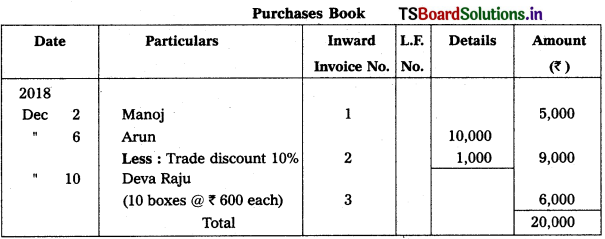

Question 2.

Prepare purchases book from the following transactions and prepare purchase account. –

2018 Dec.

Dec. 2 Purchased goods from Manoj – ₹ 5,000

Dec. 6 Goods bought from Arun – ₹ 10,000 (Trade discount 10%)

Dec. 7 Bought 10 boxes of goods ₹ 600 each from Deva raju – ₹ 6,000

Dec. 10 Purchased office table from Rajender furnitures – ₹ 10,000

Dec. 20 Cash purchases – ₹ 5,000

Solution:

Note :

Transactions dated on December 10 and December 20 are not recorded as they are purchase of assets and cash purchases of goods respectively.

![]()

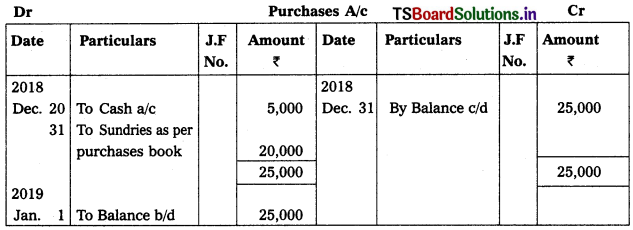

Question 3.

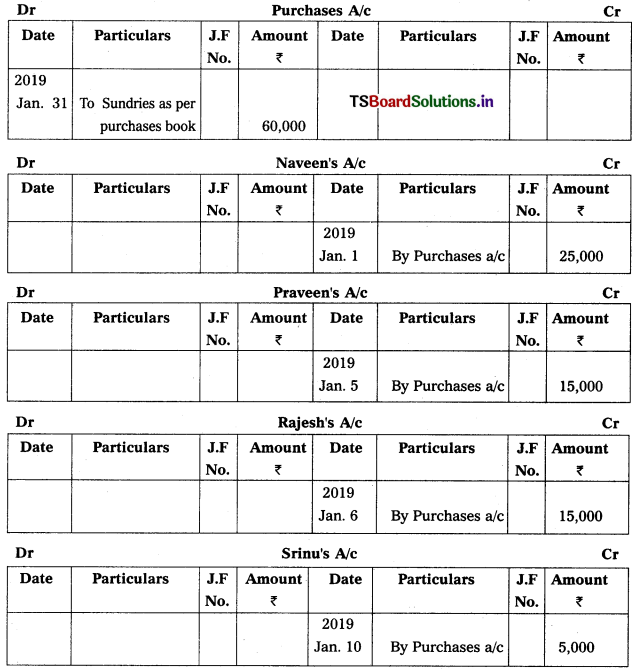

Prepare purchases book from the following transactions and post them in ledger.

2019 Jan.

Jan. 1 Purchased goods from Naveen ₹ 25,000

Jan. 5 Purchased goods from Praveen ₹ 15,000

Jan. 6 Goods purchased from Rajesh ₹ 15,000

Jan. 10 Srinu sold goods to us ₹ 5,000

Solution:

Purchases Book

Ledger Posting :

![]()

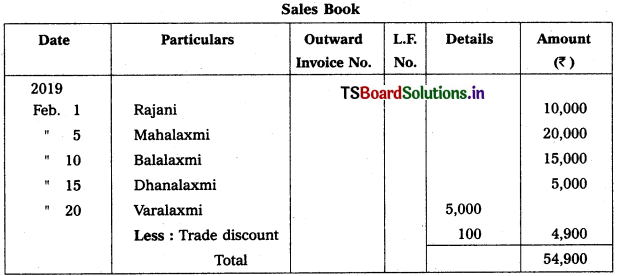

Question 4.

Prepare Sales book from the following in the books of Balaji Rao.

2019 Feb.

Feb. 1 Sold goods to Rajani ₹ 10,000

Feb. 5 Goods sold to Mahalaxmi ₹ 20,000

Feb. 10 Sales to Balalaxmi ₹ 15,000

Feb. 15 Sold goods to Dhanalaxmi ₹ 5,000 on credit

Feb. 20 Sales to Varalaxmi ₹ 5,000 (Trade discount ₹ 100)

Solution:

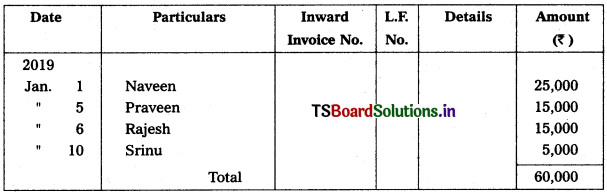

Question 5.

Enter the following transactions in the sales book and prepare sales account

2019 Jan.

Jan. 1 Sold goods to Murthy on credit ₹ 6,000

Jan. 5 Cash sales ₹ 10,000

Jan. 10 Goods sold to Sravan ₹ 3,000

Jan. 15 Sold old furniture to Karthik ₹ 20,000

Jan. 20 Sold 100 cases of goods @ ₹ 50/- each to Naveen

Jan. 25 Sold goods to Shyam (Trade discount 10%) ₹ 5,000

Solution:

Sales Book

Notes :

1. Transaction dated January 5 cash sales ₹ 10,000 is not recorded in sales book. It is entered in Cash book.

2. Transaction dated on January 15 sold old furniture to karthik ₹ 20,000 is not recorded in the sales book as it is recorded in Journal proper.

![]()

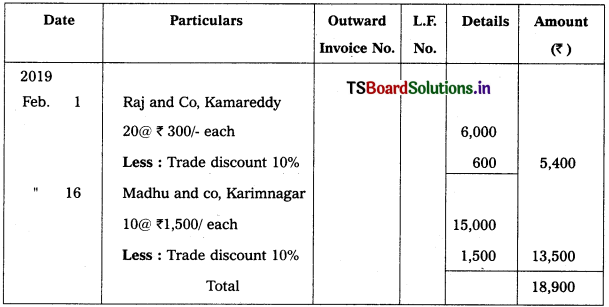

Question 6.

From the following transactions, prepare sales book of Sandeep Saree stores and post them to relevant accounts.

2019 Feb.

Feb. 1 Sold on credit to Raju and Co. Kamareddy 20 sarees at ₹ 300/- each, trade discount 10%

Feb. 11 Sold for cash to Rani and Co. Nizamabad 10 sarees at ₹ 3,000 each.

Feb. 16 Sold on credit to Madhu and Co. Karimnagar 10 sarees at ₹ 1,500 each, trade discount 10%

Feb. 28 Sold on credit to Prasad Hardware 2 old computers at ₹ 5,000 each.

Solution:

Sales Book

Note :

Transactions dated Feb. 11 and 28 should not be recorded in sales book.

Because Feb. 11 transactions is cash sales and Feb 28 transaction is not related to goods.

Ledger Posting :

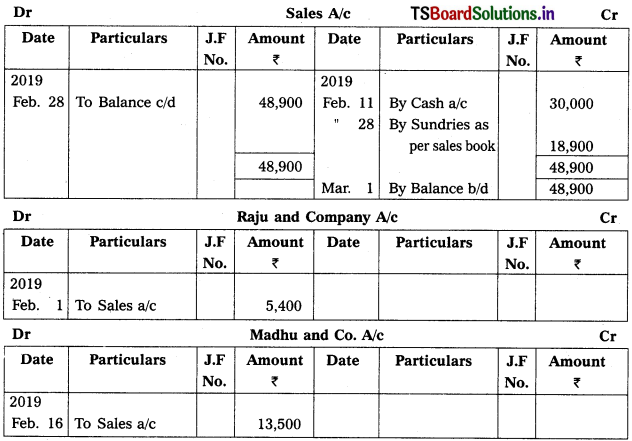

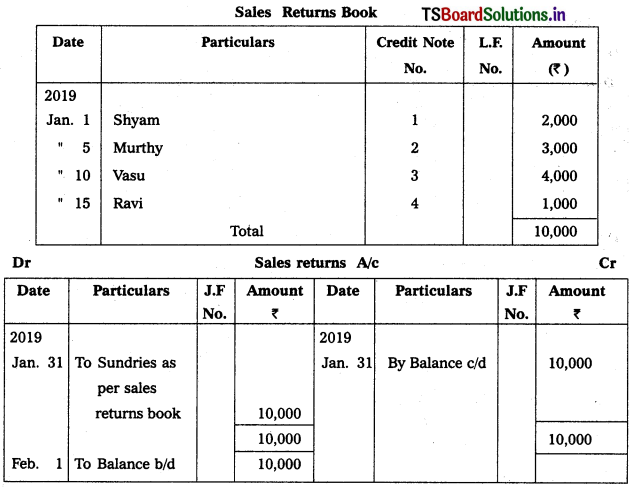

Question 7.

Enter the following transactions in purchase returns book and prepare purchases returns account.

2019 Jan.

Jan. 5 Returned goods to Ramesh, Hyderabad ₹ 2,000

Jan. 10 Returned goods to Soujanya, Bangalore ₹ 1,000

Jan. 15 Returned goods to Suresh, Bombay ₹ 2,000

Jan. 20 Returned goods to Raghu, Vizag ₹ 1,000

Solution:

Purchase Returns Book

Ledger Posting :

![]()

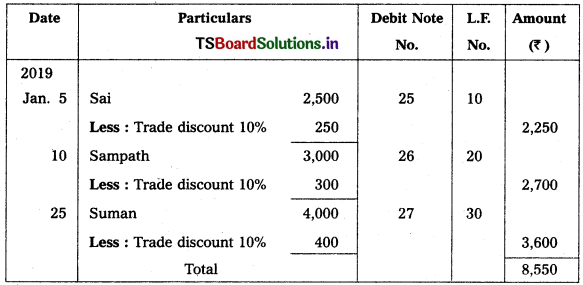

Question 8.

Prepare purchase returns book from the following transactions and post them to ledger.

2019 Jan.

Jan. 5 Returned goods to Sai ₹ 2,500, trade discount at 10%, debit note no. 25, ledger folio – 10

Jan. 10 Returned goods to Sampath ₹ 3,000, trade discount at 10%, debit note no. 26, ledger folio – 20

Jan. 25 Returned goods to Suman ₹ 4,000, trade discount at 10%, debit note no. 27, ledger folio – 30

Solution:

Purchases Returns Book

Ledger Posting :

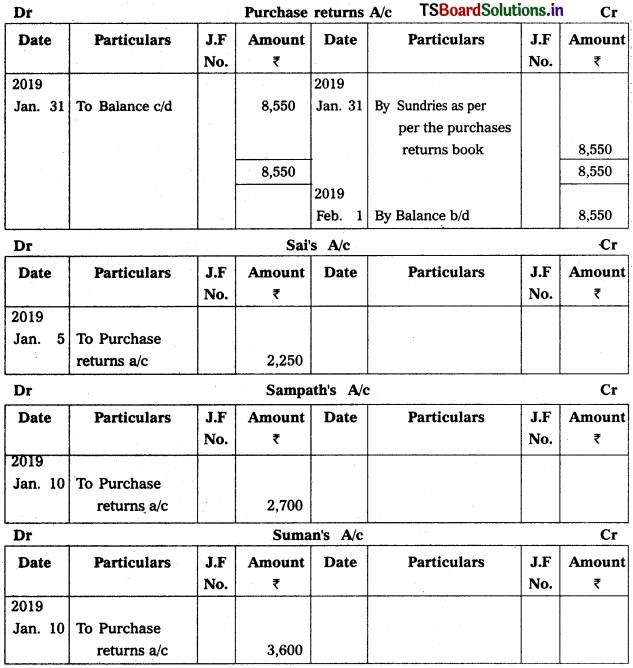

Question 9.

Enter the following transactions in the sales returns book and prepare Sales returns account.

2019 Jan.

Jan. 1 Shyam returned goods to us ₹ 2,000

Jan. 5 Murthy returned goods to us ₹ 3,000

Jan. 10 Vasu returned goods to us ₹ 4,000

Jan. 15 Goods returned by Ravi ₹ 1,000

Solution:

![]()

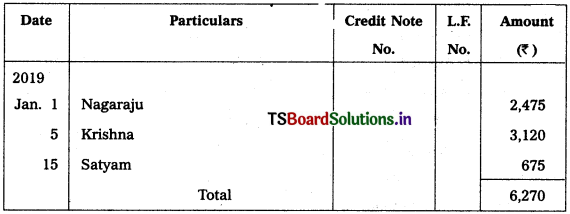

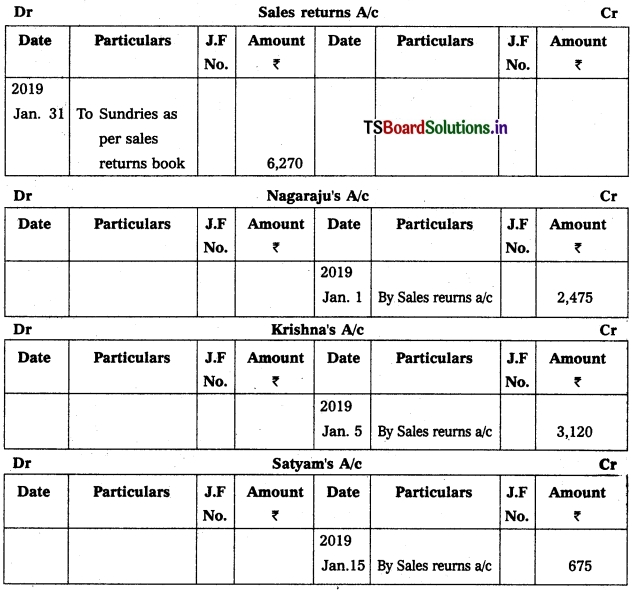

Question 10.

Prepare sales returns book from the following and post them into ledger.

2019 Jan.

Jan. 1 Returned goods by Nagaraju ₹ 2,475

Jan. 5 Returned goods by Krishna ₹ 3,120

Jan. 15 Returned goods by Satyam ₹ 675

Solution:

Sales Returns Book

Ledger Posting :

![]()

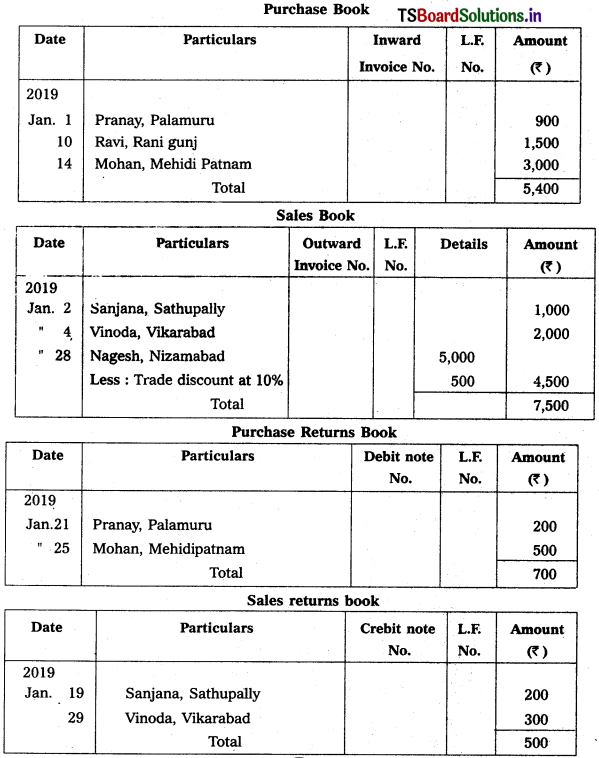

Question 11.

Enter the following transactions into respective subsidiary book.

2019 Jan.

Jan. 1 Purchased goods from Pranay, Palamuru – ₹ 900

Jan. 2 Sold goods to Sanjana, Sathupally – ₹ 1,000

Jan. 4 Sold goods to Vinoda, Vikarabad – ₹ 2,000

Jan. 10 Bought goods from Ravi, Rani gunj – ₹ 1,500

Jan. 14 Bought goods from Mohan, Mehidipatnam – ₹ 3,000

Jan. 19 Sanjana returned goods to us – ₹ 200

Jan. 21 Returned goods to Pranay – ₹ 200

Jan. 25 Returned goods to Mohan – ₹ 500

Jan. 28 Sold goods to Nagesh, Nizamabad worth subjected to a trade discount of 10% – ₹ 5000

Jan. 29 Vinoda recorded goods to us – ₹ 300

Solution:

![]()

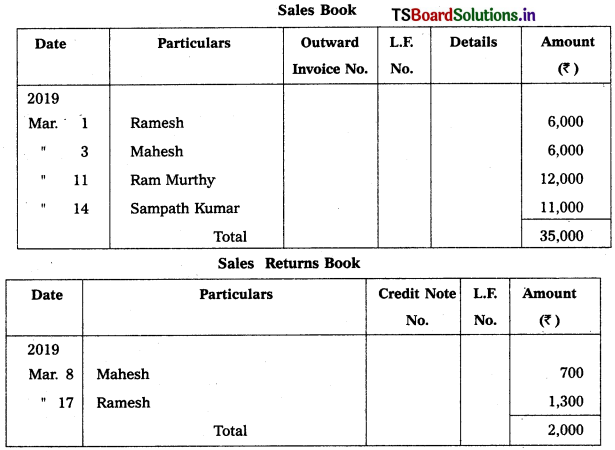

Question 12.

Prepare sales book and Sales Returns book from the following :

2019 Mar.

Mar. 1 Sold goods to Ramesh – ₹ 6,000

Mar. 3 Sold goods to Mahesh – ₹ 6,000

Mar. 8 Returned goods by Mahesh – ₹ 700

Mar. 11 Sold goods to Ram Murthy – ₹ 12,000

Mar. 14 Sold goods to Sampath Kumar – ₹ 11,000

Mar. 17 Returned goods from Ramesh – ₹ 1,300

Solution:

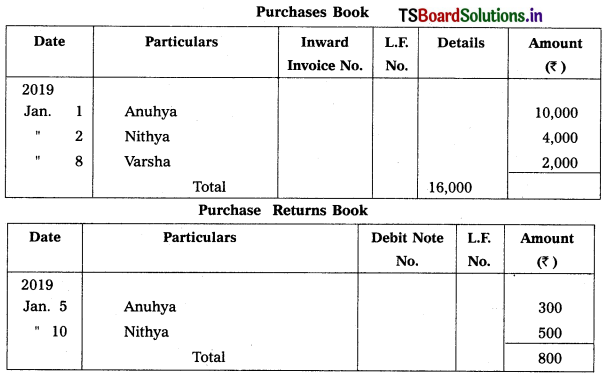

Question 13.

Enter the following transactions in the proper subsidiary books.

2019 Jan.

Jan. 1 Purchased goods from Anuhya – ₹ 10,000

Jan. 2 Purchased goods from Nithya – ₹ 4,000

Jan. 5 Returned goods to Anuhya – ₹ 300

Jan. 8 Purchased goods from Varsha – ₹ 2,000

Jan. 10 Returned goods to Nithya – ₹ 500

Solution:

![]()

Question 14.

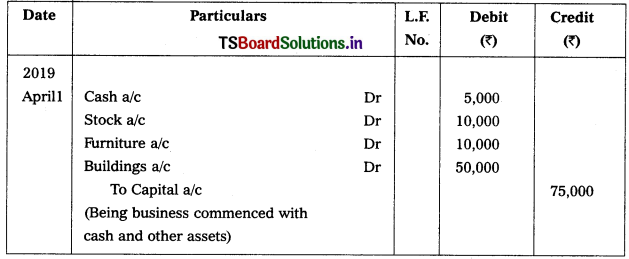

Maruthi commenced business on April 1, 2019 with cash ₹ 5,000, stock ₹ 10,000, furniture ₹ 10,000 and buildings ₹ 50,000. Pass opening entry.

Solution:

In the books of Maruthi Journal Proper

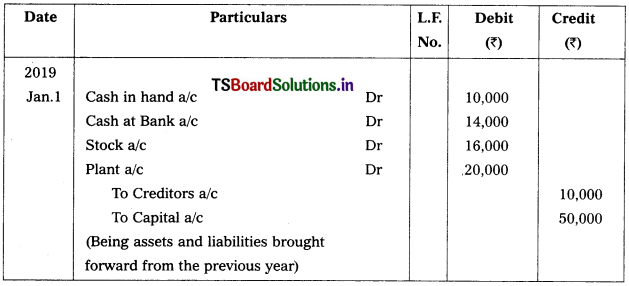

Question 15.

The following balances stated in the books of Supreeth as on 31-12-2018.

Cash in hand – ₹ 10,000

Cash at Bank – ₹ 14,000

Stock of goods – ₹ 16,000

Plant – ₹ 20,000

Creditors – ₹ 10,000

Record above balances in the books of Supreeth on Jan 1, 2019.

Solution:

In the books of Supreeth Journal Proper

![]()

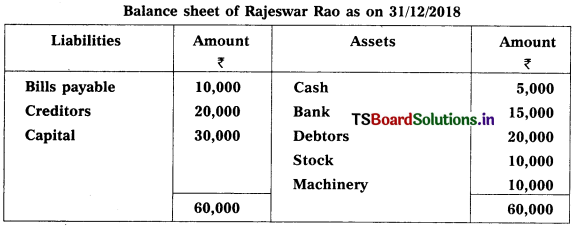

Question 16.

Write opening entry on Jan 1st 2019 from the following Balance Sheet of Rajeswar Rao.

Balance sheet of Rajeswar Rao as on 31/12/2018

Solution:

In the books of Rajeshwar Rao Journal Proper

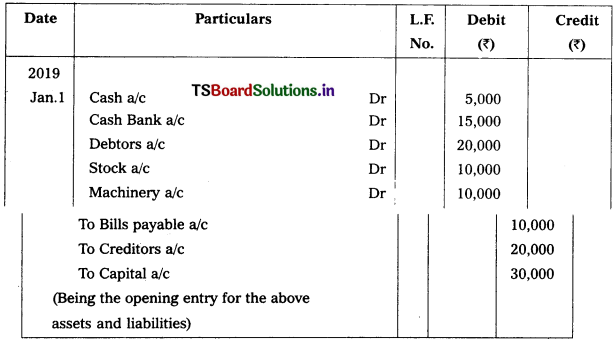

Question 17.

Pass necessary closing entries for the following balances in the books of Rajender.

Purchases – ₹ 14,000

Sales – ₹ 46,000

Purchase returns – ₹ 2,000

Sales returns – ₹ 1,000

Opening stock – ₹ 10,000

Wages – ₹ 3,000

Salaries – ₹ 5,000

Rent received – ₹ 4,000

Commission – ₹ 1,500

Discount allowed – ₹ 800

Discount received – ₹ 1,200

Carriage on purchases – ₹ 1,000

Closing stock – ₹ 12,000

Office expenses – ₹ 2,500

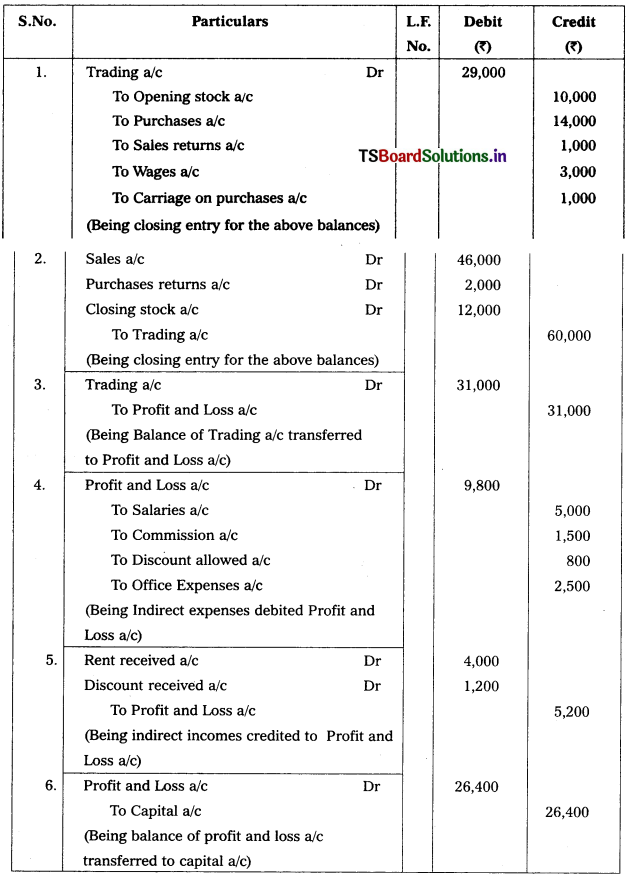

Solution:

In the books of Rajender Journal Proper

![]()

Question 18.

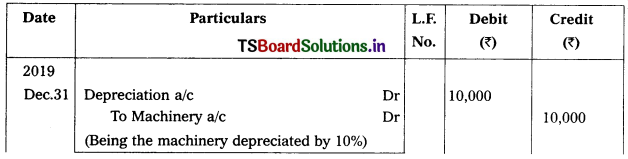

Value of Machinery ₹ 1,00,000. Depreciation to be provided on Machinery @ 10% on 31/12/2018. Pass entry.

Solution:

Journal Proper

Question 19.

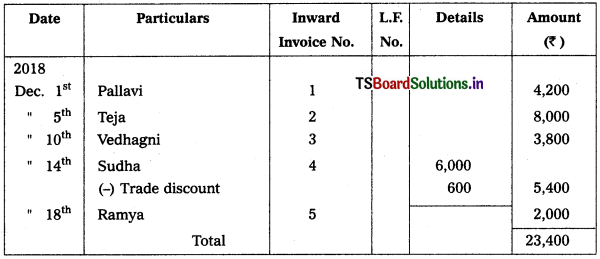

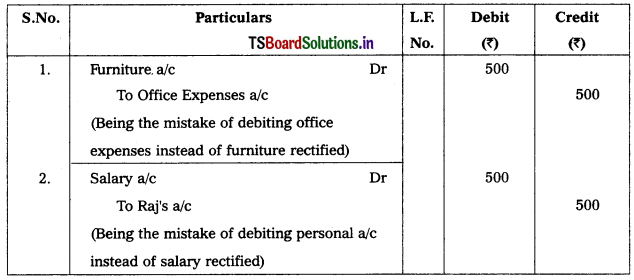

Pass the rectification entries for the following errors.

1. ₹ 500 paid for new furniture was charged to offices expenses account.

2. Salary paid to Mr. Raj ₹ 500 wrongly debited to his personal account.

Solution:

Journal Proper

![]()

Question 20.

1. The net profit of the business for the year is ₹ 1,10,000. It is decided to transfer ₹ 10,000 to General Reserve.

2. Goods taken by the proprietor for his personal use ₹ 2,000.

Solution:

Journal Proper