Telangana TSBIE TS Inter 1st Year Accountancy Study Material 8th Lesson Rectification of Errors Textbook Questions and Answers.

TS Inter 1st Year Accountancy Study Material 8th Lesson Rectification of Errors

Essay Questions:

Question 1.

What are the various types of errors ? Explain with suitable examples.

Answer:

In accountancy errors are not rectified by striking off the wrong figures and replacing it by correct one. It is better to pass an appropriate entry for rectification of mistake to neutralise the effect of error and to bring correct position.

Errors are classified into two types.

- Error of principle

- Clerical errors.

1. Error of principle :

Error of principle occurs where errors are made to defective knowledge of accounting principles. These errors may arise, when distinction is not made between capital and revenue nature items. Ex : Salaries paid to staff debited to their personal accounts purchase of furniture debited to purchases A/c. These errors are not disclosed by the trial balance because one error is compensated by the other.

2. Clerical errors :

When mistake is committed while recording them either in the books of original entry or posting them in the ledger. These errors are of three types. They are :

a) Errors of omission

b) Errors of commission

c) Compensating errors

a) Errors of omission :

These errors in the books due to omission of some transactions in any subsidiary books or posting them into ledger. Complete omission of a transactions does not effect trial balance. Ex: Credit purchases made not recorded in the purchases book. Paid cash to Suresh not entered in the cash book.

b) Errors of commission :

These are clerical errors. These errors arises because of mistakes in calculations, totalling, carry forward or balancing. There may be wrong postings or posting twice into the ledger and wrong entries in the original books. Such errors may or may not effect the trial balance. Ex : Instead of posting purchases with ^ 1,000 posted ₹ 100 in the Account.

c) Compensating errors :

These errors arise as one error is compensated by the other error. The effect of one error is cancelled with the effect of other error or errors.

Ex: Excess debit compensated with excess credit. This type of errors are not disclosed by the trial balance.

![]()

Question 2.

What are the errors disclosed by Trial Balance and not disclosed by Trial Balance ?

Answer:

Errors may be classified as

- Errors not disclosed by Trial Balance

- Errors disclosed by Trial Balance

1. Errors not disclosed by Trial Balance :

This type of errors cannot be traced out in the preparation of trial balance, because these errors cannot affect the agreement of the trial balance.

- Errors of principle, Ex : Repairs to machinery debited to machinery a/c.

- Errors of omission, Ex : Sales made are not recorded in the sales book.

- Errors of commission, Ex : Purchase Book overcast by ₹ 1000.

- Compensating errors, Ex: Amount paid to Ram ₹ 5,000 recorded as ₹ 5,500 and amount received from Shyam ₹ 10,000 recorded as ₹ 9,500.

- Posting wrong entry in the subsidiary books.

- Posting to correct side in a wrong account.

- Recording a transaction in books of account in twice.

2. Errors disclosed by Trial Balance :

The errors which are revealed by trial balance are known as Errors disclosed by trial balance.

- Posting a transaction to wrong side of an account. Ex : Discount allowed posted to credit side discount account.

- Posting a wrong amount in account. Ex : Sales ₹ 25,000 posted to sales a/c as ₹ 2,500.

- Errors in totally Ex : Sales return book is overcast by ₹ 100.

- Errors made in carrying forward. Ex : Purchases book total is carried forward ₹ 1,500 instead of ₹ 150.

- Omission to post an amount from the subsidiary book to ledger. Ex : Sold goods to Hari ₹ 1,000 not entered in Hari’s account.

- Recording one aspect twice. Ex : Paid salaries ? 1,000 debited to salaries account twice.

- Omission to enter a balance or wrong balancing in ledger account.

![]()

Question 3.

What do you mean by Suspense Account ? Explain it briefly.

Answer:

When the trial balance does not agree, an effort is made to locate the errors and rectify them. But if the errors cannot be located easily and quickly and at the same time, if the final accounts are to be prepared urgently, the difference in the trial balance is made good by writing it to smaller side of the trial balance under the name suspense account’ such temporary suspense account is closed later when once errors are located and rectified.

The suspense account is an imaginary account opened temporarily for the purpose of just tallying trial balance. Ex: if the ‘debit side of the trial balance exceeds credit side, then the difference put on the credit side and the suspense account shows credit balance. If the credit side of the trial balance exceeds debit side, then the difference is put on the debit side and suspense account shows debit balance.

The difference in trial balance are due to one side errors and not due to other errors. The errors which involve both the accounts permits the trial balance to agree and therefore they do not give rise to sus: pense account. The balance of suspense account is shown on the balance sheet either on liabilities or assets side, depending upon whether the suspense account has a credit or debit balance.

Question 4.

Distinguish between partial omission and complete omission with suitable illustra¬tions.

Answer:

| Basic difference | Error of Complete Omission | Error of Partial Omission |

| 1. Meaning | This error arises when a transaction is totally omitted in the books of accounts. | This error arises when onlyone aspect of the transaction either debit or credit is recorded. |

| 2. Example | Furniture purchased from Saketh & Co. Completely not recorded. | A credit sale of goods to Sunder is recorded in sales book but not posted in Sunder’s account. |

| 3. Effect on Trial Balance | This error does not affect the trial balance. | This error affects the trial balance. |

![]()

Short Answer Questions:

Question 1.

What is of Errors of Omission.

Answer:

These errors arise in the books due to omission of some transactions in any subsidiary book or posting into ledger account.

Ex :

- When no entry is made for a transaction in any subsidiary book or in journal.

- Omission of posting some entry in ledger.

Question 2.

Explain the errors of commission with two examples.

Answer:

These are clerical errors. These errors arise due to mistakes in calculations, totalling, carry forward or balancing.

Ex :

- Instead of posting purchases worth ₹ 1,000 posted ₹ 100 in the account.

- Instead of debiting Prasad account wrongly debited to Pratap account.

Question 3.

Explain the errors of principle with two examples.

Answer: Errors of principle occurs when errors are made due to defective knowledge of account¬ing principles. These errors arise when correct distinction between capital items is not made.

Ex :

- Purchase of furniture debited to purchases account.

- Paid salary to manager is debited to manager account.

![]()

Question 4.

What do you mean by compensating error.

Answer:

These errors arises as one error is compensated by the other error. The effect of one error is cancelled with the effect of other errors.

Ex : Amount paid to Ram ₹ 5,000 recorded as ₹ 4,500 ana amount received from syam ₹ 10,000 recorded as ₹ 9,500.

Question 5.

Define suspense account.

Answer:

- If the trial balance not agree, then difference between the debit and credit totals should be transferred to an account called suspense account.

- Suspense account is an imaginary account, opened and used as a temporary measure to make the two sides of the trial balance agree.

- As and when the errors which causes the disagreement in trial balance is detected, rectification entries should be passed through suspense account.

![]()

Problems:

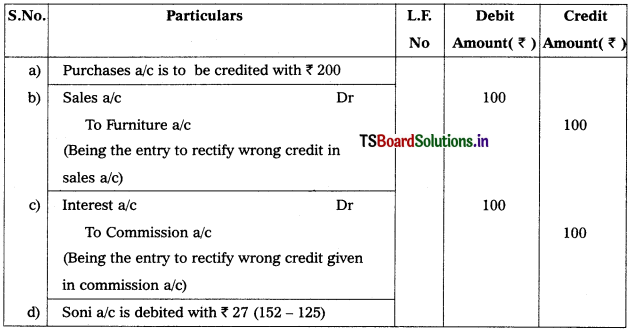

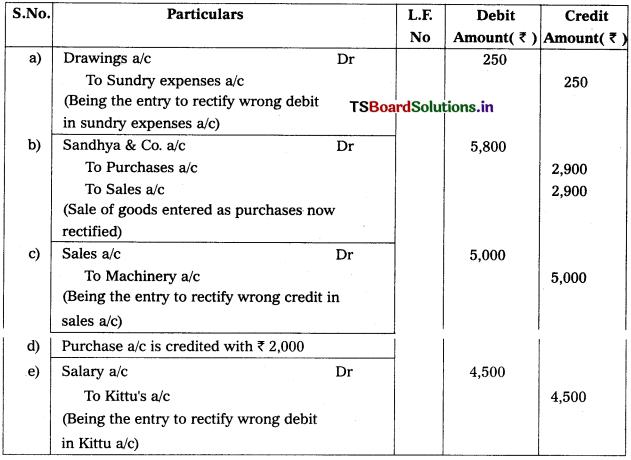

Question 1.

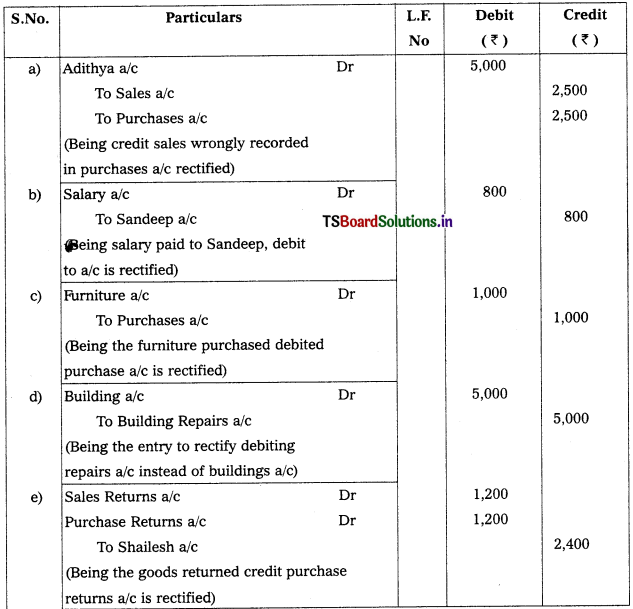

Rectify the following errors.

a) A sale of goods to Adithya for ₹ 2,500 was passed through the purchases book.

b) Salary of ₹ 800 paid to Sandeep was wrongly debited to his personal account.

c) Furniture purchased on credit from Sekhar for ₹ 1,000 was entered in the purchases book.

d) ₹ 5,000 spent on the extension of buildings was debited to buildings repairs account.

e) Goods returned by Shailesh ₹ 1,200 were entered in the return outwards book.

Solution:

Rectification entries

![]()

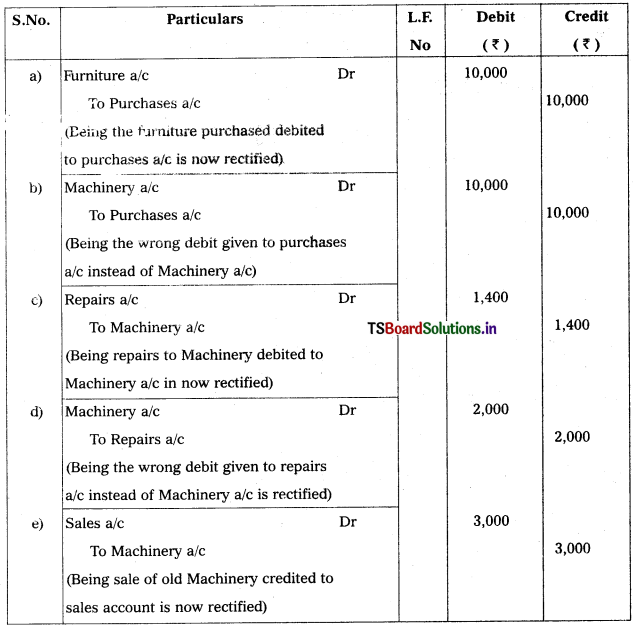

Question 2.

Rectify the following errors :

a) Furniture purchased for ₹ 10,000 wrongly debited to purchase account.

b) Machinery purchased on credit from Ramana for ₹ 10,000 was recorded through purchases book.

c) Repairs on machinery ₹ 1,400 debited to machinery account.

d) Repairs on overhauling of second hand machinery purchased ₹ 2,000 was debited to repairs account.

e) Sale of old machinery at book value of ₹ 3,000 was credited to sales account.

Solution:

Rectification entries

![]()

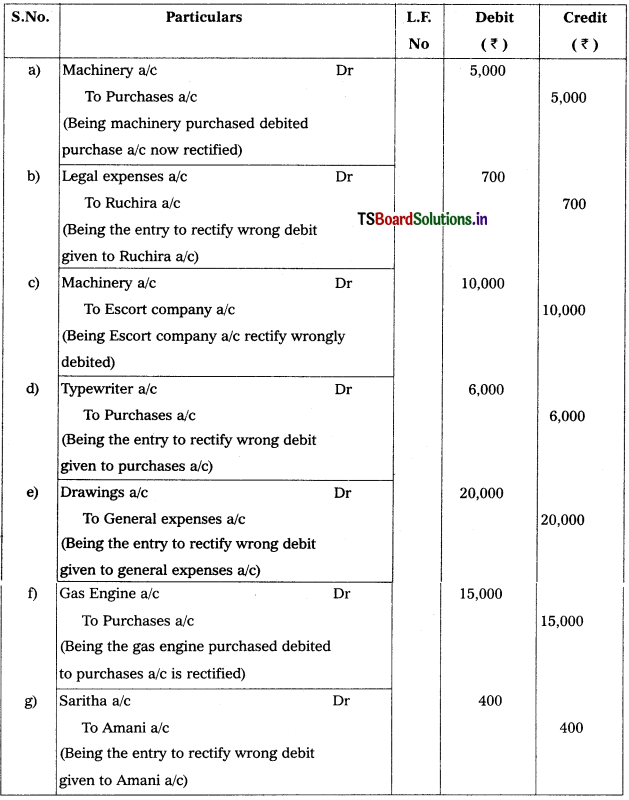

Question 3.

Pass journal entries to rectify the following errors :

a) Machinery purchased for ₹ 5,000 has been debited to purchases account.

b) ₹ 700 paid to Ruchira as legal charges were debited to his personal account.

c) ₹ 10,000 paid to Escorts Company for machinery purchased stand debited to Escorts company account.

d) Typewriter purchased for ₹ 6,000 was wrongly passed through purchase book.

e) ₹ 20,000 paid for the purchase of Motor-Cycle for proprietor has been charged to ‘General Expenses’ account.

f) ₹ 15,000 paid for the purchase of ‘Gas engine’ were debited to ‘Purchases’ account.

g) Cash paid to Saritha ₹ 400 was debited to the account of Amani.

Solution:

Rectification entries

![]()

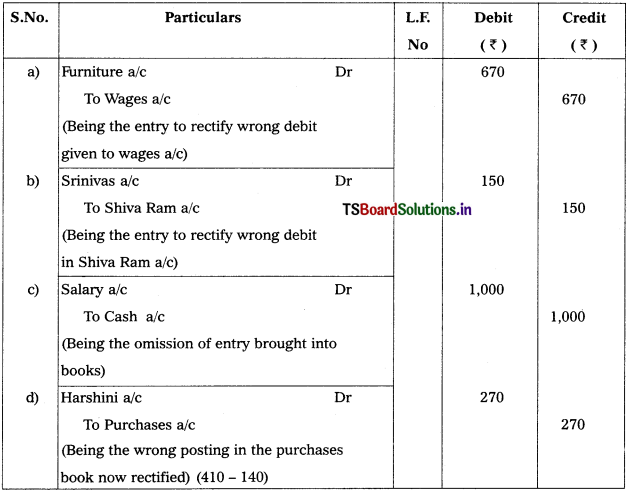

Question 4.

Give rectification entries for the following errors :

a) Wages payable to furniture maker ₹ 670 debited to Wages account.

b) A credit sale of ₹ 150 to Srinivas debited to Shiva Ram.

c) Payment of salary to Varshini not passed through book at all ₹ 1,000.

d) A credit purchase of ₹ 140 to Harshini, recorded in the books as ₹ 410.

Solution:

Rectification entries

![]()

Question 5.

Pass journal entries-to rectify the following errors :

a) The purchases book of the trader is overadded by ₹ 200 (Overcast by)

b) Old furniture sold for ₹ 100 was wrongly credited to sales account.

c) ₹ 100 paid on account of interest was debited to commission a/c.

d) An amount of ₹ 125 received from Soni was wrongly credited to his account as ₹ 152.

Solution:

Rectification entries

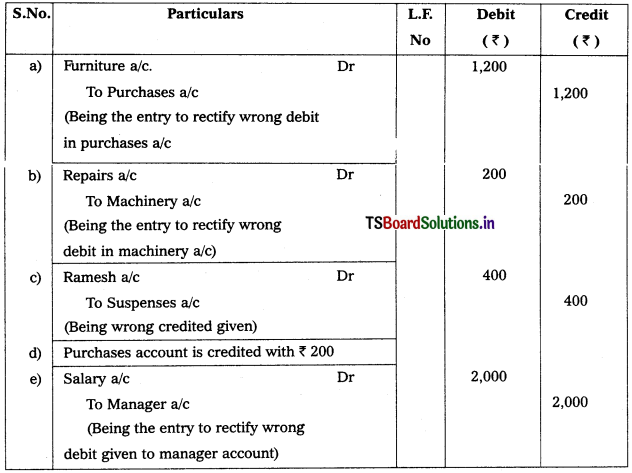

Question 6.

Rectify the following errors :

a) Purchases of furniture costing ₹ 1,200 have been recorded in purchases book.

b) Repairs to machinery ₹ 200 were debited to machinery account.

c) A credit sale of ₹ 200 to Ramesh through properly entered in the sales book has been credited to his account.

d) The total of purchases book, was overcast by ₹ 200.

e) Salary ₹ 2,000 paid to manager debited to his personal account.

Solution:

Rectification entries

![]()

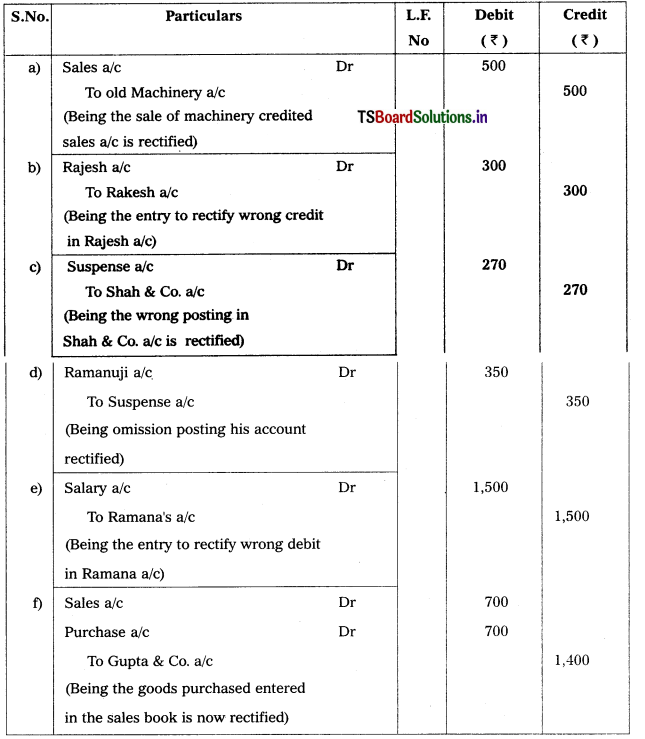

Question 7.

Rectify the following errors :

a) Sale of old machinery ₹ 500 has been entered in the sales book.

b) Rakesh pays ₹ 300. This amount has been credited to Rajesh.

c) A sale of ₹ 250 to Shah & Co., has been debited to them as ? 520.

d) Returns to Ramanuji ₹ 350 have not been posted to his account.

e) Salary of ₹ 1,500 paid to Ramana has been debited to his account.

f) A purchase of ₹ 700 from Gupta & Co. has been entered in the sales book.

Solution:

Rectification entries

![]()

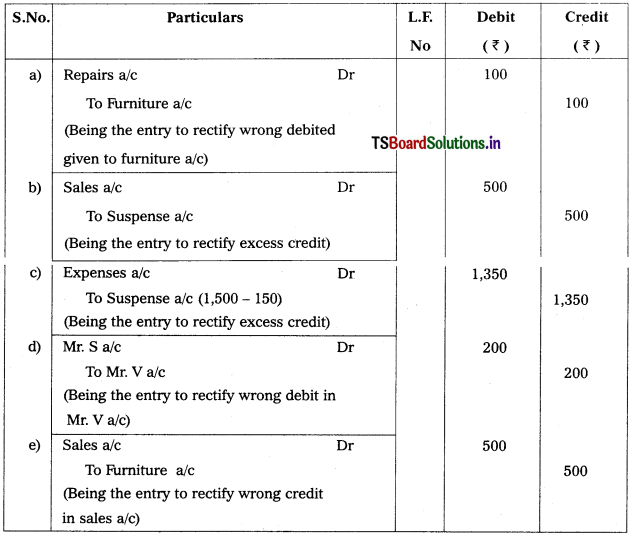

Question 8.

Rectify the following errors :

a) An amount of ₹ 100 paid for the repairs of furniture was debited to furniture account.

b) Sales book total was overcast by ₹ 500.

c) Expenses ₹ 1,500 were posted in the ledger as ₹ 150.

d) A sale of ₹ 200 to Mr. S was wrongly debited to the account of Mr. V.

e) Old furniture sold has been credited to sales account ₹ 500.

Solution:

Rectification entries

Question 9.

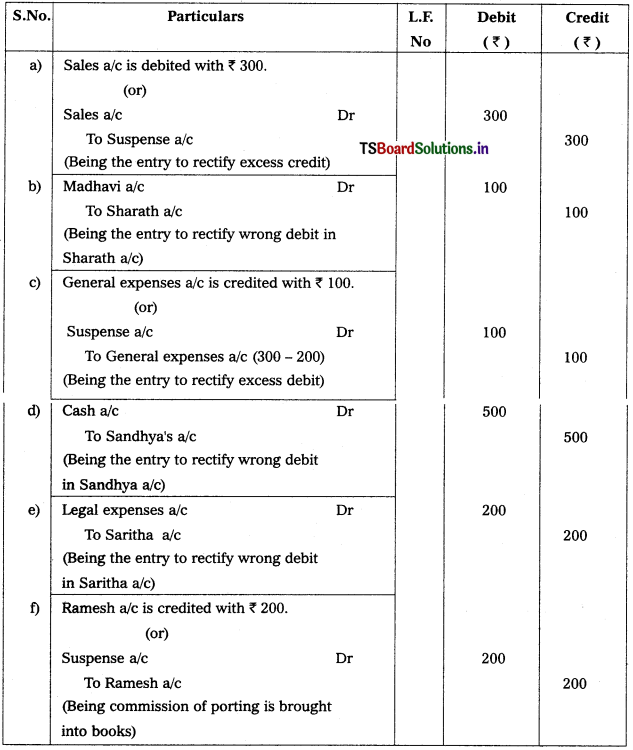

Write the entries for the rectification of the following errors :

a) Sales book was overcast by ₹ 300.

b) Sales of ₹ 100 to Madhavi was wrongly debited to account of Sharath.

c) General expenses of ₹ 200 were posted in the general ledger as ₹ 300.

d) ₹ 300 received from Shankar was debited to Sandhya.

e) Legal expenses ₹ 200 paid to Saritha was debited to her personal account.

f) An amount of ₹ 200 paid of Ramesh is not posted to his account.

Solution:

Rectification entries

![]()

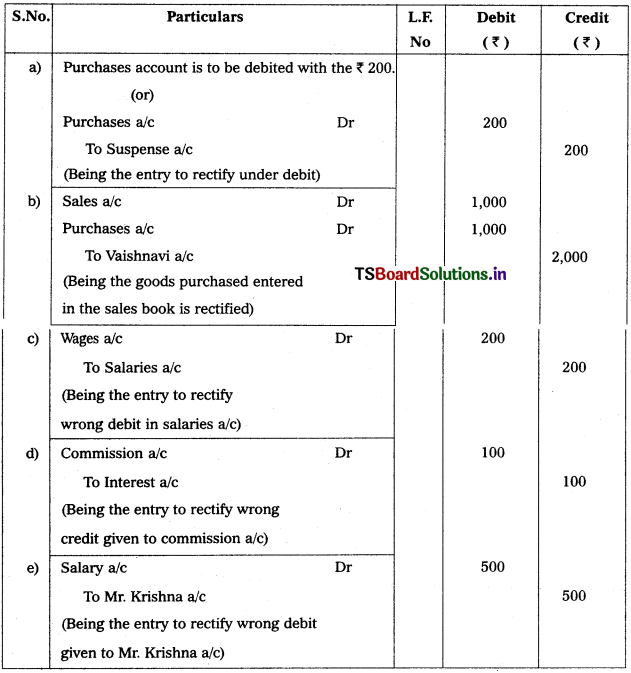

Question 10.

Pass journal entries to rectification of the following errors :

a) The total of purchases book was under cast by ₹ 200.

b) A credit purchase from Vaishnavi for ₹ 1,000 has been wrongly passed through the sales book.

c) Wages paid ₹ 200 was wrongly debited to salaries account.

d) ₹ 100 received on account interest stands wrongly credited to commission account.

e) Salary of ₹ 500 paid to manager Mr. Krishna is debited to his personal account.

Solution:

Rectification entries

Question 11.

Rectify the following errors before preparation of trial balance :

a) Purchase book was undercast by ₹ 2,000.

b) Rent paid ₹ 350 was debited to that account as ₹ 530.

c) Discount received from Rama & Co. ₹ 250 was not posted to their account.

d) Interest paid ₹ 89 was wrongly credited to that account as ₹ 98.

e) Sales book was overcast by ₹ 1,700.

f) Purchase returns book undercast by ₹ 275.

Solution:

Rectification entries :

a) Purchase a/c is debited with ₹ 2,000.

b) Rent account is credited with ₹ 180.

c) Rama & Co. a/c Dr 250.

To Discount a/c 250 (Being error of omission is retified)

Note :

In transaction ‘c’, it not posted to their account, i.e. it’s a complete omission so we write the omission entry)

d) Interest a/c is debited with ₹ 187(89 + 98).

e) Sales a/c is debited with ₹ 1,700.

f) Purchase returns a/c is credited with ₹ 275.

![]()

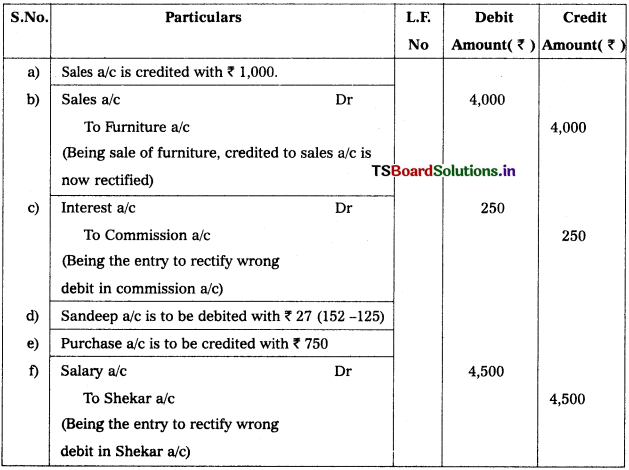

Question 12.

Rectify the following errors discovered before preparation of the trial balance.

a) The sales book has been total ₹ 1,000 short.

b) Sale of old furniture ₹ 4,000 was credited to sales account.

c) ₹ 250 paid towards interest was debited to commission account.

d) ₹ 125 paid by Sandeep but was entered in his account ₹ 152.

e) The purchase account was overcast by ₹ 750.

f) ₹ 4,500 salary paid to Mr. Shekar heard clerk stands debited to his personal account.

Solution:

Rectification entries

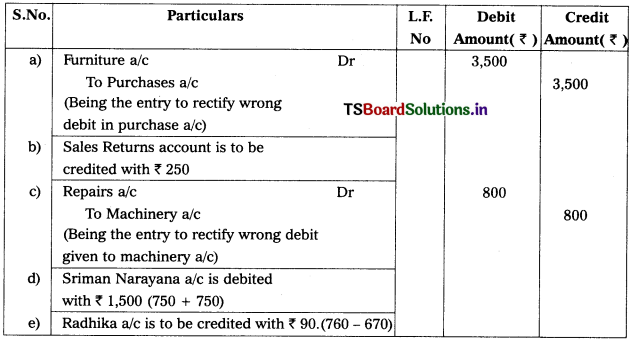

Question 13.

Rectify the following errors discovered before preparation of the trial balance :

a) Furniture purchased ₹ 3,500 has been entered in the purchases book.

b) The returns inward book was overcast by ₹ 250.

c) ₹ 800 paid for repairs to machinery was debited to machinery account.

d) A sale of ₹ 750 made to Sriman Narayana was entered in sales book but was credited to his account

e) A purchase of ₹ 760 made from Radhika was credited to his account ₹ 670.

Solution:

![]()

Question 14.

Rectify the following errors before preparation of trial balance.

a) ₹ 250 paid for proprietors medical bill was debited to sundry expenses account.

b) Sale of goods to Sandhya & Co. for ₹ 2,900 was entered through the purchase book.

c) Sale of old machinery ₹ 5,000 was posted to the credit of sales account.

d) The total of purchases book was overcast by ₹ 2,000.

e) Salary of ₹ 4,500 paid to Kittu has been debited to his account.

Solution:

Rectification entries

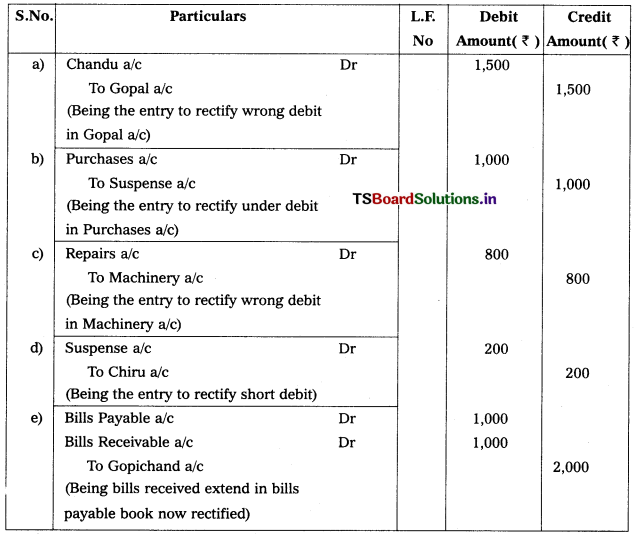

Question 15.

Pass necessary entries to rectify the following errors. After the preparation of trial balance.

a) ₹ 1,500 received from Gopal has been wrongly credited to Chandu’s account.

b) The purchase book was undercast by ₹ 1,000.

c) Repairs to machinery ₹ 800 were debited to machinery account.

d) Discount allowed to Chiru ₹ 200 correctly entered in cash book, has not been posted to his account.

e) Bills payable from Mr.Gopichand ₹ 1,000 was entered in the bills payables book.

Solution:

Rectification entries

![]()

Textual Examples:

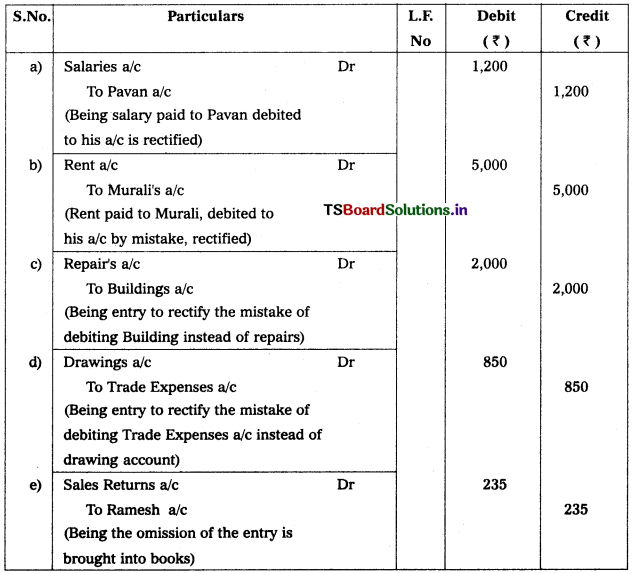

Question 1.

Rectify the following errors.

a) Salary paid to Pavan ₹ 1,200 has been debited to his account.

b) Paid rent to owner of the house Mr. Murali ₹ 5,000, has been debited to his account.

c) ₹ 2,000 paid for the repairs of building was debited to building a/c.

d) ₹ 850 used by proprietor for his personal use has been debited to Trade Expenses a/c.

e) Goods amounting to ₹ 235 returned by Ramesh were taken into stock, but no entry was made in the books.

Solution:

Rectification entries

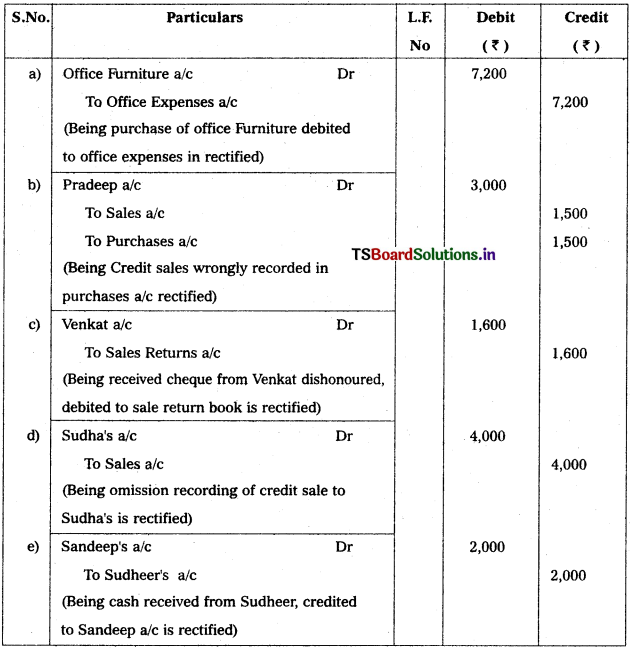

Question 2.

Rectify the following through passing Journal Entries :

a) Office Furniture bought for ₹ 7,200 wrongly debited to Office Expenses a/c.

b) A credit sale ₹ 1,500 to Pradeep has been passed through purchases book.

c) Received cheque for amount ₹ 1,600 from Venkat is dishonoured and wrongly entered in Sales Return Book.

d) Goods sold to Sudha ₹ 4,000. not recorded in the Books.

e) ₹ 2,000 received from Sudheer has been wrongly credited to Sandeep’s a/c.

Solution:

Rectification Entries

![]()

Question 3.

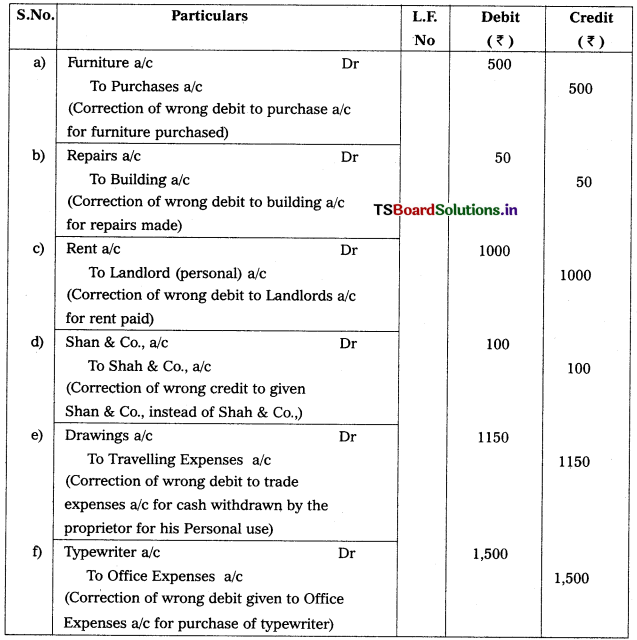

The following errors were found in the books of Laxminarayana & Sons. Give the necessary entries to correct them.

a) ₹ 500 paid for furniture purchased has been charged to ordinary purchases a/c.

b) Repairs made to building were debited to Building a/c for ₹ 50.

c) ₹ 1000 paid for rent debited to Landlord’s a/c.

d) ₹ 100 received from Shah & Co., has been wrongly entered as from Shan & Co.,

e) An amount of ₹ 1150 withdrawn by the proprietor for his personal use had been debited to travelling expenses a/c.

f) ₹ 1,500 paid for the purchase of a typewriter was charged to office expenses a/c.

Solution:

Rectification entries

![]()

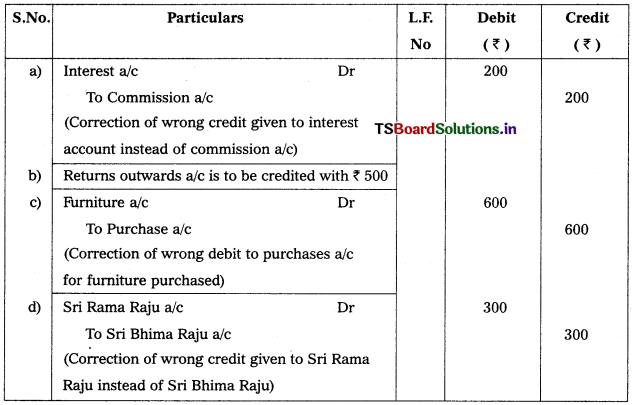

Question 4.

Pass journal entries to rectify the following errors discovered while preparing the trial balance.

a) Commission of ₹ 200 received was wrongly credited to interest account.

b) Return outwards book was undercast by ₹ 500.

c) Furniture worth ₹ 600 purchased was debited to Purchases a/c.

d) An amount of ₹ 300 received from Sri Bhima Raju was wrongly credited to the account of Sri Rama Raju.

Solution:

Rectification Entries

Question 5.

The following errors, affecting the accounts were detected in the books of Varun Bros., Warangal.

a) Sale of Old Furniture ₹ 1,500 treated as sale of goods.

b) Receipt of ₹ 500 from Ram credited to Shyam.

c) Goods worth ₹ 1,000 bought of Mohan have remained unrecorded.

d) A return of goods ₹ 120 from Mukesh posted to debit of his account.

e) Rent of proprietor’s residence ₹ 600 debited to Rent a/c.

f) A payment of ₹ 215 to Rafi posted to his credit as ₹ 125.

g) Sales book added ₹ 400 short.

h) The total of bills receivable book ₹ 1,500 left un posted.

Solution:

Rectification entries

![]()

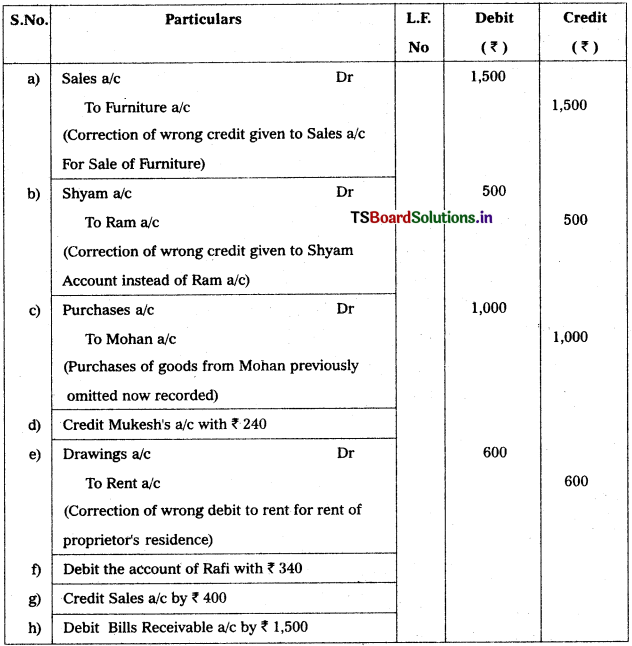

Question 6.

Rectify the following errors with the help of Suspense Account.

a) Credit sales to Mohan ₹ 7,000 were posted to Srinu as ₹ 5,000.

b) Credit purchases from Sarath ₹ 9,000 were posted to the debit of Kiran as ₹ 10,000.

c) Goods returned to Sailaja ₹ 4,000 were posted to the credit of Pavani as ₹ 3,000.

d) Goods returned by Ratnaji ₹ 1,000 were posted to debit of Sandhya’s account as ₹ 2,000.

e) Cash sales of ₹ 2,000 were posted to commission account as ₹ 200.

Solution:

Rectification entries

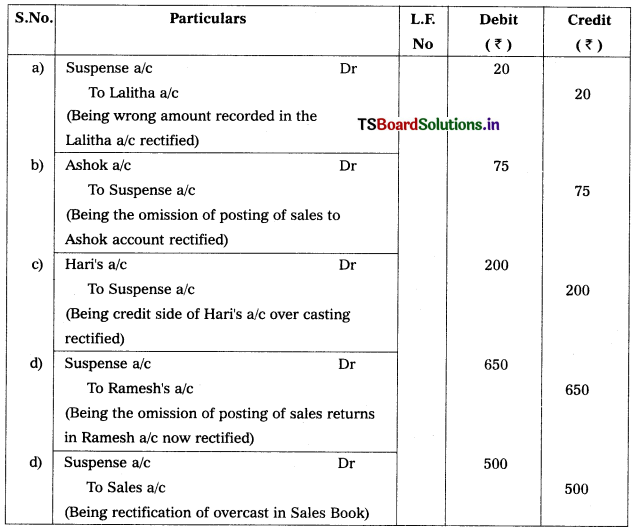

Question 7.

Rectify the following errors.

a) Received cash from Lalitha ₹ 200 has been posted to her account as ₹ 180.

b) Goods sold to Ashok ₹ 75 were omitted to be entered in his account.

c) Credit side of Hari’s account was overcast by ₹ 200.

d) Goods returned from Ramesh ₹ 650 were not posted to his account.

e) Sales book under cast by ₹ 500.

Solution:

Rectification entries

![]()

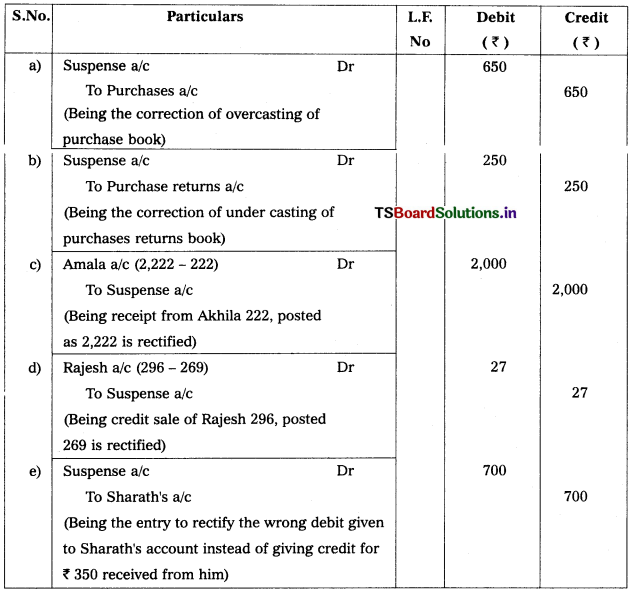

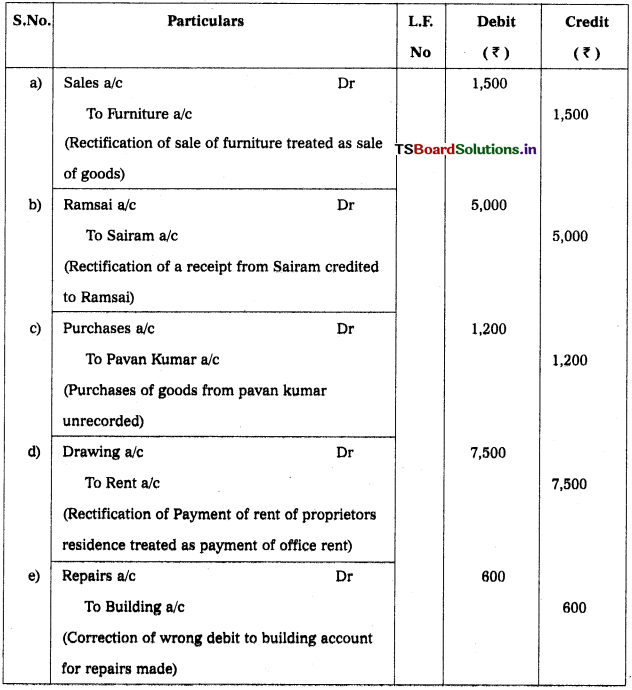

Question 8.

Rectify the following errors with the help of Suspense a/c.

a) Purchases book overcast by ₹ 650.

b) Purchases returns book under cast ₹ 250.

c) Received ? 222 from Amala has been entered in her account ₹ 2,222.

d) Sold goods to Rajesh ₹ 296 in his account posted as ₹ 269.

e) Received ₹ 350 from Sharath was posted on the Debit side of his account.

Solution:

Rectification retries

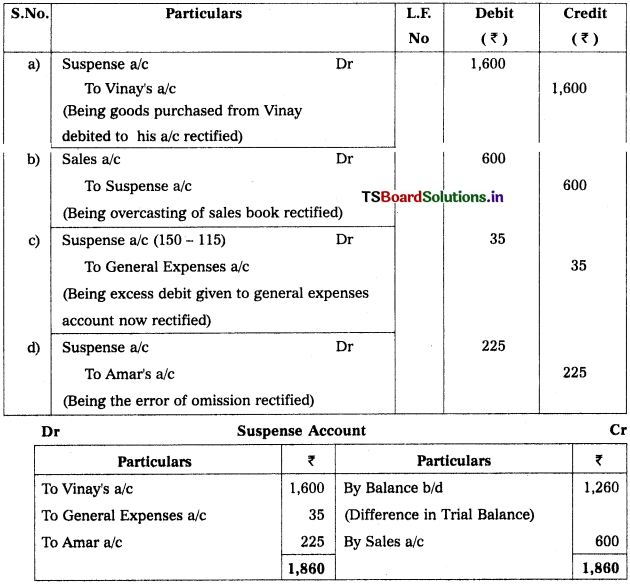

Question 9.

The books of Mahendra traders did not agree. They found the difference of ₹ 1,130 in the trial balance. The difference was placed on the credit side of suspense a/c. Later, the following errors were discovered, you are required to rectify them and show the Suspense a/c.

a) Purchased goods from Vinay ₹ 800 recorded correctly in purchases book but wrongly debited to his account.

b) Sales book was overcast by ₹ 600.

c) ₹ 115 paid for general expenses but entered in account as ₹ 150.

d) Cash discount allowed to Amar ₹ 225 entered in cash book but not posted to her personal account.

Solution:

Rectification Entries

![]()

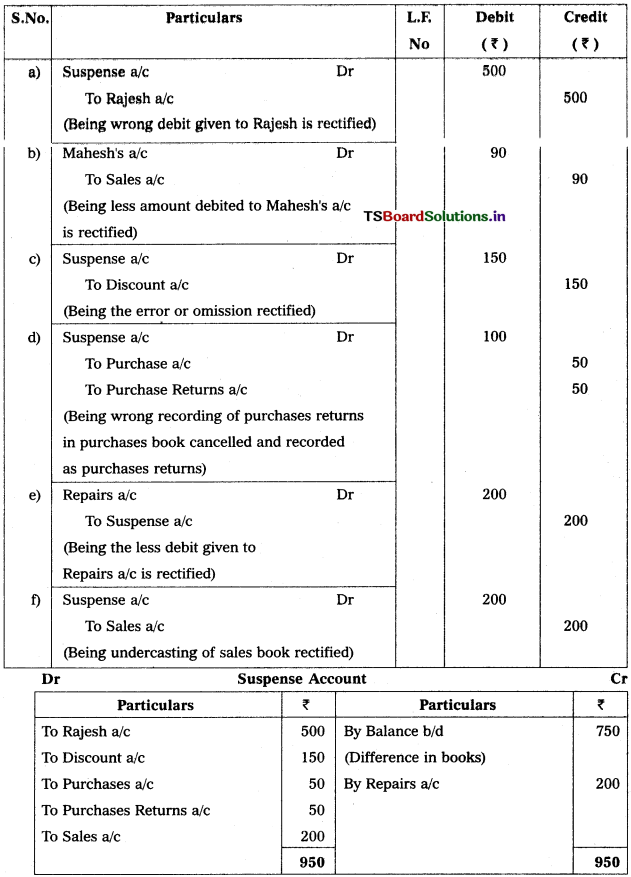

Question 10.

The Trial balance of a firm is out by ₹ 750 (excess debit) and the amount was put to the credit side of Suspense a/c, following errors are detected. You are asked to rectify them and prepare the Suspense a/c.

a) An amount of ₹ 250 received from Rajesh was wrongly debited to his personal account.

b) Sold goods to Mahesh ₹ 540 but is entered in Sales book as ₹ 450.

c) Discount received ₹ 150 entered in cash book but not entered in discount account.

d) Purchases returns amount ₹ 50 has been debited to purchases account.

e) Repairs to machinery ₹ 370 but wrongly debited to repairs account as ₹ 170,

f) Sales book under cast by ₹ 200.

Solution:

Rectification Entries

![]()

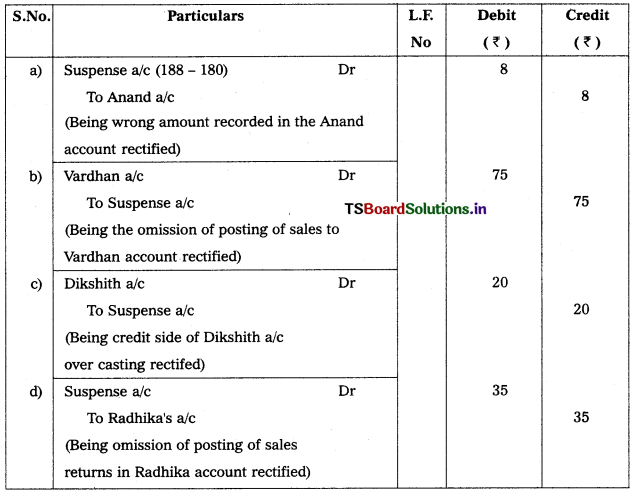

Question 11.

Rectify the following errors.

a) Received cash from Anand ₹ 188 has been posted to his a/c as ₹ 180.

b) Goods sold to Vardhan ₹ 75 were omitted to be entered in his account.

c) Credit side of Dikshith account was overcast by ₹ 20.

d) Goods returned by Radhika ₹ 35 was not posted to her account.

Solution:

Rectification entries

Question 12.

Rectify the following errors with the help of Suspense a/c.

a) Purchases book overcast by ₹ 400.

b) Purchases returns book undercast ₹ 260.

c) ? 660 received from Sunder has been entered in his account ₹ 1,160.

d) Goods sold to Param for ₹ 550 was posted to his account as ₹ 450.

e) ₹ 1050 received from Kiran were posted to the debit side of his account.

Solution:

Rectification Entries

![]()

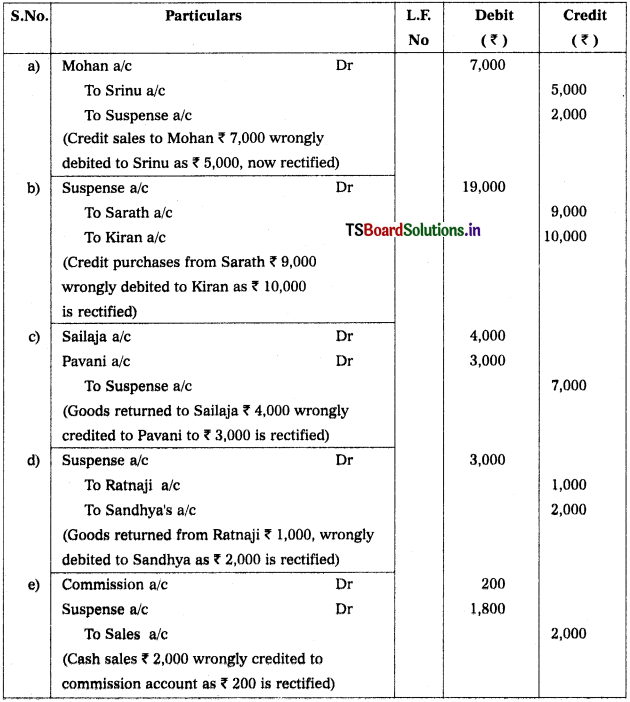

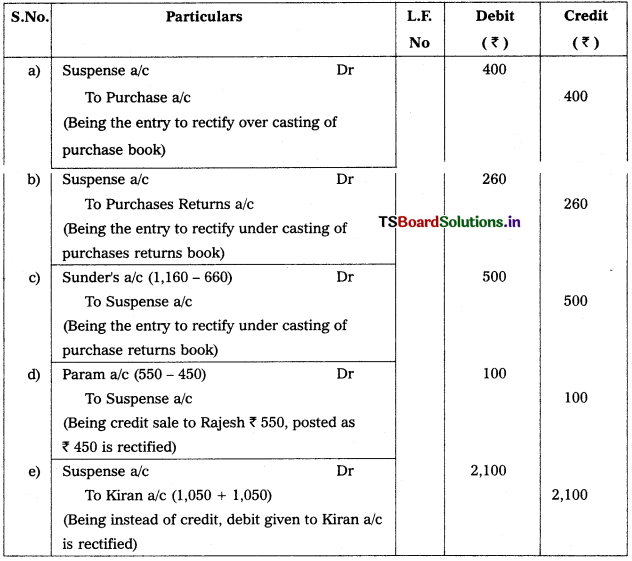

Question 13.

An accountant could not tally the Trial balance. The difference of ₹ 5,180 was temporarily placed to the credit of suspense account for preparing the final accounts. The following errors were later located.

a) Commission of ₹ 500 paid, was posted twice, once to discount allowed account and once to commission account.

b) The sales book was undercast by ₹ 1,000.

c) A credit sale of t 2,780 to Sudha though correctly entered in sales book, was posted wrongly to her account as ₹ 3,860.

d) A credit purchase from Nataraj of ₹ 1,500, though correctly entered in purchases book, was wrongly debited to his personal account.

e) Discount column of the payments side of the cash book was wrongly added as ₹ 2,800 instead of ₹ 2,400.

You are required to pass necessary rectifying entries and prepare suspense account.

Solution:

Rectification Entries

![]()

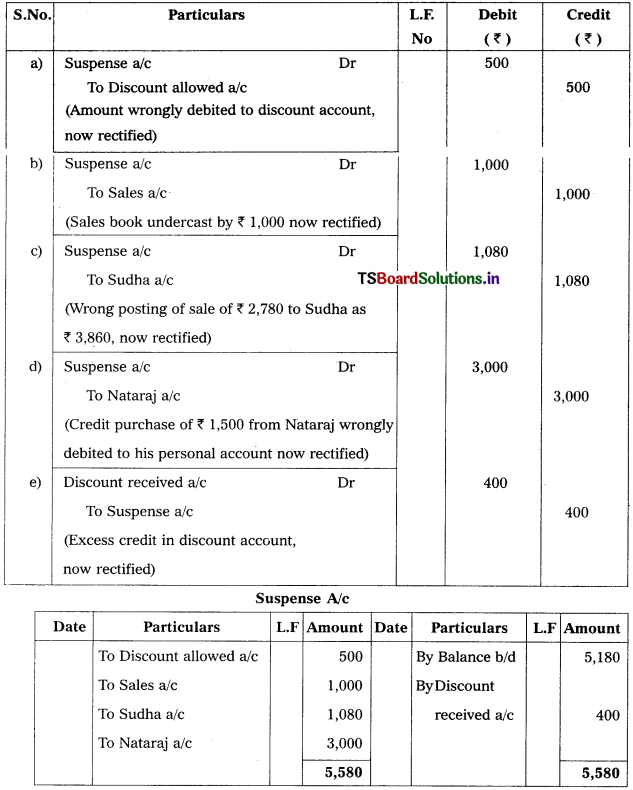

Question 14.

The following errors affecting the account for the year 2018 were detected in the books of Sheshu & Brothers, Warangal.

a) Sale of old furniture ₹ 1,500 treated as sale of goods.

b) Receipt of ₹ 5,000 from Sairam credited to Ramsai.

c) Goods worth ₹ 1,200 brought from Pavan Kumar have remained unrecorded so far

d) Rent of proprietor’s residence ₹ 7,500 debited to rent a/c.

e) Repairs made were debited to building account for ? 600.

You are required to pass the necessary rectifying entries.

Solution:

Rectification Entries

Question 15.

Rectify the following errors.

a) Purchases book overcast by ₹ 2,500.

b) Sales book undercast by ₹ 4,200.

c) Purchases return book overcast by ₹ 1,450.

d) Sales return book undercast by ₹ 3,500.

Solution:

|

Nature of Mistake |

Effect of Mistake |

Rectification |

| 1. Over casting of Purchases book | Excess debit in Purchases a/c | Credit the Purchases a/c |

| 2. Under casting of Sales book | Short credit in Sales a/c | Give further credit to Sales a/c |

| 3. Over casting of Purchases return book | Excess credit in Purchases Return a/c | Debit Purchases Return a/c |

| 4. Under casting of Sales return book | Short debit in Sales Return a/c | Give further debit to Sales Return a/c |

To rectify the errors :

i) Credit – Purchases a/c with ₹ 2,500.

ii) Credit – Sales a/c with ₹ 4,200.

iii) Debit – Purchases return a/c with ₹ 1,450.

iv) Debit – Sales return a/c with ₹ 3,500.