Telangana TSBIE TS Inter 1st Year Accountancy Study Material 2nd Lesson Business Transactions Textbook Questions and Answers.

TS Inter 1st Year Accountancy Study Materia 2nd Lesson Recording of Business Transactions

Short Answer Questions:

Question 1.

How vouchers are prepared?

Answer:

A ‘voucher’ is a source document for recording the business transactions. It is a piece of printed paper that is used for some purpose. The document provide proof / evidence of a business transaction and is known as ‘voucher’. The source documents include invoice, pay in slip, cash memo, cheque, debit note, credit note, wage sheets, salary slips etc.

Preparation of Vouchers :

a) Cash Memo :

When goods are purchased or sold for cash, the firm gives or receives Cash Memo. It provides details regarding cash transactions.

b) Purchase Invoice:

When goods are purchased on credit, firm receives purchase invoice from the supplier of goods. It contains date, description of goods, quantity, value of goods etc.

c) Sales Invoice :

When goods are sold on credit, sales invoice is prepared. It contains date, name of customer, description of goods, quantity, value of goods etc. The original copy of invoice is sent to customer and duplicate copy is preserved by the firm.

d) Receipt:

When a firm receives cash from customers, it issues a receipt as a proof of cash receipt. It is prepared in duplicate. The original copy is handed over to the parties making payment and the duplicate copy is kept as record for reference.

e) Pay in Slip :

Pay in slip is available when firm deposits cash or deposits a cheque in the bank account of party to whom it is paid. The counterfoil of pay in slip issued by banker serves as evidence.

f) Cheque :

A cheque is a direction to the banker to pay certain sum of money to a person stated in the cheque by the depositor (firm). When cheques are issued, the details are recorded in the counterfoil of the cheque book giving the information as to party name, amount and date of issue etc.

g) Debit Note :

It is a written note sent by the customer to the supplier when the goods are returned (Purchase returns). The note received gives information of goods returned, their quantity and value. It states the amount debited to suppliers account. This note received is filed for future reference.

h) Credit Note :

It is a written note sent by the supplier of the goods to the customer when the goods are returned by the customer. This note issued to customer stating that the party (customer) account is credited with the value of goods returned. Original copy is sent to the customer and the second copy is retained for reference.

![]()

Question 2.

Explain Accounting equation with an example.

Answer:

Accounting equation is based on dual aspect concept of accounting principle. The accounting equation shows the relationship between the economic resources of a business and claims created against those resources. This is presented in the form of an accounting equation as under.

Assets (Resources) = Equities (Claims)

(Or)

Assets = Capital + Liabilities

Capital = Assets – Liabilities

Liabilities = Assets – Capital

The following example explains effect of each transaction on accounting equation :

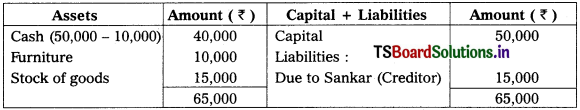

1. Mr. Ganesh commenced business with cash of ₹ 50, 000. When we fit it into equation.

Cash 50000 = Capital ₹ 50,000 + Liabilities ₹ 0

2. Purchased furniture for cash for ₹ 10,000, then the equation stands as :

Cash 40,000 + Furniture ₹ 10,000 – Capital ₹ 50,000 + Liabilities ₹ 0

3. Purchased goods on credit from Mr. Sankar for ₹ 15,000

Assets = Capital + Liabilities

Cash + Furniture + Stock = Capital + Creditors

40,000 + 10,000 + 15,000 = 50,000 + 15,000

65,000 = 65,000.

![]()

Question 3.

Explain briefly systems of recording transation.

Answer:

Book-keeping is the science of recording business transactions of financial nature in regular and systematic manner. Such recording of transactions may be done in any one of the following ways :

1. Single Entry System : .

- It is treated as an incomplete system of book – keeping which is usually followed by small business units. According to Koehler, it is a system of book – keeping in which, as a rule, only records of cash and personal accounts are maintained.

- Hence, it is not treated as a reliable system of book – keeping. In fact, this is not accepted as a system. Instead, it is often called as accounts from incomplete records.

2. Double Entry System :

- It is a system in which both the aspects of all the business transactions are recorded. Every transaction has two aspects, giving and receiving.

- For every transaction, two accounts are affected at the same time and with the same amount – one account about giving the benefit and the other account about receiving the benefit. One is called Debit and the other is called Credit. Double entry is a system which recognises and records both the aspects (Debit and Credit) of a transaction.

Question 4.

Explain classification of accounts with examples.

Answer:

The accounts are broadly divided into two types.

- Personal Accounts

- Impersonal accounts.

1. Personal Accounts :

These accounts which relate to the persons, group of persons or institutions are called personal accounts.

Ex: Rama’s a/c, Andhra Bank a/c., LIC a/c, Infosys Ltd. The rule in personal accounts is “Debit the receiver and credit the giver”. According to this, benefit receivers account is debited and benefit givers account is credited.

2. Impersonal Accounts:

Impersonal accounts are those accounts which are not personal accounts. They are again divided into

- Real Accounts

- Nominal Accounts.

i) Real Accounts :

These accounts related to the assets and properties of the business firm. Ex.: Building, machinery, stock, goodwill etc. The rule in real accounts is “Debit what comes in and credit what goes out”. When an asset is received the asset account is debited and when the asset goes out of the business, the asset is credited.

ii) Nominal Accounts:

These accounts relate to expenses, incomes or gains or losses. Ex.: Salary a/c, Rent a/c, Commission received a/c etc. The rule in nominal accounts is “Debit all expenses and losses and credit all incomes and gains”.

![]()

Question 5.

State the rules of debit and credit with examples.

Answer:

Every transaction has two aspects, one is called debit aspect and the other is credit aspect. Under double entry Book keeping system, to identify which aspect is to be debited or credited, rules of Debit and Credit are framed. They are :

Rule:

1. Personal Accounts : Debit the Receiver

(Natural, Artificial, Representative persons) Credit the Giver

A person who receives benefit from the business, his account is to be debited, similarly, a person who gives benefit to the business, his account is to be credited. For example, goods sold on credit to Mr. Ramesh for ₹ 5,000. In this case, Ramesh is the benefit receiver, hence, his account is to be debited. In the same way, credit purchase of goods from Mahesh ₹ 2,000, Mahesh account is to be credited, as he is benefit giver.

Rule :

2. Real Accounts : Debit What comes in

(Assets) Credit What goes out.

As per this rule the assets coming into the business are to be debited and assets going out of the business are to be credited.

3. Rule:

Nominal Accounts Debit all expenses and losses

(Expenses, Losses, Incomes and Gains) Credit all incomes and gains.

According to this rule, all expenses incurred and losses suffered by business are to be debited. All incomes and gains of the business are to be credited.

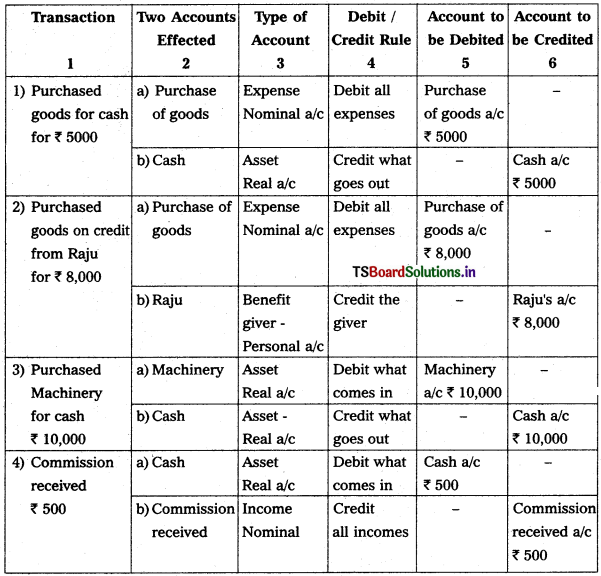

The following table explains application of Debit and Credit rules and the account to which each aspect of a transaction is related.

Some transactions are presented as under :

![]()

Question 6.

Explain briefly the systems of accounting.

Answer:

There are two types of accounting systems which are given below :

1. Cash System of Accounting :

- Under this system, entries made in the records only for transactions which involve receipt and payment of cash. Outstanding aspects such as, expenses payable, incomes receivable or accrued have no place in cash system of accounting. Usually, Government accounts are prepared on cash system.

- They record only the actual income received but, while recording the expenses, they take into account the expenses actually paid and outstanding as well. To some extent, they follow the principle of conservatism. In such case, their income statement is shown as receipts and expenditure account.

2. Mercantile or Accrual System of Accounting :

- Under the Mercantile or accrual system, the whole effect of business transactions are recorded, i.e., the amount received and receivable, the expenses paid and outstanding are recorded.

- In other words, this system, takes into account, while preparing financial statements, all expenses whether paid or due, all incomes earned whether received in cash or accrued / receivable if they are pertaining the financial year for which final accounts are prepared, eg., salaries due, rent receivable etc.

- Thus, under accrual system of accounting all expenses incurred and all incomes accrued for a given financial year are accounted in the same financial year irrespective of their actual receipt or payment, by passing necessary journal entries in the books of accounts.

Question 7.

What do you mean by posting ? Explain the rules relating to posting.

Answer:

The process of transferring the entries recorded in the journal or subsidiary books to the respective accounts in the ledger is called posting. So, posting means the process of grouping of all the transactions relating a particular account at one place.

It is necessary to post all the journal entries in the ledger because posting keeps to know the net effect of various transactions during a period of time on a particular account.

Rules Relating to Posting :

- Each transaction affects minimum two accounts for which separate accounts are to be opened in the ledger.

- If an account is debited in the journal, posting will be made on the debit side of the account in the ledger. Similarly, if an account is credited, posting will be made on the credit side of the account.

- While writing the debit side, commerce with the word To’ and write the name of the account which is credited in the journal. Write the word ‘By’ on the credit side before writing the name of the account that is debited in the journal.

- The difference between debit and credit totals of an account is the net position of the account known as balance of account.

![]()

Very Short Answer Questions:

Question 1.

What is Voucher ?

Answer:

- Voucher is a source document. It forms the basis for recording transactions in the books of accounts.

- A voucher may be in the form of cash memo, invoice, bill, debit note, credit note etc. Vouchers are to be preserved for verification of books of accounts.

Question 2.

State accounting equation.

Answer:

1. Accounting equation is based on the duel aspect concept (i.e., debit and credit). The accounting equation shows the relationship between the economic resources of the business and claims against these resources.

Economic resources = claims.

2. Another term of economic resources is assets. The claims consists of liabilities and owners claims or equity. The accounting equation is as follows :

Assets = equities or capital + liabilities.

Question 3.

What is cash system of accounting ?

Answer:

Cash System of Accounting :

- Under this system, entries made in the records only for transactions which involve receipt and payment of cash. Outstanding aspects such as, expenses payable, incomes receivable or accrued have no place in cash system of accounting. Usually, Government accounts are prepared on cash system.

- They record only the actual income received but, while recording the expenses, they take into account the expenses actually paid and outstanding as well. To some extent, they follow the principle of conservation. In such case, their income statement is shown as receipts and expenditure account.

![]()

Question 4.

What is mercantile system of accounting ?

Answer:

Mercantile or Accrual System of Accounting :

- Under the Mercantile or accrual system, the whole effect of business transactions are recorded, i.e., the amount received and receivable, the expenses paid and outstanding are recorded.

- In other words, this system, takes into account, while preparing financial statements, all expenses whether paid or due, all incomes earned whether received in cash or accrued / receivable if they are pertaining the financial year for which final accounts are prepared, eg. salaries due, rent receivable etc.

- Thus, under accrual system of accounting all expenses incurred and all incomes accrued for a given financial year are accounted in the same financial year irrespective of their actual receipt or payment, by passing necessary journal entries in the books of accounts.

Question 5.

What is an account ?

Answer:

Every transaction has two aspects and each aspect has an account. An account is a summary of relevant transactions at one place relating to a particular head. An account has three parts.

i) A title describes the name of the account.

ii) A left side or debit side.

iii) A right side or credit side.

The form of an account is called T account because of the similarity to the letter T.

Question 6.

State the types of accounts.

Answer:

1) Accounts are classified into two types : (1) Personal Accounts and (2) Impersonal Accounts.

2) Personal accounts may relate to natural, artificial and representative persons.

3) Impersonal accounts are further divided into two types.

They are :

- Real Accounts and

- Nominal Accounts.

![]()

Question 7.

What are personal accounts ?

Answer:

Personal Accounts :

- These accounts which relate to the persons, group of persons or institutions are called personal accounts.

- Ex.: Rama’s a/c, Andhra Bank a/c., LIC a/c, Infosys Ltd.

- The rule in personal accounts is “Debit the receiver” “Credit the giver”.

- According to this, benefit receivers account is debited and benefit givers account is credited.

Question 8.

What are nominal accounts.

Answer:

Nominal Accounts : Nominal accounts are related to expenses, incomes or gains or losses.

Ex.: Salary a/c, rent a/c, commission received a/c etc.

The rule in nominal accounts is : “Debit all expenses and losses

Question 9.

State different types of personal accounts.

Answer:

Personal Accounts :

Personal accounts may relate to natural persons, artificial persons and representative persons. They are explained as under with examples :

a) Natural Persons :

Accounts which relate to individual human beings. For example, Ram, Ramesh, Suresh, Robert, Akbar, Laxmi etc. They are natural persons.

b) Artificial Persons:

They relate to a group of persons, firms or institutions. For example, Infosys Ltd., Andhra Bank, Life Insurance Corporation of India, Lions Club, L & T Ltd., Wipro Ltd., etc.

c) Representative Persons :

These accounts are also personal in nature, e.g., salaries payable (to employees) account, rent receivable (from tenant) account, insurance premium paid in advance (to an insurance company) account. These accounts represents or refers to a particular person or group of persons.

![]()

Question 10.

What is Journal ?

Answer:

- The book in which the business transactions are recorded in chronological order, after analysing them and classifying the benefits according to the principles of debit and credit is called ‘Journal’.

- Journal is also called “original entry” or “prime entry”.

Question 11.

What is Journalising ?

Answer:

- The process of recording a transaction in the Journal is called Journalising.

- For journalising transactions, it is essential to identify the two accounts involved in the transaction, then apply the rule of debit and credit and make the entry in Journal in their respective columns.

Question 12.

What is Journal Entry ?

Answer:

- The process of recording business transactions in a chronological order in Journal after analysing, classifying and identifying as debit and credit is called Entry.

- All the transactions recorded in the Journal are in the form of entries. Hence, they are called as Journal Entries.

Question 13.

What is ledger ?

Answer:

- Ledger is also called as “Book of Secondary Entry”.

- Ledger is a book which facilitates recording of all type of transactions related to personal, real and nominal accounts separately.

- According to Cropper, “The book which contains a classified and permanent record of all the transactions of a business is called ledger”.

![]()

Question 14.

What is posting ?

Answer:

- The process of transferring the entries recorded in the journal or subsidiary books to the respective accounts in the ledger is called posting.

- So, posting means the process of grouping of all the transactions relating to a particular account at one place.

Question 15.

What do you mean by balancing of an account ?

Answer:

- Balancing is the process of finding the difference between the total debits and total credits of an account.

- When posting in done, many accounts may have entries on the debit side as well as on – the credit side. The net result of such debits and credits in an account is the balance.

Question 16.

What is debit balance ?

Answer:

The excess of debit total over the credit total is called the debit balance.

Question 17.

What is credit balance ?

Answer:

The excess of credit total over the debit total is called the credit balance.

![]()

Problems:

Question 1.

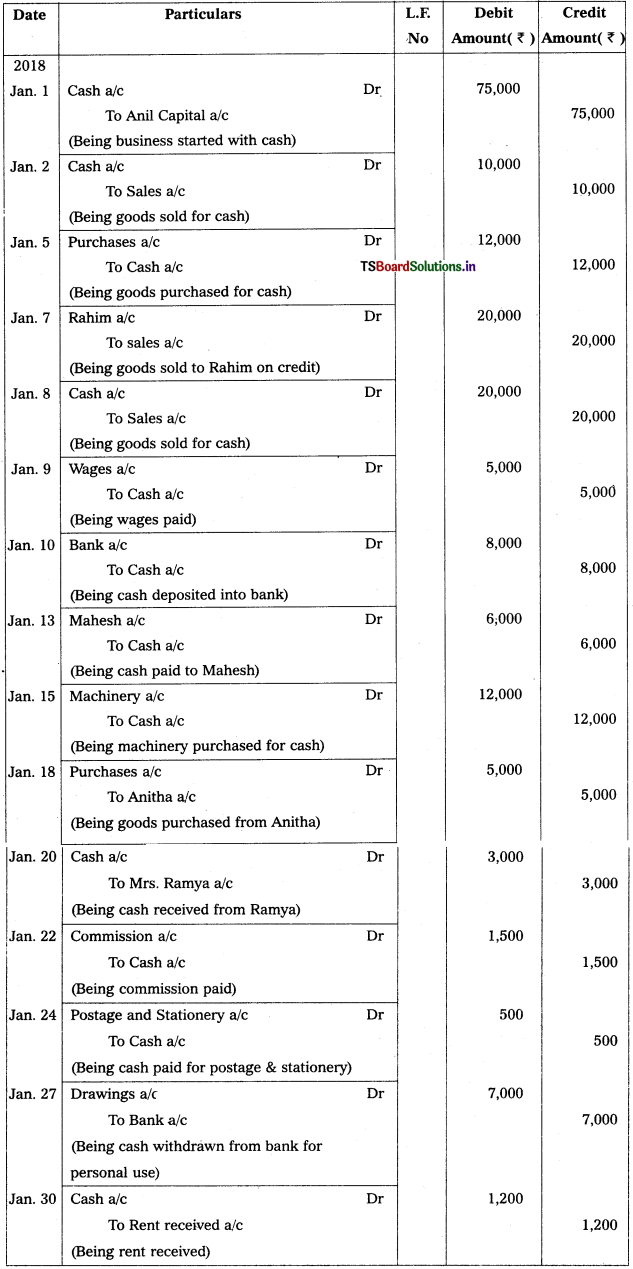

Mr. Anil started business with cash ₹ 75,000 on 1st January 2018. The details of business transactions for the month of January are as follows. Prepare Journal.

2018 Jan

Jan 02 Cash Sales – ₹ 10,000

Jan 05 Goods Purchased for Cash – ₹ 12,000

Jan 07 Goods sold on credit to Rahim – ₹ 20,000

Jan 08 Sale of Goods – ₹ 20,000

Jan 09 Wages Paid – ₹ 5,000

Jan 10 Cash Deposited into bank – ₹ 8,000

Jan 13 Cash paid to Mahesh – ₹ 6,000

Jan 15 Machinery purchased for cash – ₹ 12,000

Jan 18 Purchased goods from Anitha – ₹ 5,000

Jan 20 Cash received from Mrs. Ramya – ₹ 3,000

Jan 22 Paid commission – ₹ 1,500

Jan 24 Paid for Postage and Stationery – ₹ 500

Jan 27 Cash drawn from Bank for personal use – ₹ 7,000

Jan 30 Received rent – ₹ 1,200

Solution:

Journal Entries in the book of Mr. Anil

![]()

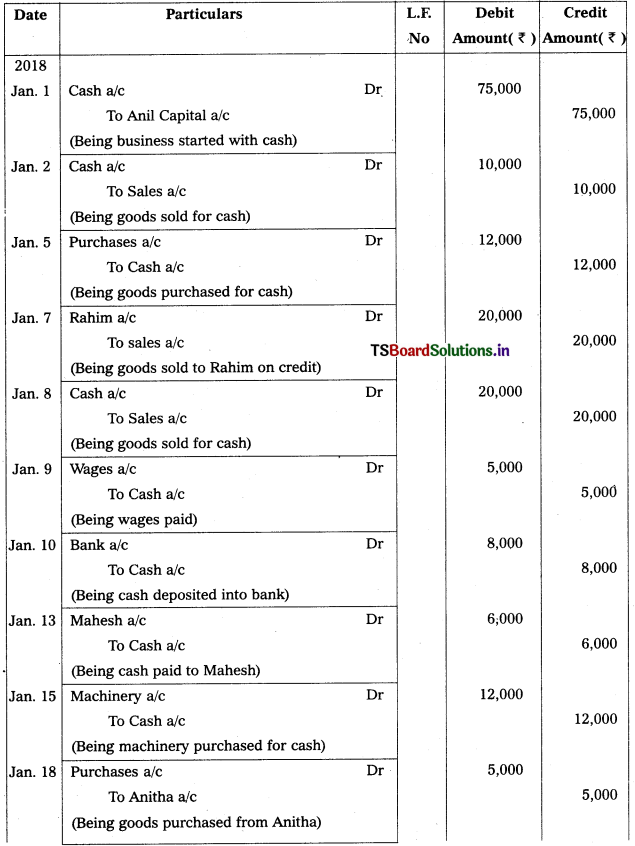

Question 2.

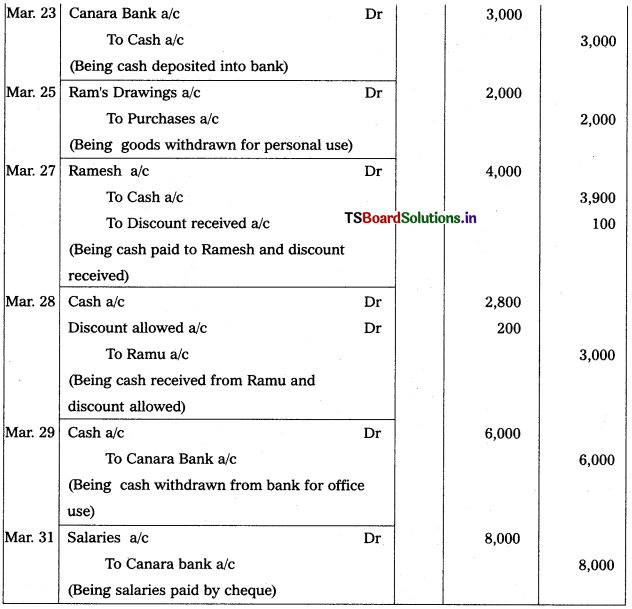

Pass journal entries in the books of Mr. Ram

2019 March

March 01 Ram Commenced business with cash – ₹ 1,00,000

March 02 Cash deposited into Canara Bank – ₹ 60,000

March 04 Purchased from Rama – ₹ 4,000

March 06 Purchased computer and paid by cheque – ₹ 15,000

March 09 Ram withdrew cash for his personal expense – ₹ 5,000

March 13 Furniture purchased – ₹ 10,000

March 15 Returned goods to Rama – ₹ 500

March 18 Amir returned goods – ₹ 1,000

March 20 AdvertIsement Expenses paid – ₹ 1,000

March 23 Deposited cash into Canara Bank – ₹ 3,000

March 25 Goods withdrawn for personal work – ₹ 2,000

March 27 Cash paid to Ramesh Rs. 3,900 and discount received – ₹ 100

March 28 Cash received from Ramu Rs. 2,800 and discount allowed – ₹ 200

March 29 Cash withdrawn from bank for office use – ₹ 6,000

March 31 Salaries paid by cheque – ₹ 8,000

Solution:

Journal Entries in the book of Mr. Anil

![]()

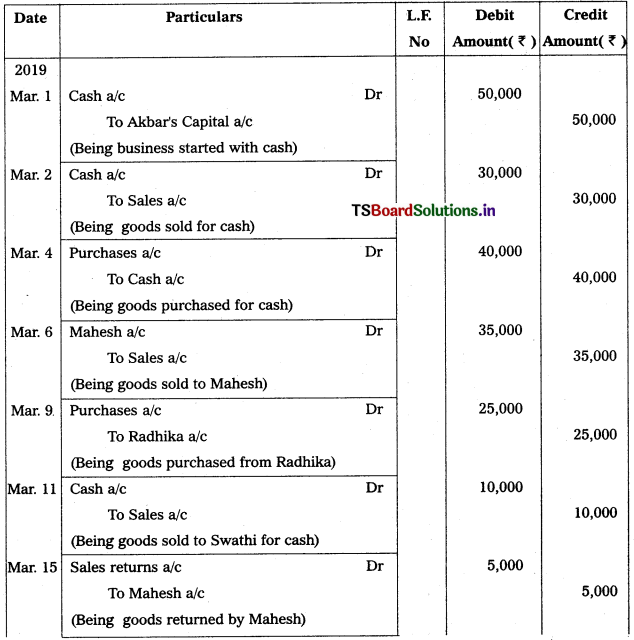

Question 3.

Journalize the following transactions in the books of Akbar.

2019 March

1st Akbar Started business with cash – ₹ 50,000

March 02 Cash Sales – ₹ 30,000

March 04 Cash Purchases – ₹ 40,000

March 06 Sold goods to Mahesh – ₹ 35,000

March 09 Bought goods from Radhika – ₹ 25,000

March 11 Sold goods to Swathi for cash – ₹ 10,000

March 15 Mahesh returned goods – ₹ 5,000

March 18 Commission Received – ₹ 1,000

March 19 Office Expenses paid – ₹ 500

March 20 Cash paid to Pramod – ₹ 6,000

March 22 Returned goods to Radhika – ₹ 2,000

March 25 Goods withdrawn for domestic use – ₹ 5,000

March 27 Cash received from Anand Rs. 3800 and discount allowed – ₹ 200

March 28 Interest received – ₹ 500

March 29 Cash paid to Raman Rs. 4,900 discount allowed by him – ₹ 100

March 31 Commission paid – ₹ 300

Solution:

Journal Entries in the books of Mr. Akbar

![]()

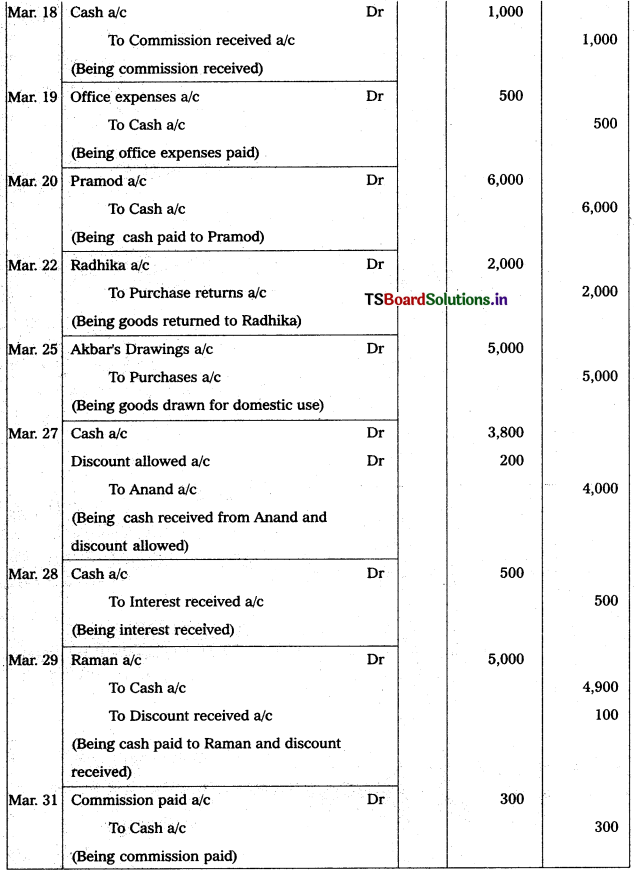

Question 4.

Journalize the following transactions in the books of Bhagat.

2019 January

January01 Commenced business with cash 40,000 and furniture worth 10,000

January02 Sold goods to Suchitra – ₹ 20,000

January03 Purchased Machinery – ₹ 30,000

January05 Paid rent – ₹ 5,000

January09 Paid Electricity bill – ₹ 1,000

January12 Sold goods for cash – ₹ 6,000

January15 Bought goods on credit from Nikhil – ₹ 10,000

January18 Paid wages – ₹ 5,000

January21 Interest received through cheque – ₹ 5,000

January25 Advertisement Expenses paid – ₹ 3,000

Solution:

Journal entries in the books of Mr. Bhagat

![]()

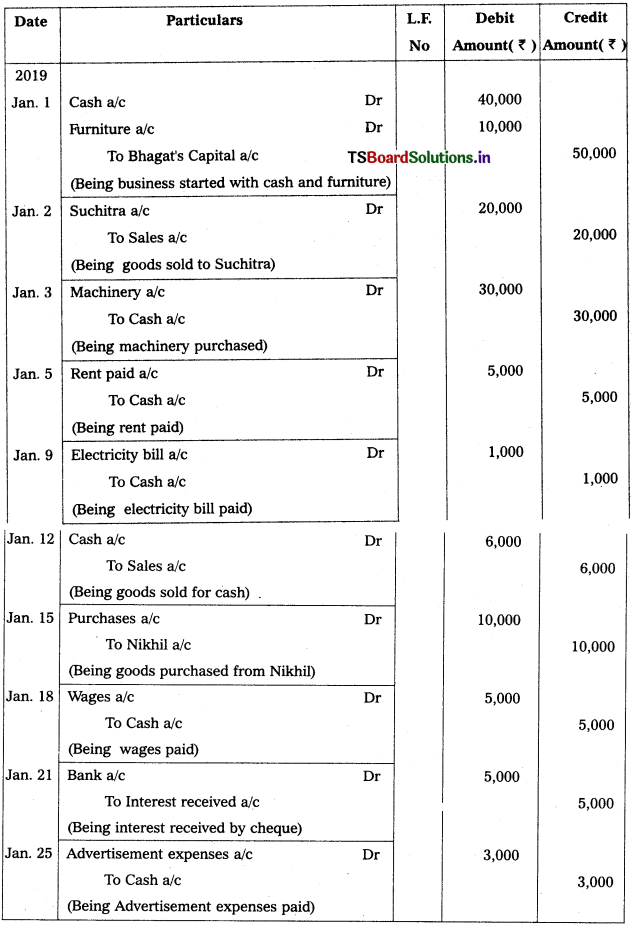

Question 5.

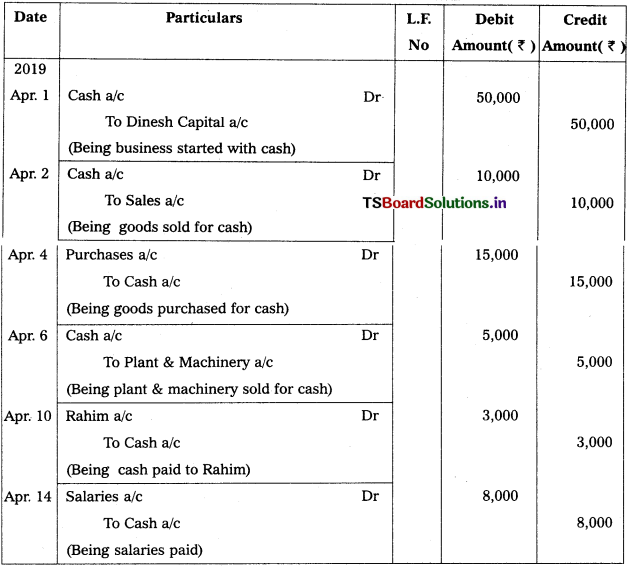

Journalize the following transactions in the books of Dinesh.

2019 April

April 01 Dinesh Started Business with cash – ₹ 50,000

April 02 Sale of goods for cash – ₹ 10,000

April 04 Purchase of goods for cash – ₹ 15,000

April 06 Sold Plant and Machinery for cash – ₹ 5,000

April 10 Cash paid to Rahim – ₹ 3,000

April 14 Salaries paid – ₹ 8,000

Solution:

Journal entries in the books of Mr. Dinesh

![]()

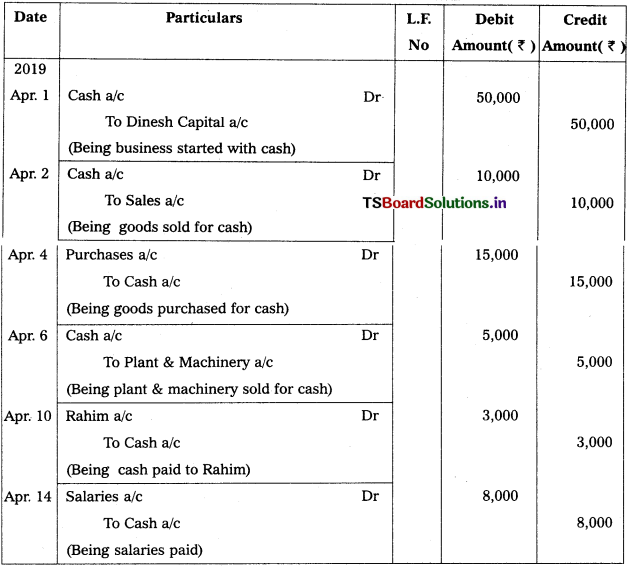

Question 6.

Journahze the following transactions in the books of Atma Ram.

2019 January

January 01 Started business with cash – ₹ 25,000

January 03 Purchased computer – ₹ 5,000

January 06 Purchased goods for cash – ₹ 6,000

January 07 Purchased goods on credit from Mahesh – ₹ 8,000

January 10 Purchased goods for and paid by cheques – ₹ 7,000

January 12 Sold goods for cash – ₹ 10,000

January 15 Goods sold for Rs. 15,000 of which Rs. 8,000 received in cash and by a cheque. – ₹ 7,000

Solution:

Journal entries in the books of Atma Ram

![]()

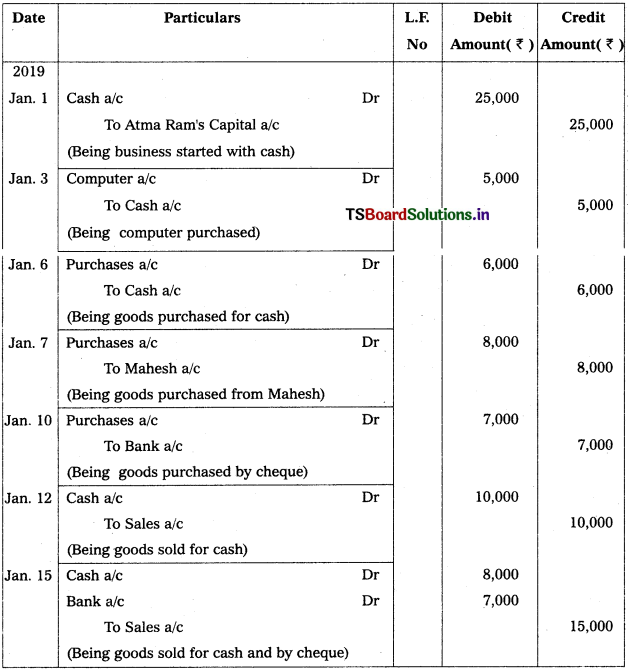

Question 7.

Journahze the following transactions

March 2019

March 01 MrAnthony Commenced business with cash ₹ 13,000 and stock ₹ 7,000

March 02 Bought plant – ₹ 5,000

March 03 Paid for postage – ₹ 500

March 05 Paid for Sundry Expenses – ₹ 500

March 06 Paid into bank – ₹ 10,000

March 07 Paid salaries – ₹ 5,000

March 09 Cash withdrawn from bank for office use – ₹ 1,200

Solution:

Journal entries

![]()

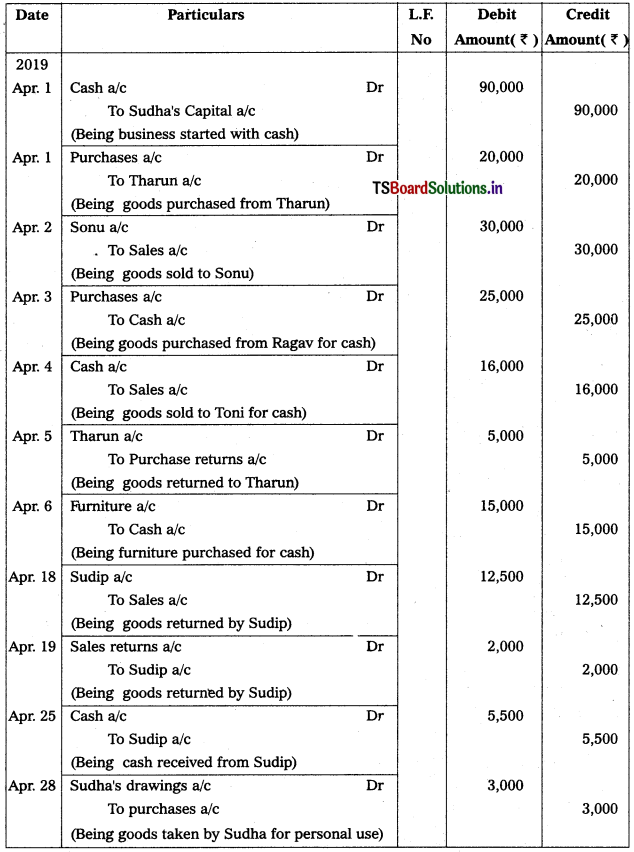

Question 8.

Write journal entries in the books of Sudha.

2019 April

April 01 Started business with a capital of – ₹ 90,000

April 01 Purchased goods from Tharun on credit – ₹ 20,000

April 02 Sold goods to Sonu – ₹ 30,000

April 03 Purchased goods from Ragav for cash – ₹ 25,000

April 04 Sold goods to Toni for cash – ₹ 16,000

April 05 Goods retuned to Tharun – ₹ 5,000

April 06 Bought furniture for cash – ₹ 15,000

April 18 Sold goods to Sudip – ₹ 12,500

April 19 Goods returned by Sudip – ₹ 2,000

April 25 Cash received from Sudip – ₹ 5,500

April 28 Goods taken by Sudha for domestic use – ₹ 3,000

Solution:

Journal entries in the books of Sudha

![]()

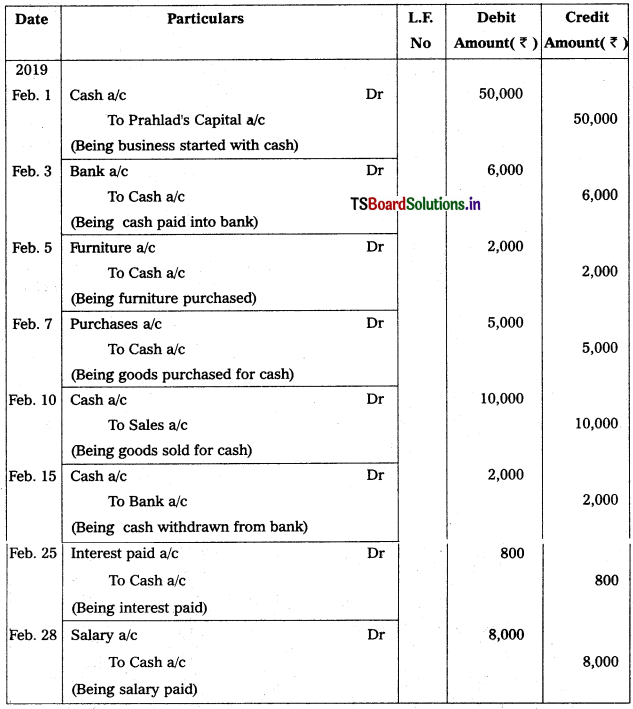

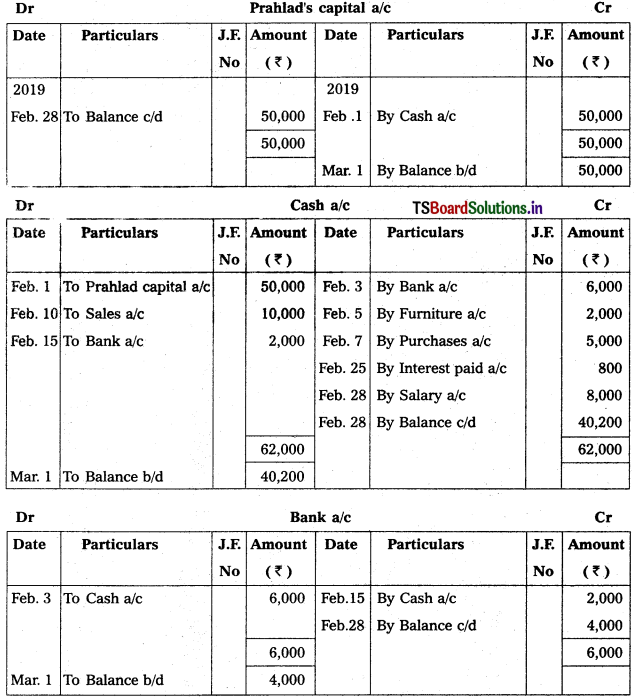

Question 9.

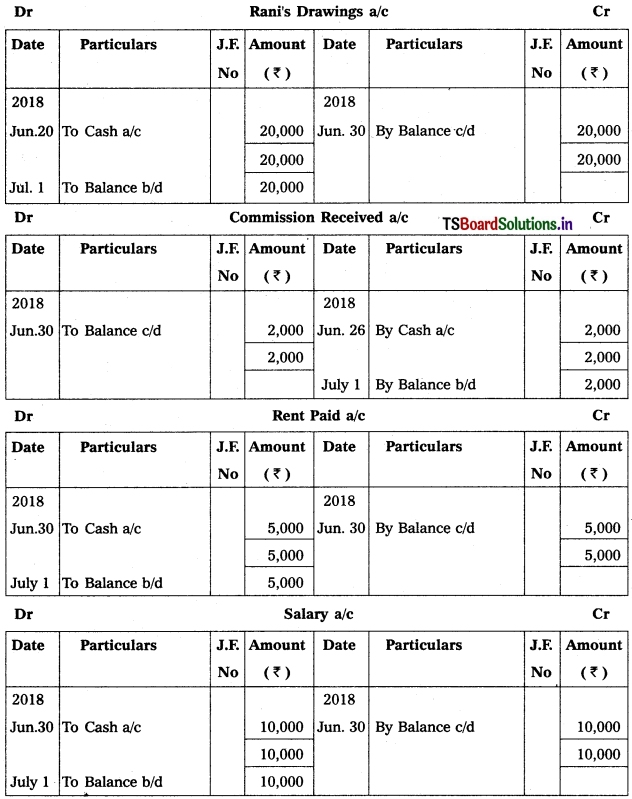

Journalise the following transactions of Mr. Prahlad and post them in the ledger and balance the same

2019 February

February 1 Prahlad invested ₹ 50,000 cash in the business

February 3 Paid into Bank – ₹ 6,000

February 5 Purchased Furniture for – ₹ 2,000

February 7 Purchased goods for – ₹ 5,000

February 10 Sold goods for – ₹ 10,000

February 15 Withdrew cash from bank – ₹ 2,000

February 25 Paid interest – ₹ 800

February 28 Paid Salary – ₹ 8,000

[Answer: Bank Balance ₹ 4,000 Dr. Cash balance ₹ 40, 200 Dr.]

Solution:

Journal entries in the books of Mr.Prahlad

![]()

![]()

Question 10.

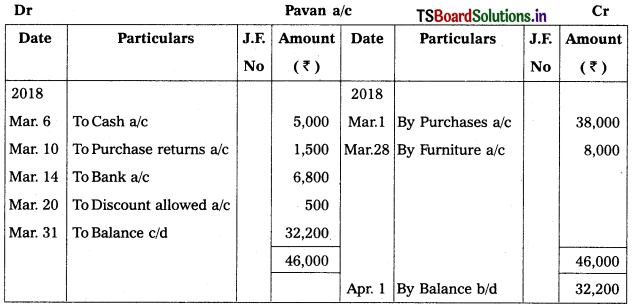

Prepare Pavan account from the following :

2018 March

March 1 Goods purchased from Pavan – ₹ 38,000

March 6 Cash paid to Pavan – ₹ 5,000

March 10 Goods returned to Pavan – ₹ 1,500

March 14 Paid to Pavan by Cheque – ₹ 6,800

March 20 Discount allowed by Pavan – ₹ 500

March 26 Goods purchased from Pavan for Cash – ₹ 2,500

March 28 Furniture purchased from Pavan – ₹ 8,000

Solution:

Question 11.

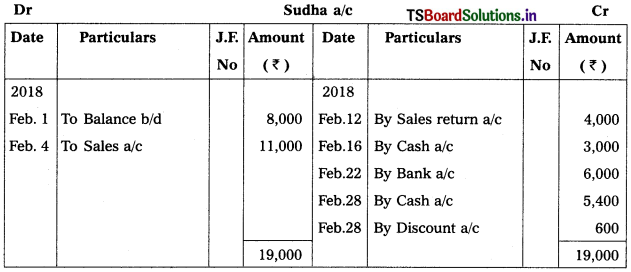

Prepare Sudha account from the following :

2018 February

February 1 Amount due from Sudha – ₹ 8,000

February 4 Goods sold to Sudha – ₹ 11,000

February 12 Goods returned by Sudha – ₹ 4,000

February 16 Cash received from Sudha – ₹ 3,000

February 22 Received cheque from Sudha – ₹ 6,000

February 28 Sudha account settled with 10% discount

Solution:

Note:

Discount = 6000 × \(\frac{10}{100}\) = 600.

![]()

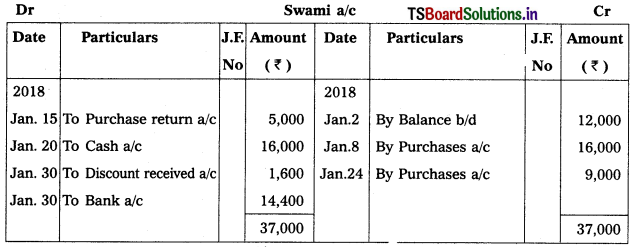

Question 12.

Prepare Swami’s account from the following :

2018 January

January 2 Amount due to Swami – ₹ 12,000

January 8 Goods purchased from Swami – ₹ 16,000

January 15 Goods returned to Swami – ₹ 5,000

January 20 Cash paid to Swami – ₹ 16,000

January 24 Goods purchased from Swami – ₹ 9,000

January 30 Swami’s account is settled by cheque with 10% discount

[Ans: Paid₹ 14,400; Discount received ₹ 1,600]

Solution:

Note :

Discount = 16,000 × \(\frac{10}{100}\) = 1600

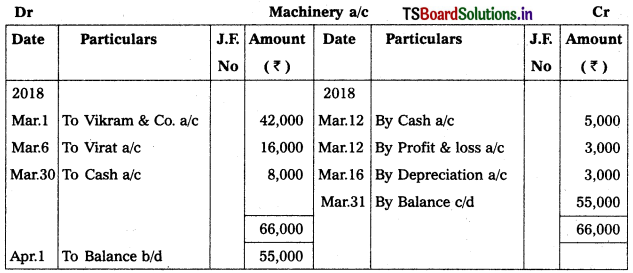

Question 13.

Prepare Machinery account from the following :

2018 March

March 1 Purchased machinery from Vikram & co – ₹ 42,000

March 6 Machinery purchased from Virat – ₹ 16,000

March 12 Machinery costing ? 8,000 sold for – ₹ 5,000

March 16 Depreciation provided on Machinery – ₹ 3,000

March 22 Goods purchased from Swami – ₹ 9,000

March 30 Purchase of machinery for cash – ₹ 8,000

Solution:

![]()

Question 14.

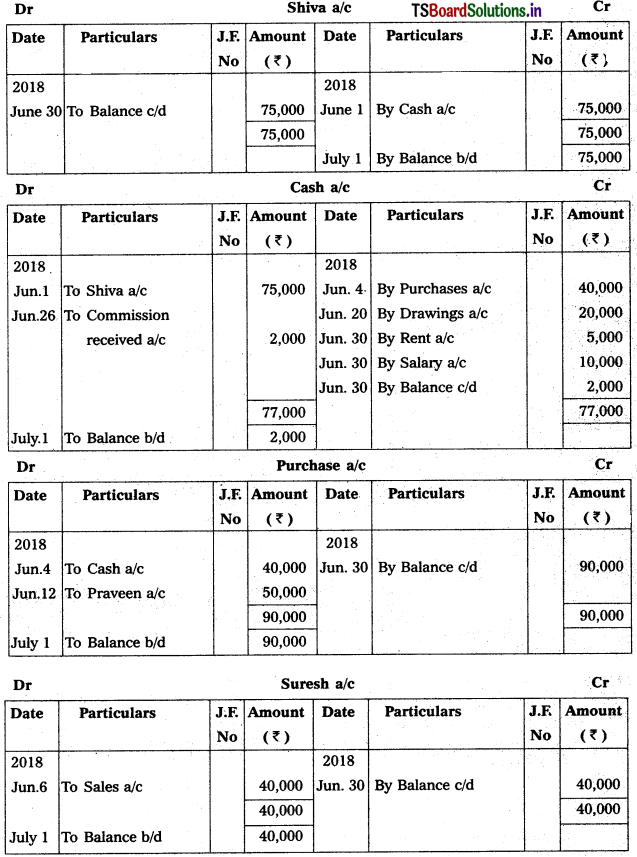

Prepare the Ledger accounts from the following particulars in the Books of Rani

2018 June

June 1 Received cash from Shiva – ₹ 75,000

June 4 Bought goods for cash – ₹ 40,000

June 6 Sold to Suresh – ₹ 40,000

June 12 Bought goods from Praveen – ₹ 50,000

June 16 Sold goods to Ganesh – ₹ 35,000

June 20 Withdrew cash for personal use – ₹ 20,000

June 26 Received Commission – ₹ 2,000

June 30 Paid rent – ₹ 5,000

June 30 Paid salary – ₹ 10,000

Solution:

Ledger Accounts in this books of Rani:

![]()

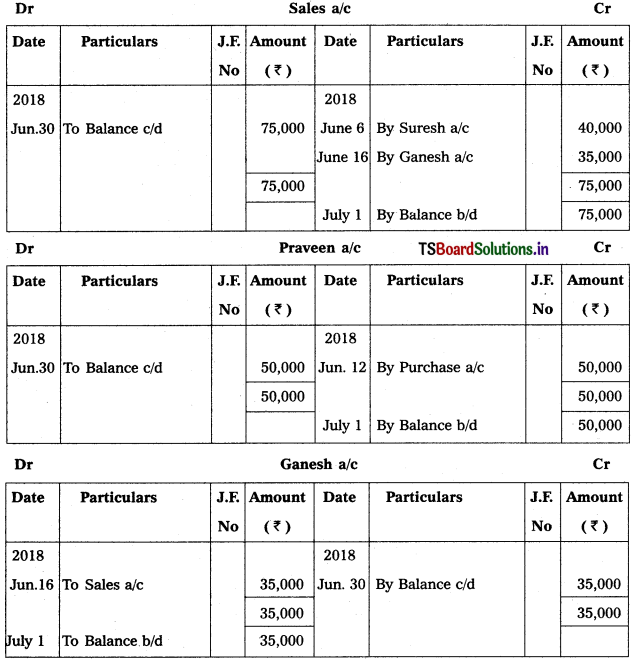

Question 15.

From the following information prepare Praveen’s Account as on 31-03-2014

2018 March

March 7 Balance due from Praveen – ₹ 3,500

March 7 Sold goods to Praveen – ₹ 1,500

March 10 Purchased goods from Praveen – ₹ 1,000

March 15 Paid cash to Praveen – ₹ 800

March 23 Received cash from Praveen – ₹ 500

March 25 Returned goods to Praveen – ₹ 200

Praveen settled account with 10% discount.

Solution:

Note:

Discount = 4500 × \(\frac{10}{100}\) = 450.

Question 16.

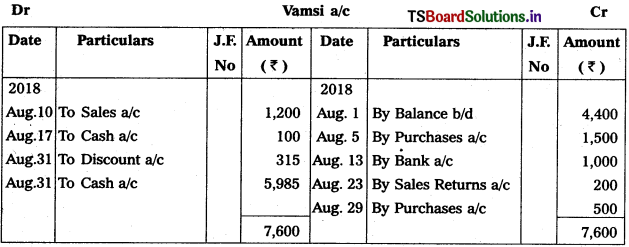

Prepare Vamsls Account from the following

2018 August

August 1 Balance due to Vamsi – ₹ 4,400

August 5 Purchased goods from Vamsi – ₹ 1,500

August 10 SoldgoodstoVamsi – ₹ 1,200

August 13 Received cheque from Vamsi – ₹ 1,000

August 17 Paid cash to Vamsi – ₹ 100

August 23 Vamsi returned goods – ₹ 200

August 29 Purchased goods from Vainsi – ₹ 500

Vamsi account settled with 5% discount.

Solution:

Note:

Discount = 4500 × \(\frac{5}{100}\) = 315.

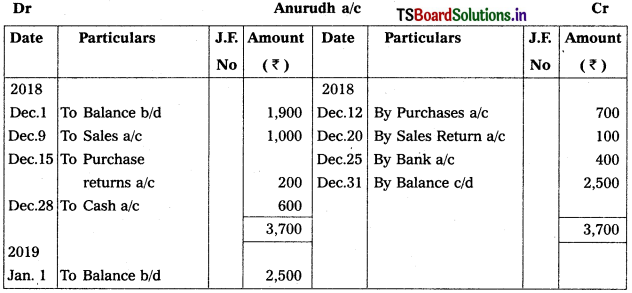

Question 17.

Prepare Anurudh’s Account from the following 2018

2018 December

December 1 Balance due from Anurudh – ₹ 1,900

December 9 Sold goods to Anurudh – ₹ 1,000

December 12 Purchased goods from Anurudh – ₹ 700

December 15 Returned goods to Anurudh – ₹ 200

December 20 Anurudh returned goods – ₹ 100

December 25 Received cheque from Anurudh – ₹ 400

December 28 Paid cash to Anurudh – ₹ 600

Solution:

![]()

Textual Examples:

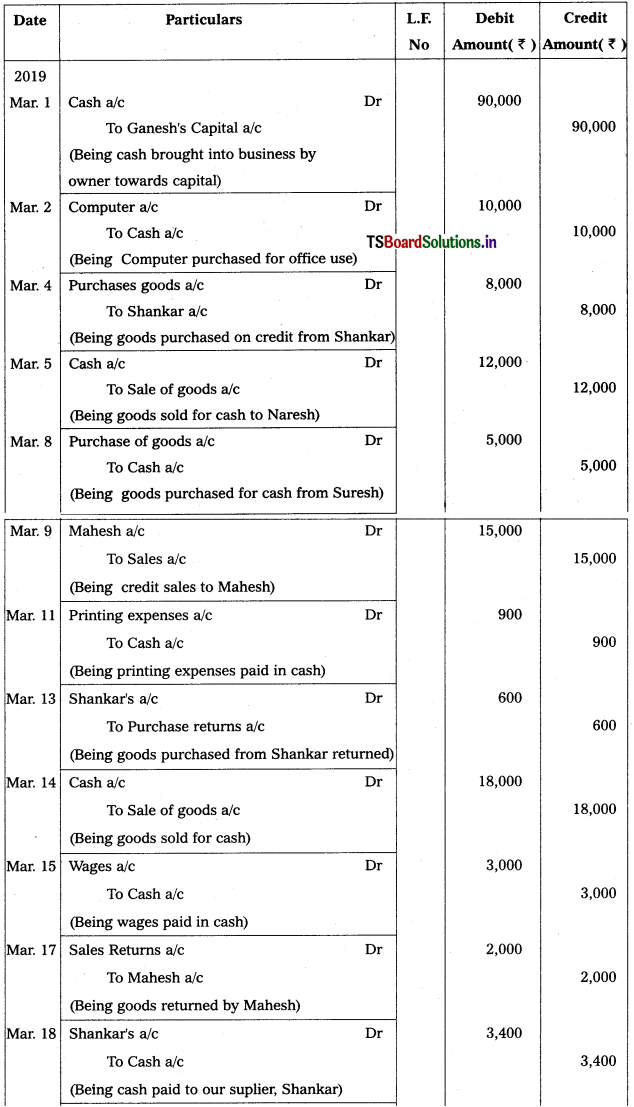

Question 1.

Journalise the following transactions.

Date 2019 March

March 11 Paid for printing expenses – ₹ 900

March 13 Goods returned to Sankar on account – ₹ 600

March 14 Cash sales – ₹ 18,000

March 15 Wages paid – ₹ 3,000

March 17 Mahesh returned goods – ₹ 2,000

March 18 Paid to Sankar – ₹ 3,400 on account

March 20 Received from Mahesh on account – ₹ 7,000

March 23 Rent paid – ₹ 1,500

March 25 Commission received – ₹ 1,200

March 28 Paid salaries – ₹ 5,000

March 30 Ganesh (proprietor) taken – ₹ 1,000 for personal expenses

March 31 Goods taken for personal use – ₹ 800

Solution:

Journal Entries in the book of Mr. Ganesh

![]()

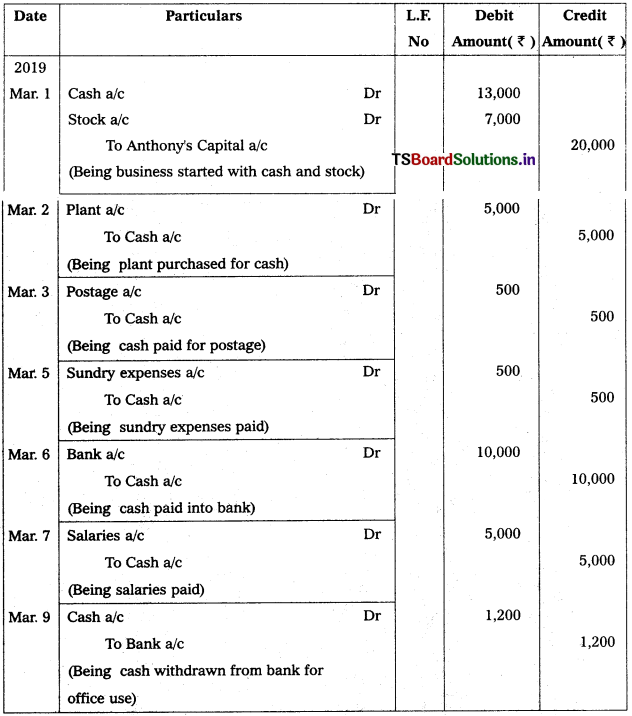

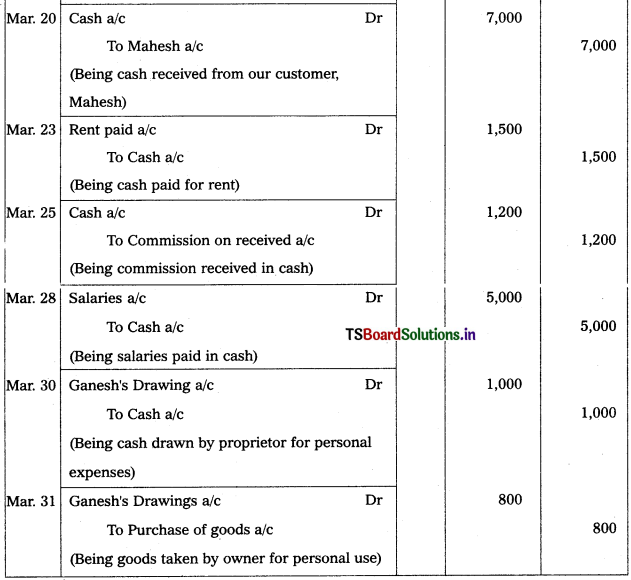

Question 2.

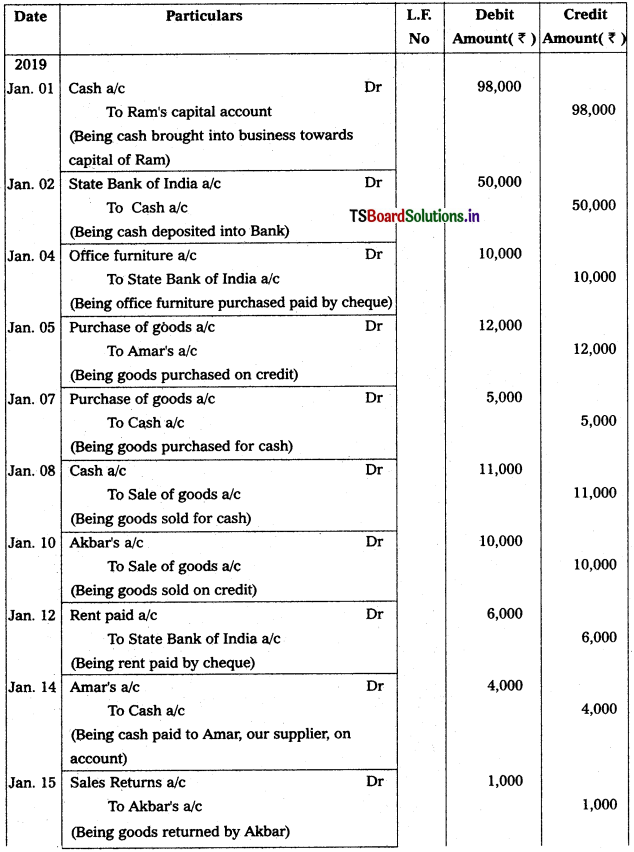

Journalise the following transactions.

Date 2019 January

January 01 Mr.Ram Commenced business with ₹ 98,000

January 02 Cash deposited into State Bank of India ₹ 50,000

January 04 Purchased office furniture for ₹ 10,000 paid through bank

January 05 Purchased goods from Amar ₹ 12,000

January 07 Purchased goods for cash ₹ 5,000 from Ramesh

January 08 Cash sales ₹ 11,000

January 10 Goods sold to Akbar for ₹ 10,000

January 12 Paid rent by cheque ₹ 4,000

January 14 Paid to Amar ₹ 6,000 on account

January 15 Goods returned by Akbar ₹ 1,000

January 16 Goods returned to Amar ₹ 1,500

January 18 Paid for advertising ₹ 1,200

January 19 Received from Akbar by cheque ₹ 3,000

January 21 Loan taken / borrowed from Raju ₹ 9,000

January 25 Goods purchased for ₹ 15,000 paid by cheque

January 28 Drawings from Bank by Ram ₹ 1,500

January 31 Salaries paid by cheque ₹ 12,000.

Solution:

Journal of Mr. Ram

![]()

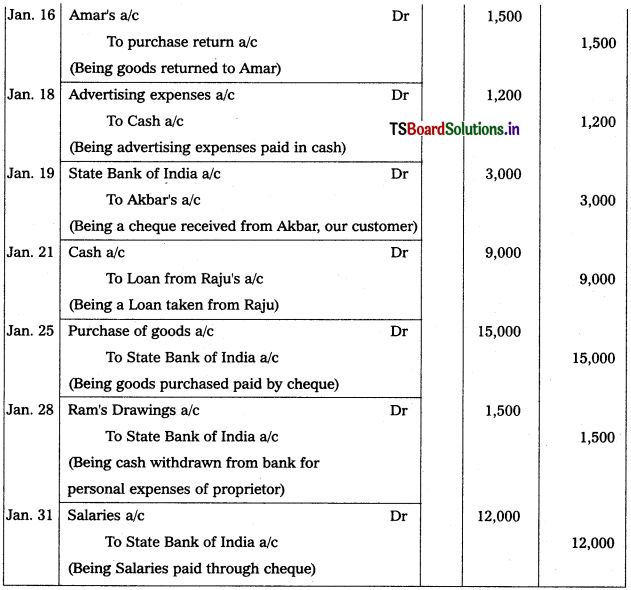

Question 3.

Journalise the following transactions.

Date 2019 January

January 05 Received cash from Ramesh ₹ 2,800, discount allowed ₹ 200.

January 10 Paid to Mohan ₹ 8,500 infull satisfaction of his account ₹ 9,000.

January 18 Rahim is a customer from whom ₹ 5,000 due, he became insolvent, only ₹ 3,000 received as final divident from his estate.

January 24 Interest received on investment by cheque (our Banker’s is Canara Ban ₹ 1,200).

January 28 Commission paid ₹ 1,200.

January 30 Interest paid on Loan ₹ 3,000.

Solution:

Journal entries

![]()

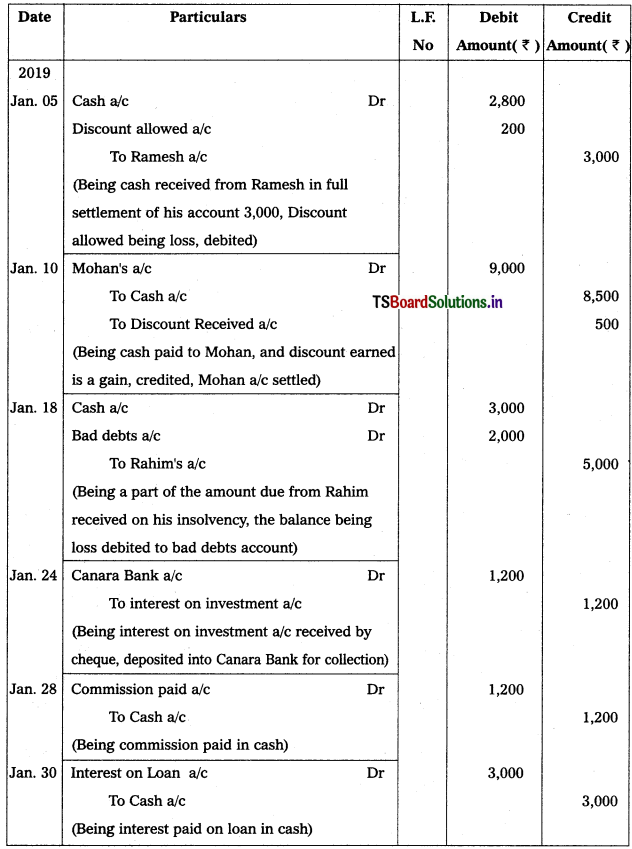

Question 4.

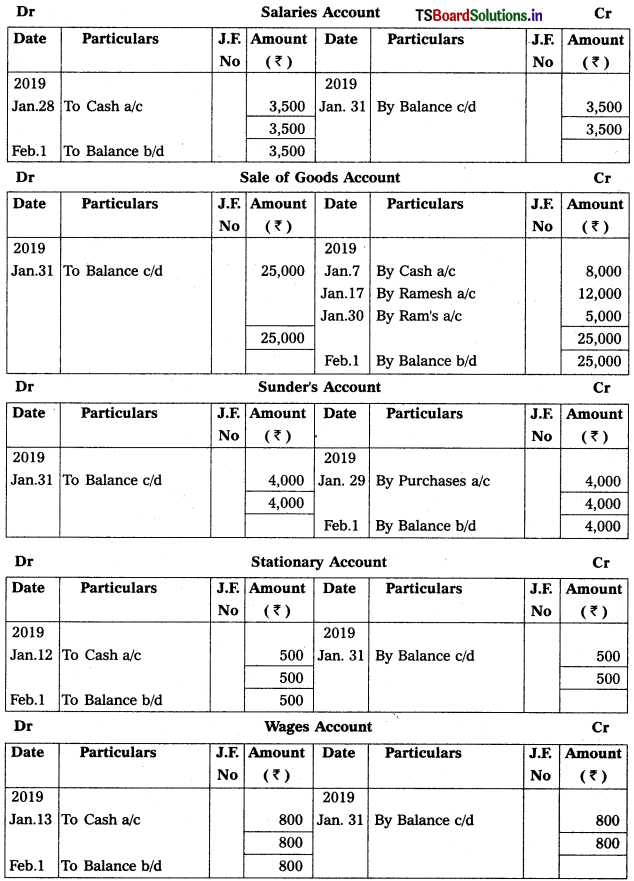

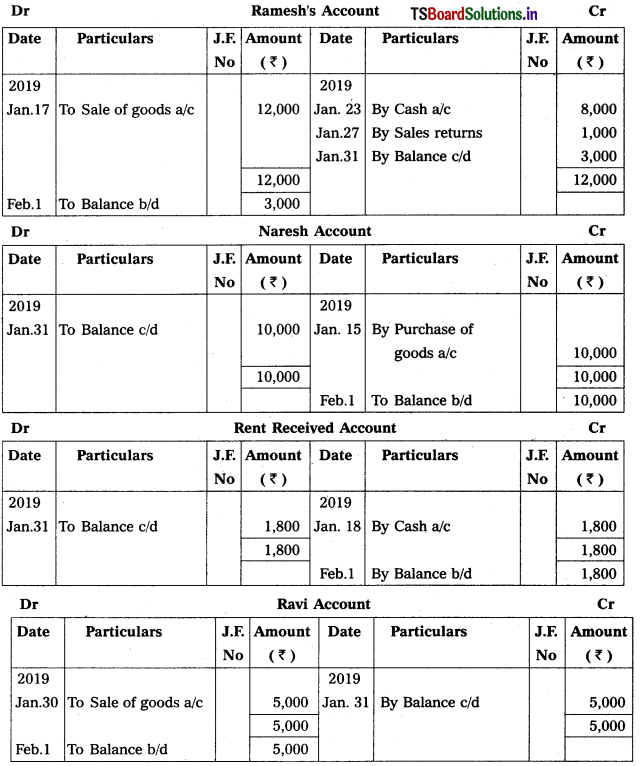

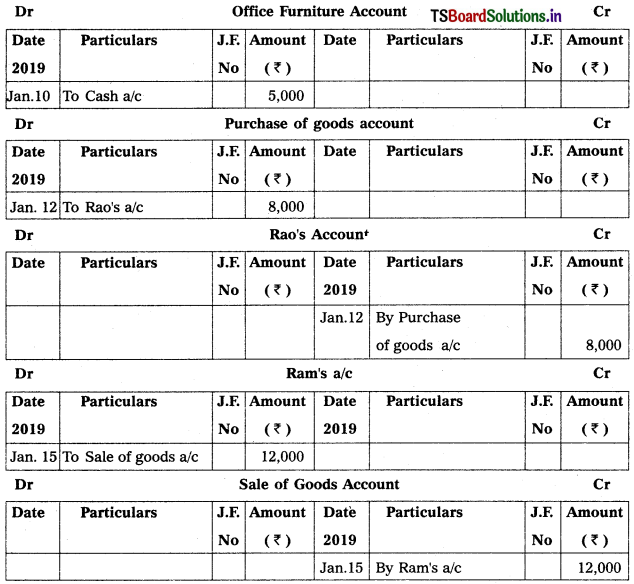

Journalise the following transactions and post them into their respective accounts in the ledger.

Date 2019 January

January 05 Ramesh commenced business with ₹ 25,000

January 10 Purchased office furniture for cash ₹ 10,000

January 12 Goods purchased on credit from Rao ₹ 8,000

January 25 Sold goods on credit to Ram ₹ 12,000

Solution:

Journal entries of Ramesh

![]()

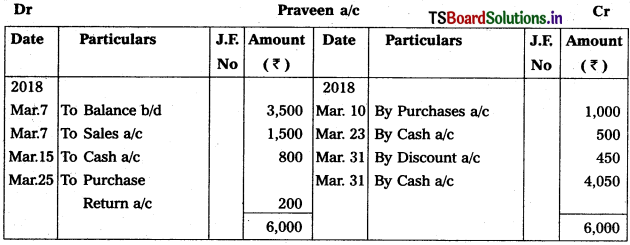

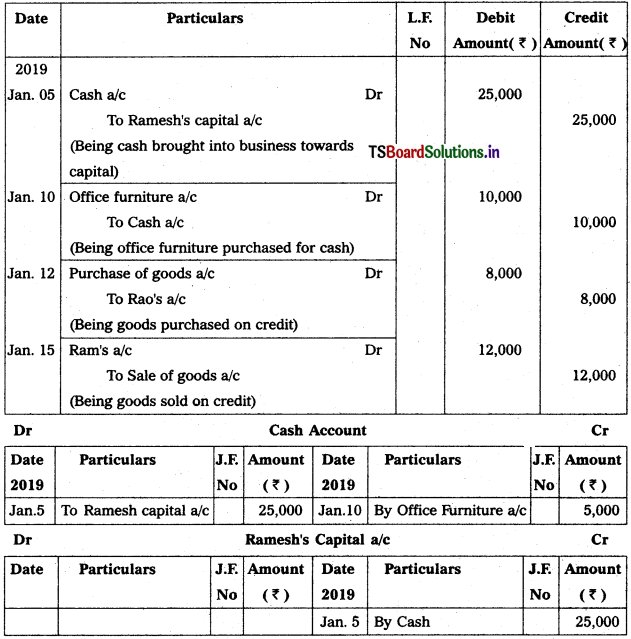

Question 5.

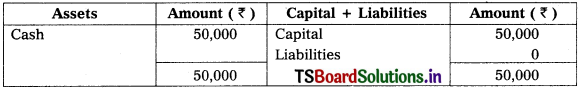

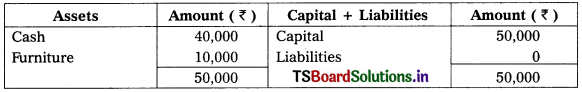

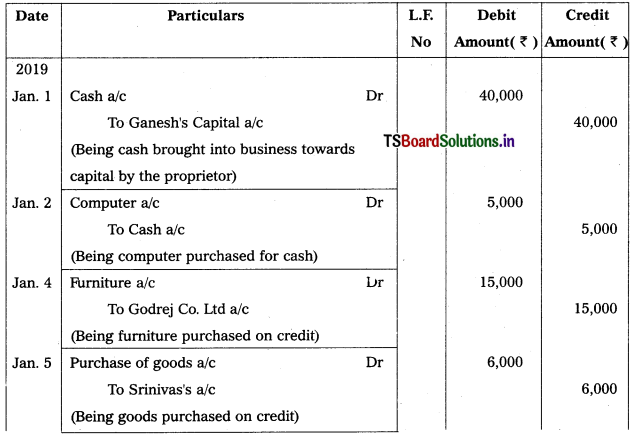

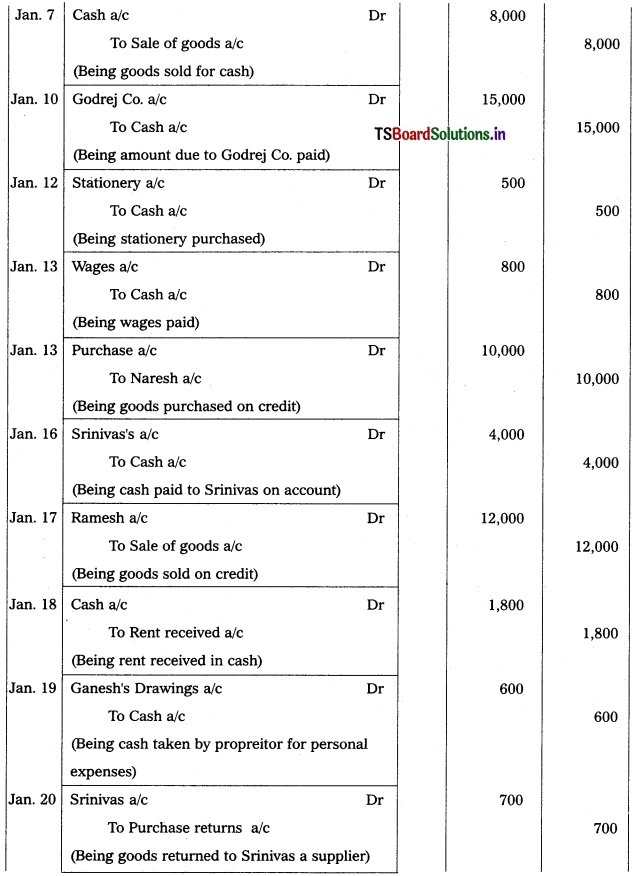

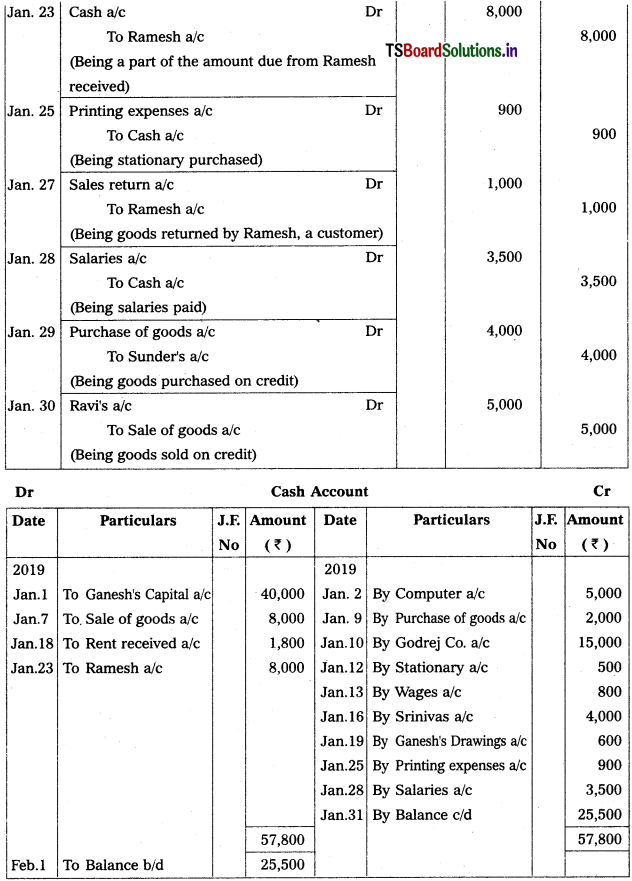

Journalise the following transactions and post them into ledger and balance the accounts.

Date 2019 January

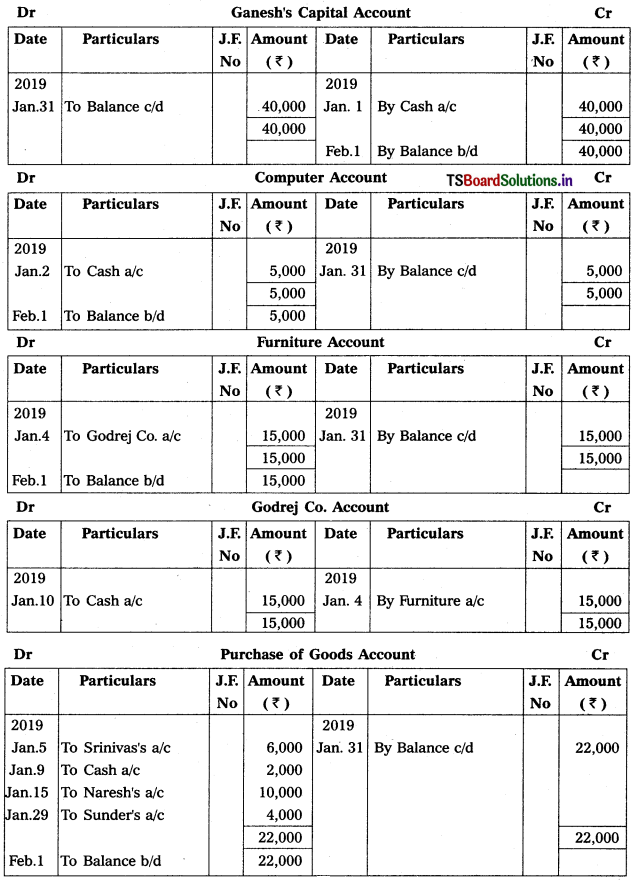

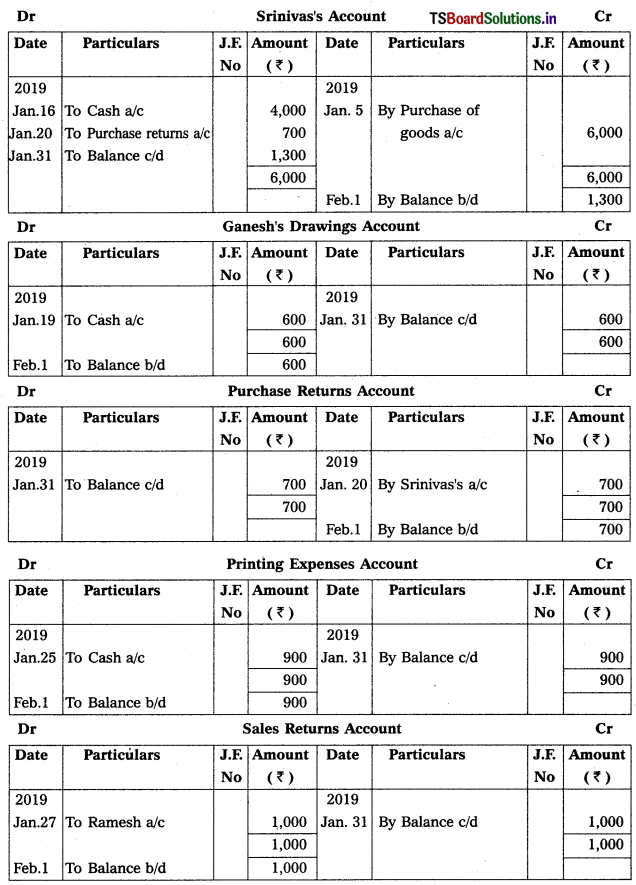

January 1st Mr.Ganesh commenced business with – ₹ 40,000

January 2nd Purchased a Computer for office use – ₹ 5,000

January 4th Purchased Furniture from Godrej Co. for – ₹ 15,000

January 5th Goods purchased from Srinivas – ₹ 6,000

January 7th Goods Sold for Cash – ₹ 8,000

January 9th Purchased goods for Cash – ₹ 2,000

January 10th Paid to Godrej Co. – ₹ 15,000

January 12th Paid for stationery – ₹ 500

January 13th Wages paid – ₹ 800

January 15th Goods purchased from Naresh – ₹ 10,000

January 16th Paid to Srinivas on account – ₹ 4,000

January 17th Goods sold to Ramesh – ₹ 12,000

January 18th Rent received – ₹ 1,800

January 19th Ganesh (owner) taken cash for personal expenses – ₹ 600

January 20th Goods returned to Srinivas – ₹ 700

January 23rd Received cash from Ramesh on account – ₹ 8,000

January 25th Paid for printing – ₹ 900

January 27th Goods returned by Ramesh – ₹ 1,000

January 28th Paid Salaries – ₹ 3,500

January 29th Purchased goods from Sunder – ₹ 4,000

January 30th Sold goods to Rav – ₹ 5,000

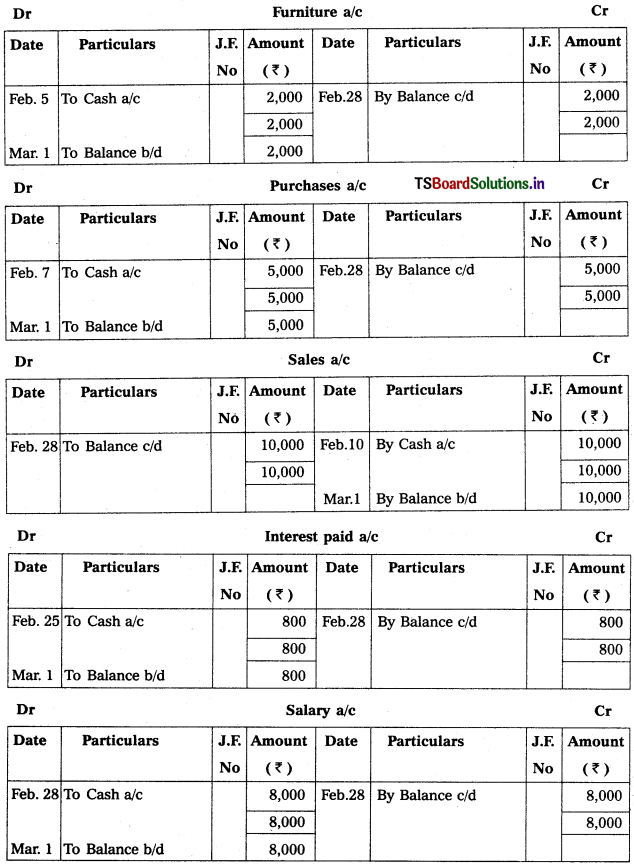

Solution:

Journal Entries

![]()

![]()