Telangana TSBIE TS Inter 1st Year Accountancy Study Material 7th Lesson Trial Balance Textbook Questions and Answers.

TS Inter 1st Year Accountancy Study Material 7th Lesson Trial Balance

Essay Questions:

Question 1.

What is hail Balance ? How it is prepared?

Answer:

Trial balance is a statement prepared by putting all debits on one side and all credits on the other side to check the arithmetical accuracy of the ledger balances. Trial balance is a connecting link between the ledger accounts and final accounts.

The following points are to be kept in mind while preparing the trial balance.

- As the trial balance is prepared on a particular date, the particular date should be shown on the head of the trial balance.

- Draw the proforma of trial balance with title.

- Trial balance is a statement, hence we need not use the words ‘to’ or ‘by’. It contains SL. No., name of the account, ledger folio, debit and credit balance.

- All asset account, expenses, losses, purchase and sales returns account shows the debit balance. All liabilities, incomes and gains, reserves, provisions sales and purchase returns accounts shows credit balance. The debit balances are to be written in debit column, credit balances are to be written in credit column of the trial balance.

- The total of the both the columns should be equal to prove arithmetical accuracy.

![]()

Question 2.

Explain the merits and demerits of Trial Balance.

Answer:

Merits of Trial Balance:

- It helps in finding out the arithmetical accuracy of the accounts in the ledger.

- Trading, profit and loss account and balance sheet are prepared on the basis of trial balance.

- It will help in detecting the errors and their rectification.

- Trial balance enables us to know balances of all accounts in one place.

Demerits of Trial Balance :

- Trial Balance tallies eventhough errors are existing in the books of accounts.

- It is only possible to prepare trial balance of an organisation, if the double entry system of book-keeping is followed which is costly and time consuming.

- Even if some transactions are omitted, the trial balance agrees.

- If trial balance is not prepared in a systematic method and the final accounts prepared on the basis of such trial balance, it do not show the actual financial position of the concern.

![]()

Short Answer Questions:

Question 1.

Define Trial Balance’.

Answer:

- J. R. Batliboi defines trial balance as “A trial balance is statement prepared with the debit and credit balances of ledger accounts to test the arithmetical accuracy of the books”.

- According to Spicer and Peglar “A trial balance is a list of all the balances standing on the ledger accounts and cash book of the concern at any given date”.

Question 2.

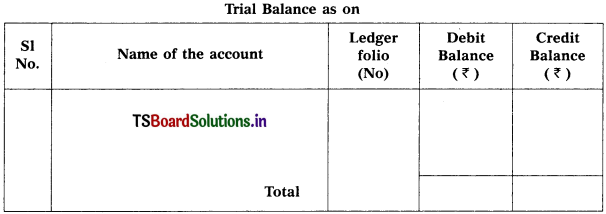

Give the format of the Trial Balance.

Answer:

Format of the trial balance

![]()

Question 3.

What are the objectives of the Trial Balance ?

Answer:

- To check the arithmetical accuracy of various ledger accounts.

- To help in preparation of final accounts.

- To act as important tool for auditing work.

- To generate match between ledger balances and final accounts.

- To identify errors and mistakes crept in preparation of a accounts.

Question 4.

What are the methods of preparation of Trial Balance ?

Answer:

Trial Balance can be prepared in two methods. They are

- Total Balance Method

- Net Balance method.

1. Total Balance Method :

Debit as well as credit sides of all accounts will be summed up and with the totals the trial balance will be prepared. Hence this method is called Gross trial balance method.This method is now out of use.

2. Net Balance Method :

This method is most commonly used trial balance. The net balance of the accounts were ascertained on a particular date and arranged in the proforma of trial balance. If these totals of debit and credits agree, we can say the trial balance has the arithmetical accuracy.

Question 5.

Write the features of Trial Balance.

Answer:

- Trial Balance is a statement or list of balances of ledger accounts not an account.

- It is working paper.

- It is always prepared based on double entry principles of accounts.

- It is prepared periodically usually at the end of each month or at the end of accounting year.

- It is prepared before the preparation of find accounts, it is basis for final accounts preparation.

- It test the arithmetical accuracy of ledger accounts.

![]()

Very Short Answer Questions:

Question 1.

Suspense Account.

Answer:

- When Trial Balance does not agree, to avoid delay in the preparation of final accounts, that difference in the trial balance may be temporarily posted to a special account known as “Suspense account”.

- The suspense account is an imaginary account opened temporarily for the purpose of tallying trial balance.

Question 2.

Total Balances method.

Answer:

- Under this method instead of taking balance in each ledger account, total of debit side and total of credit side of each individual account is taken in to account. Hence trial balance here is prepared before ascertaining the balance.

- This method is also called ‘Gross Trial Balance Method’ but it is outdated and not in use now.

Question 3.

Net Balances method.

Answer:

- Under this method, balance in each ledger account is taken in to trial balance. All the ledger accounts showing debit balances are put on the debit side of the trial balance and the accounts showing credit balances are put on the credit side.

- After this, the debit and credit columns of the trial balance are totaled and if the totals are equal, it is said that the trial balance has tallied or agreed.

![]()

Question 4.

Horizontal form of Trial Balance.

Answer:

- The Trial Balance is not an account it is a statement and it may be prepared either in vertical form or in Horizontal form.

- The term Horizontal means parallel to the ground or flat and level with ground or something is arranged side ways.

- Horizontal form of Trial Balance is a format that present ledger balances of Assets, Expenses, Losses, Drawings, Debtors etc are on left side and Liabilities, Incomes, Gains, Capital, Reserves, Provisions etc are on right side.

Question 5.

Arithmetical accuracy means.

Answer:

- Arithmetical accuracy means recording with out any mistakes or errors.

- The Trial Balance is prepared to check Arithmetical accuracy of ledger accounts, whether all debits and credits are properly recorded or correctly balanced.

- If the totals of Debit and Credit Balances are equal, it is assumed that the accounting books are arithmetically correct and free from clearical mistakes or errors.

![]()

Problems:

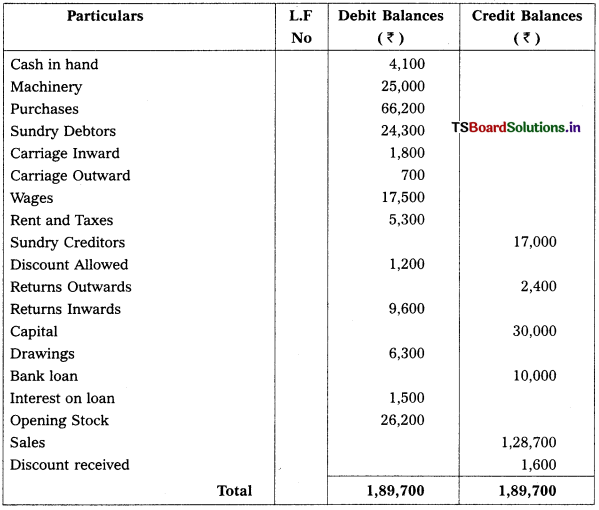

Question 1.

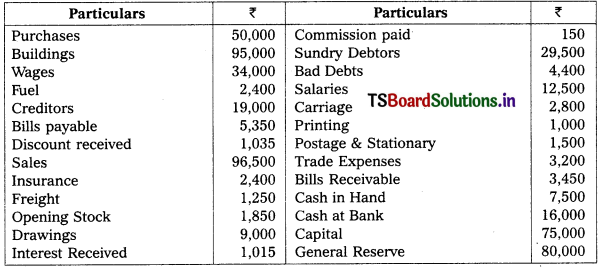

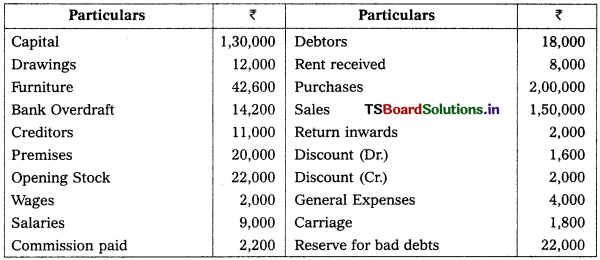

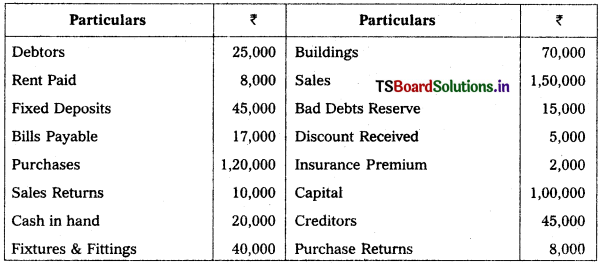

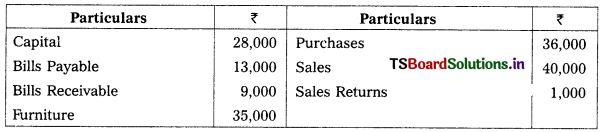

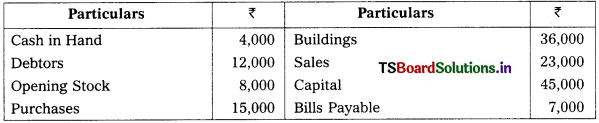

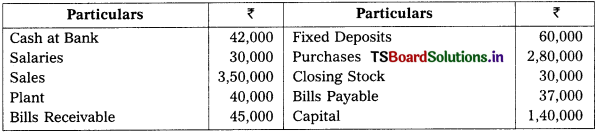

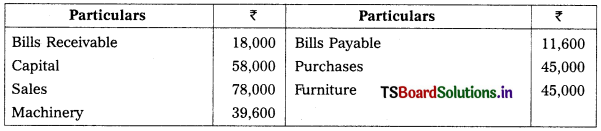

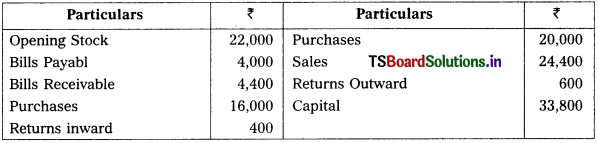

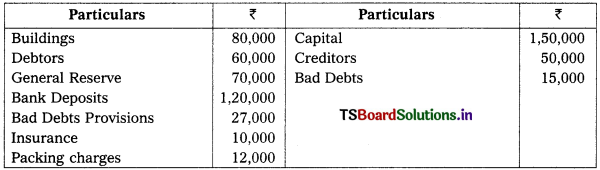

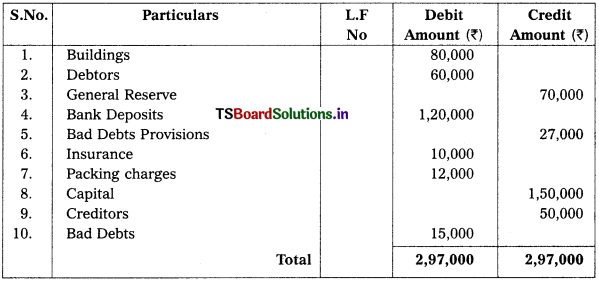

From the following balances taken from the books of Sanjeeva Reddy as on 31st December 2016, prepare a trial balance in proper form.

Solution:

Trial Balance of Sanjeev Reddy as on 31-12-2016

![]()

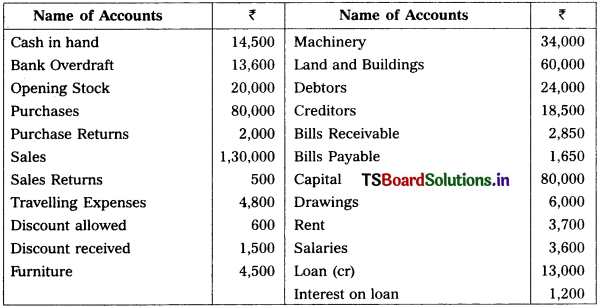

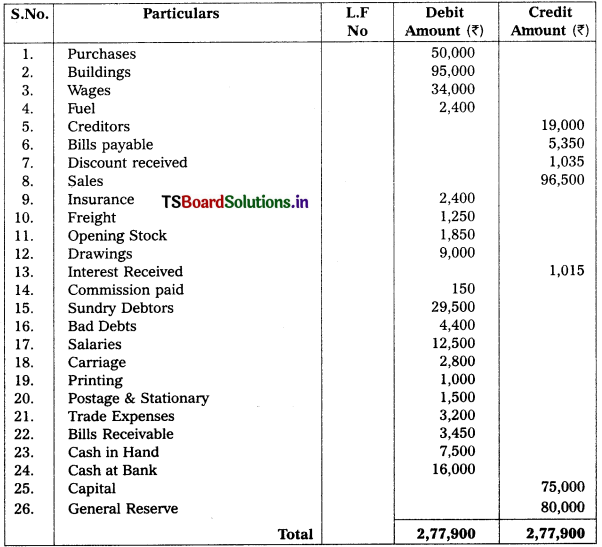

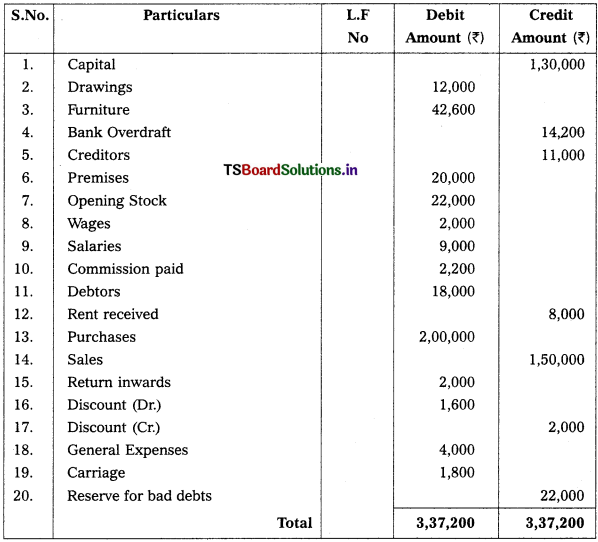

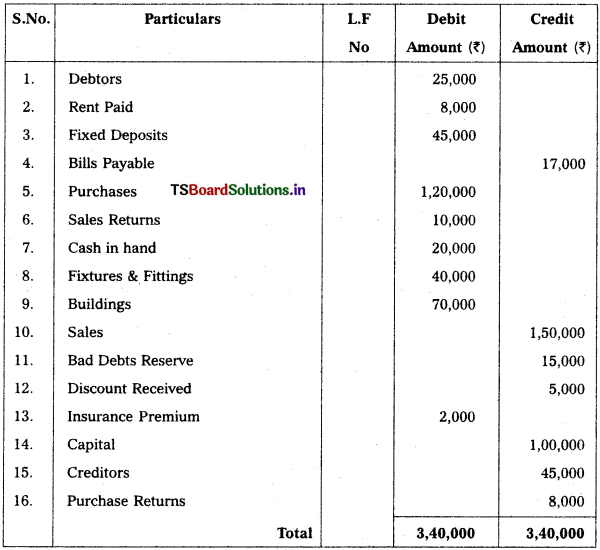

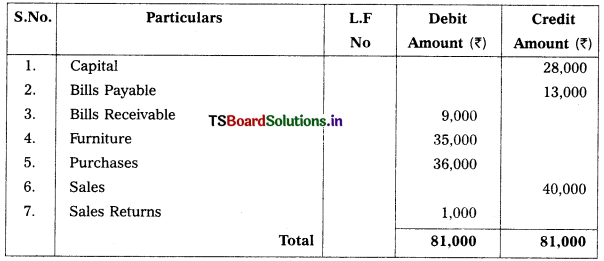

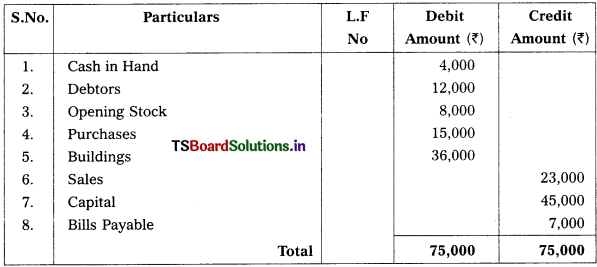

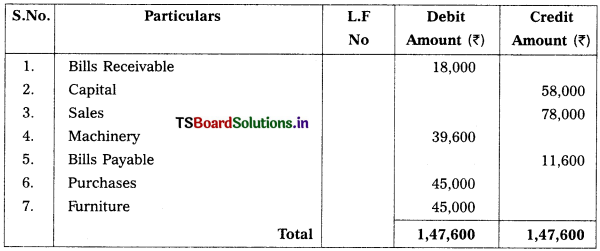

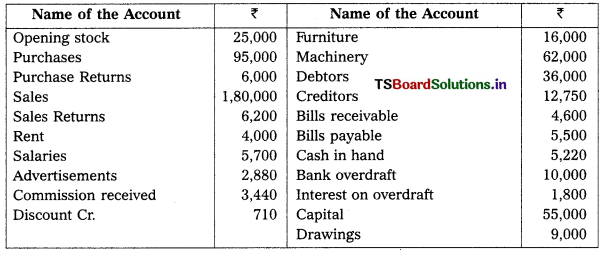

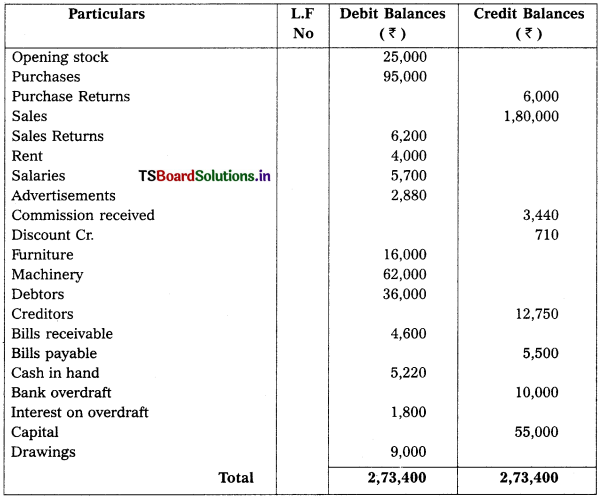

Question 2.

Prepare a trial balance from the following balances of Veena as on 31st March 2018:

Solution:

Note :

To tally the trial balance, the difference in debit & credit sides total is transfered to “Suspense” account.

![]()

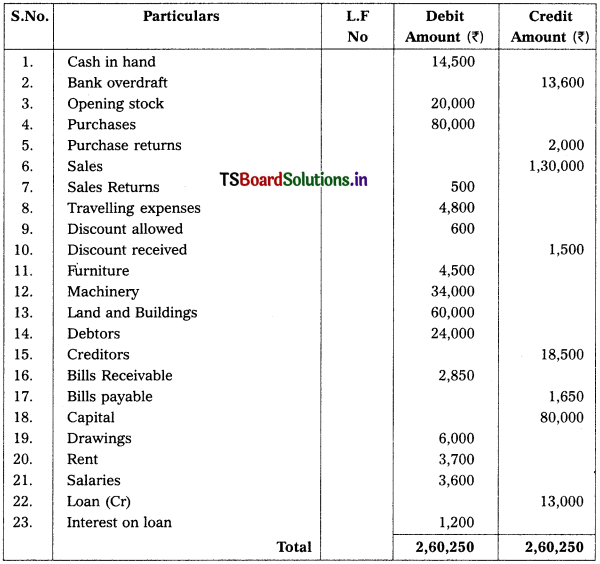

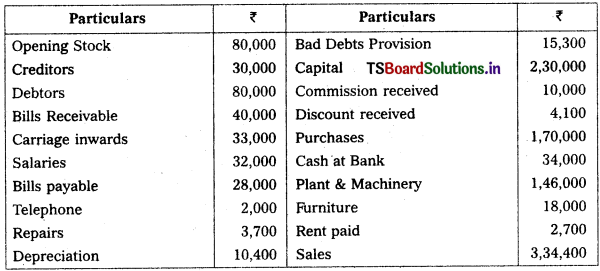

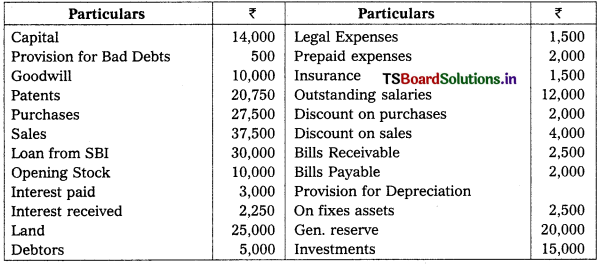

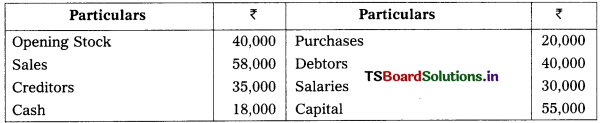

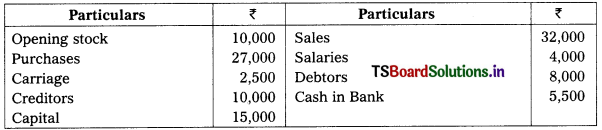

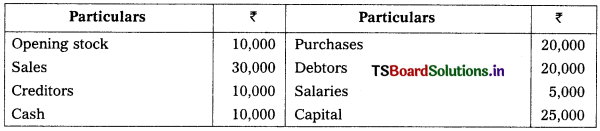

Question 3.

The following trial balance has been prepared by an inexperienced accountant. Re¬draft it in a correct form:

Solution:

Corrected trial balance

![]()

Question 4.

The following are the balances extracted from the books of Manohar, prepare a trial balance as on 31-03-2018.

Solution:

![]()

Question 5.

From the following balances, prepare trial balance of J.P.Reddy as at 31-12-2016.

Solution:

Trial Balance in the books of Manohar as on 31-12-2016

![]()

Question 6.

The following are the balances extracted from the books of Pullanna on 31-12-2017. Prepare the trial balance.

Solution:

Trial Balance of Pullanna as on 31-12-2017

![]()

Question 7.

The following are the balances extracted from the books of Vishnu Charan as on 31st December 2018. Prepare trial balance.

Solution:

Trial Balance of Vishnu Charan as on 31-12-2018

Question 8.

Prepare the Trial Balance of Renish as on 31.12.2013.

Solution:

Trial Balance of Renish as on 31-12-2016

![]()

Question 9.

From the following balances prepare Trial Balance of Manasa as on 31.12.2013.

Solution:

Trial Balance of Manasa as on 31-12-2013

Question 10.

From the following balances prepare Trial Balance of Ramu as on 31.12.2013.

Solution:

Trial Balance of Manasa as on 31-12-2013

![]()

Question 11.

Prepare Trial Balance of Pradeep Kumar from the following balances as on 31.03.2017.

Solution:

Trial Balance of Pradeep Kumar as on 31-12-2017

Question 12.

Prepare Trial Balance of Suchitra as on 31.12.2015 from the following balances.

Solution:

Trial Balance of Suchitra as on 31-12-2015

![]()

Question 13.

Prepare Trial Balance of Radha from the following balances:

Solution:

Trial Balance of Radha

Question 14.

Prepare Trial Balance of N.N.Rao from the following balances:

Solution:

Trial Balance of N.N.Rao

![]()

Question 15.

Prepare Trial Balance of Sheshadri from the following balances as on 31-12-2016.

Solution:

Trial Balance of Sheshadri as on 31-12-2016

Question 16.

Prepare Trial Balance of Bhagya Laxmi :

Solution:

Trial Balance of Bhagya Laxmi

![]()

Question 17.

Prepare Trial Balance of Kasturi from the following balances as on 31-03-2018 :

Solution:

Trial Balance of Kasturi as on 31-03-2018

Question 18.

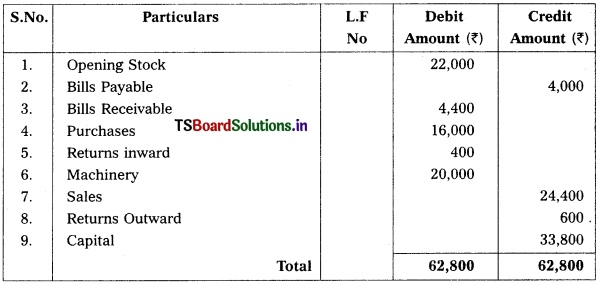

Prepare Trial Balance of Sudha from the following particulars:

Solution:

Trial Balance of Sudha

Note :

In Text book, purchases is given two times, so we take 2nd purchases as Machinery ₹ 20,000.

![]()

Question 19.

Prepare Trial Balance of Anji Reddy from the following balances.

Solution:

Trial Balance of Anji Reddy

Question 20.

Prepare Trial Balance of Dr. Chilumula Srinivas from the following balances as on 31-12-2018.

Solution:

Trial Balance of Dr.Chilumula Srinivas as on 31-12-2018

![]()

Textual Questions:

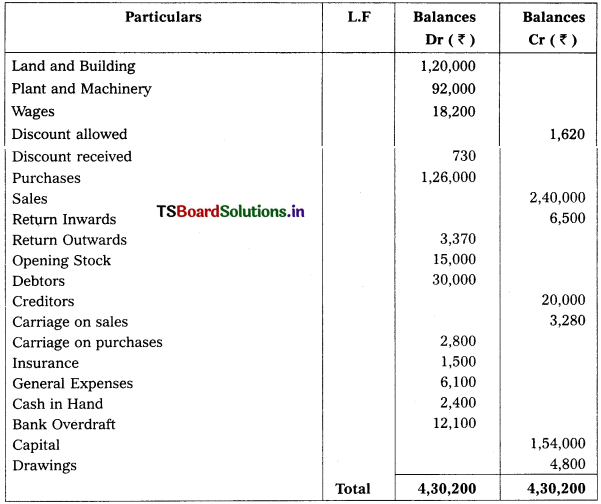

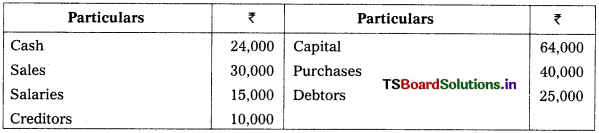

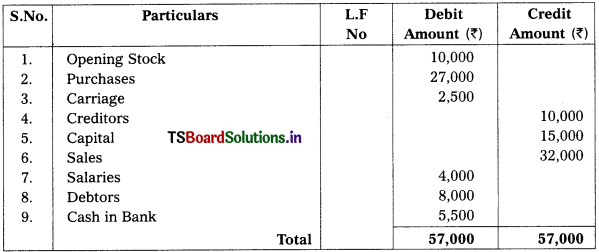

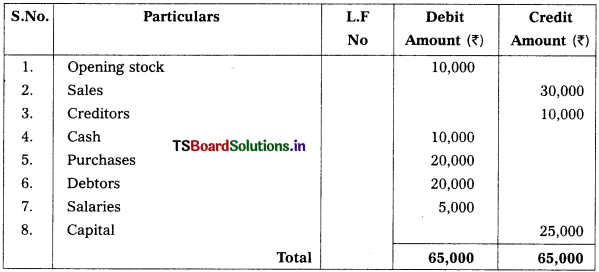

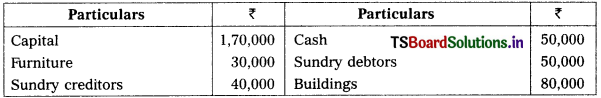

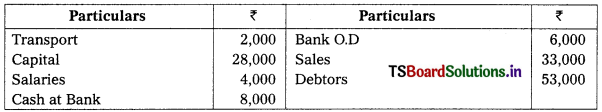

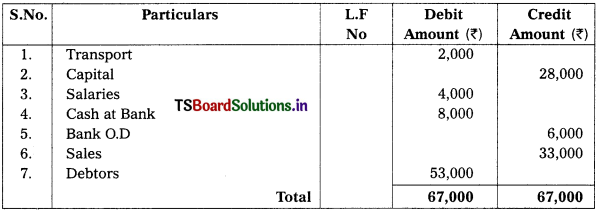

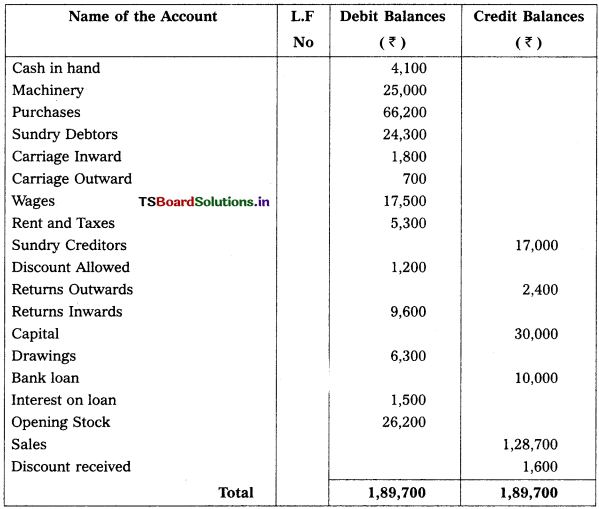

Question 1.

Prepare a trial balance from the following balances of Mr. Vinod Kumar as on 31st December 2018.

Solution:

Trial Balance of Mr. Vinod iumar as on 31st December, 2018

![]()

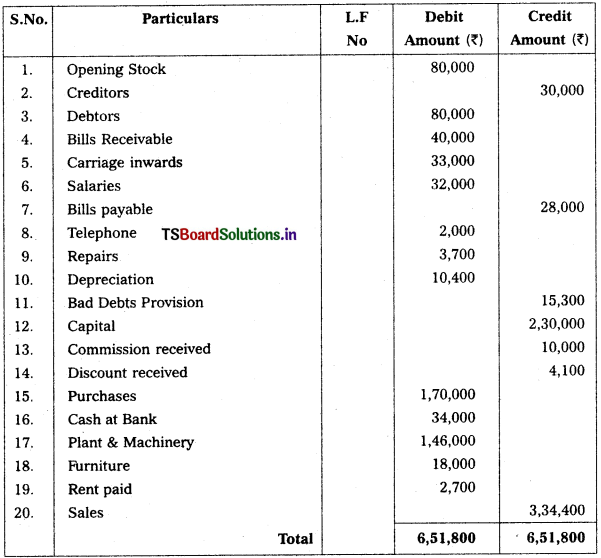

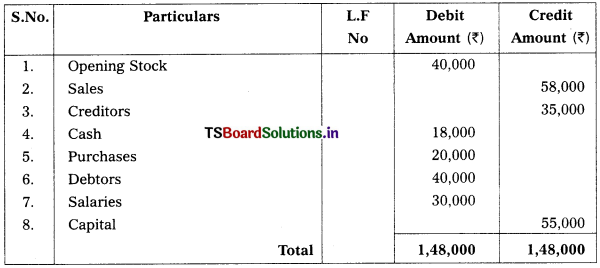

Question 2.

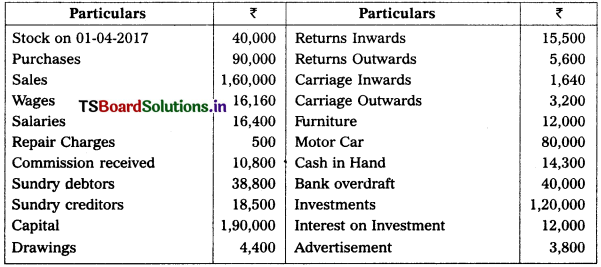

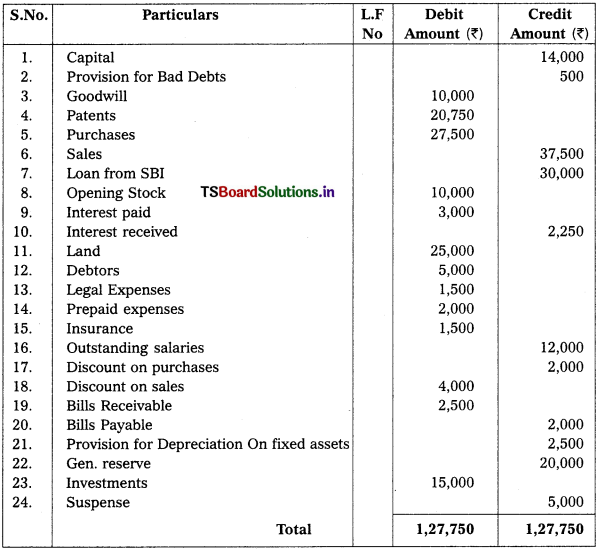

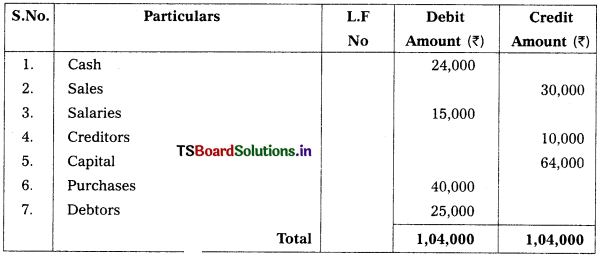

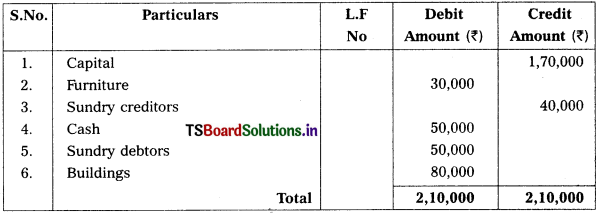

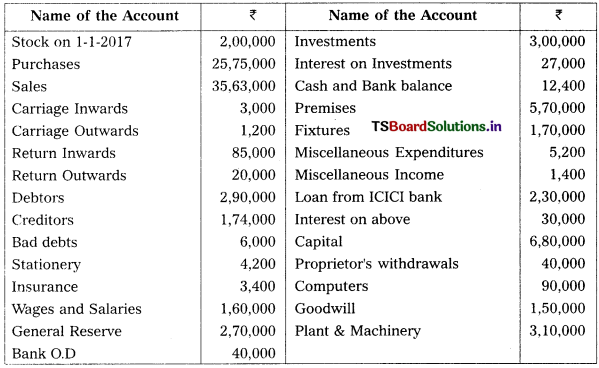

From the following list of balances extracted from the books of Smt. Shobha Rani, prepare a trial balance as on 31st December, 2017.

Solution:

Trial Balance of Mr. Vinod Kumar As on 31st December, 2018

![]()

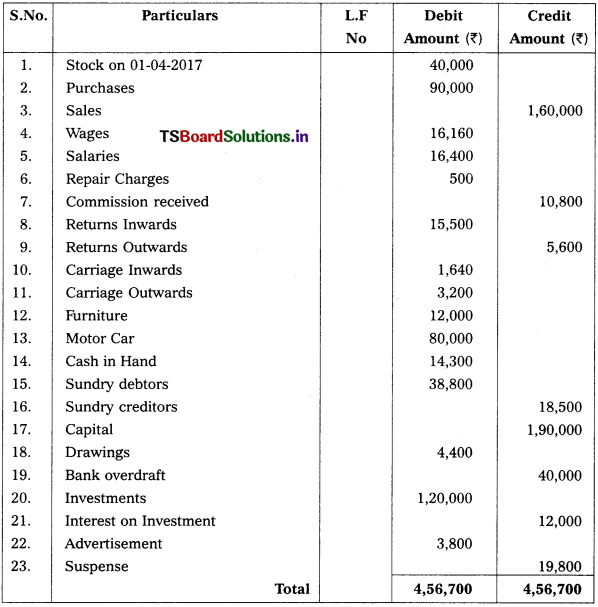

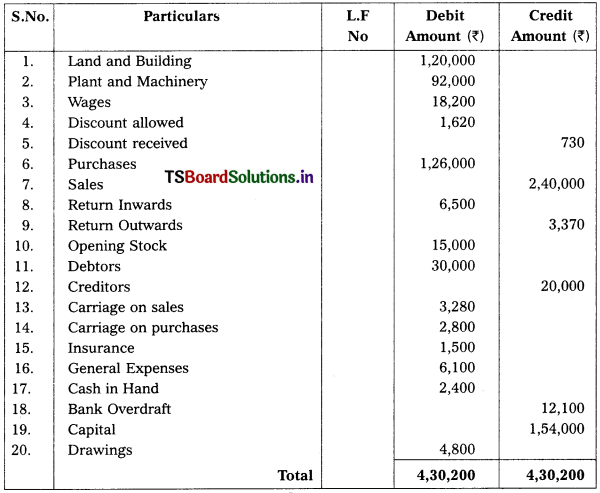

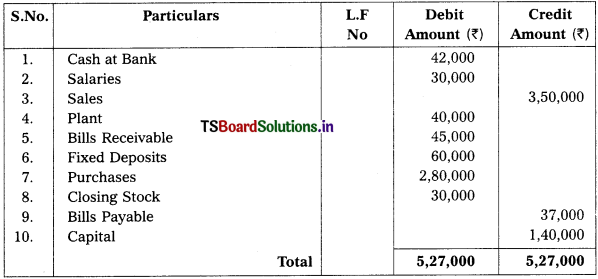

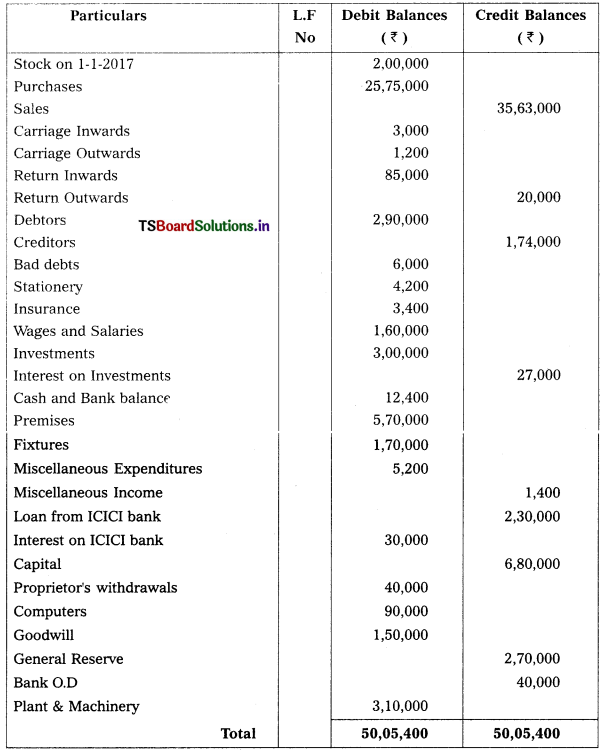

Question 3.

The following trial balance has been prepared by an inexperienced accountant. Redraft it in a correct form:

Solution:

Corrected Trial Balance